I own shares in Legal & General (LSE: LGEN) as part of my second income strategy. The company ticks several key principal boxes I’ve outlined below. It’s a solid and reliable dividend payer with a 9% yield — considerably higher than the FTSE 100’s average of 3.5%.

However, the shares have disappointed me of late. Since early 2022, they’ve steadily declined from 307p to 231p. Possibly, high interest rates and stifling inflation bloated expenses and suppressed revenue. Naturally, this would limit capital available to the company for growth and reinvestment.

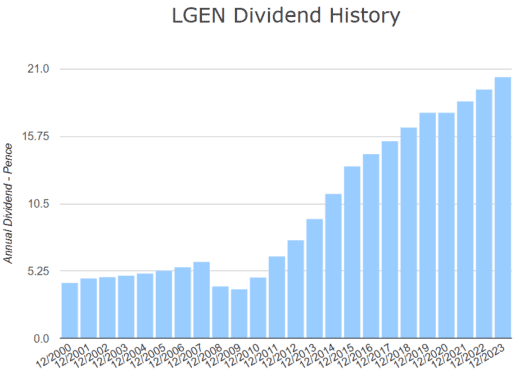

Yet through it all it’s remained loyal to its shareholders, consistently increasing dividends since 2009. When aiming for passive income, that type of consistency is precisely what I look for. Of course, if the dwindling profits force the insurance giant to cut its dividends, I’ll reassess my position.

But for now, it’s one of my best earners.

Now, a 9% yield’s at the high end of the scale. On average, I think a good portfolio could achieve a 7% yield and 5% annual price growth. With that, a monthly investment of £300 could grow to around £265,000 in two decades, paying an annual dividend of £16,740.

So how’s this type of portfolio constructed? Here’s my strategy.

Laying the groundwork

To get the best tax savings, UK residents can invest up to $20k a year via a Stocks and Shares ISA. I believe strategic investing could turn this allowance into a significant second income over time.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

To aim for a consistent second income of £16,000 a year, I’ve considered some strategic investment ideas that leverage the full potential of my £20k ISA allowance. This plan involves a combination of regular contributions and smart portfolio management to achieve a sustainable passive income stream.

But bringing in an extra £16k a year isn’t easy. Here are the key investment principles I’d use.

Diversification

I should just invest in stocks with the highest returns, right? Seems logical. However, these often come with the highest risk. A 30% gain one year could be a 40% loss the next. That’s why it’s best to spread an investment across various asset classes like stocks, bonds and ETFs. Some may have slower growth but can protect an investment when the economy inevitably dips.

Long-term focus

There’s no shortcut to a lucrative second income. It’s best to focus on long-term growth rather than short-term gains. This allows the investment to compound more over time.

Regular contributions

Making small contributions every month can maximise the ISA’s growth potential. This also defends against suffering a big loss by investing a large amount just before a market slump.

Reinvest dividends

As mentioned above, I’d add some stocks that pay dividends as they provide small amounts of regular income. By reinvesting the dividends, the returns will compound even quicker.

Consider index funds

These funds typically include a range of assets, offering an easy way to invest in a diversified portfolio. Some even track the performance of an entire index like the FTSE 100 or S&P 500.

Rebalancing

Markets change constantly due to economic, social and geopolitical events. Periodically reviewing and adjusting the assets in a portfolio can help to reduce risk and maximise returns.