In hindsight, we know that the Rolls-Royce share price between 2020 and 2022 was a stock market bargain. So, it stands to reason that there are probably other golden FTSE 100 opportunities staring us right in the face.

Could BT Group (LSE: BT.A) stock be one? Let’s take a look.

A value trap

I first considered BT shares a few years ago and I’m now glad that I didn’t invest. They’ve fallen 62% across a decade and 15% in five years.

BT has long been a value trap. This is where a stock looks like a shiny bargain because its price is low. But instead of rebounding, it traps investors by staying stuck in the bargain bin or falling even further.

This could be for any number of reasons, such as poor prospects, underlying issues, or repeated cuts to the dividend (which undermines investor confidence). I’d say BT ticks all those boxes.

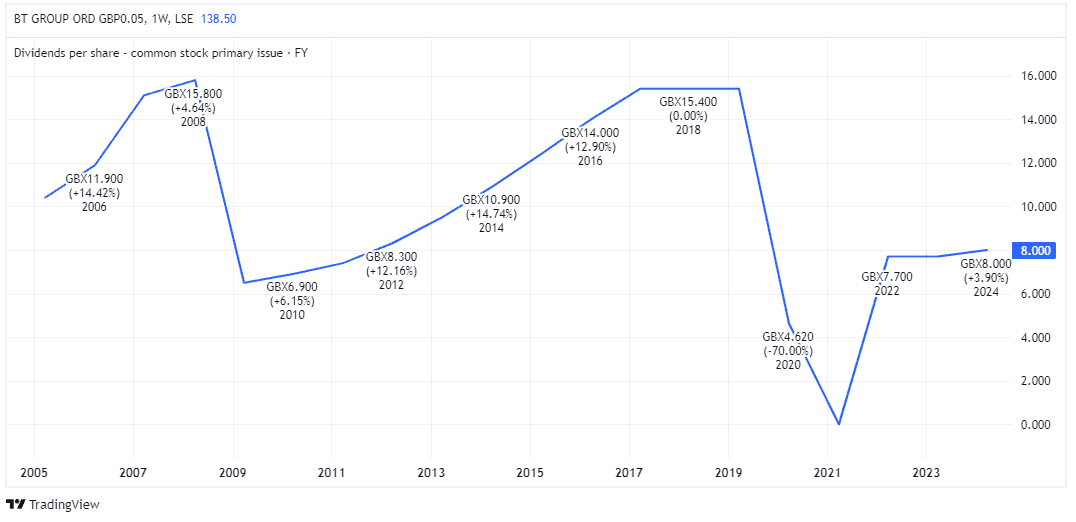

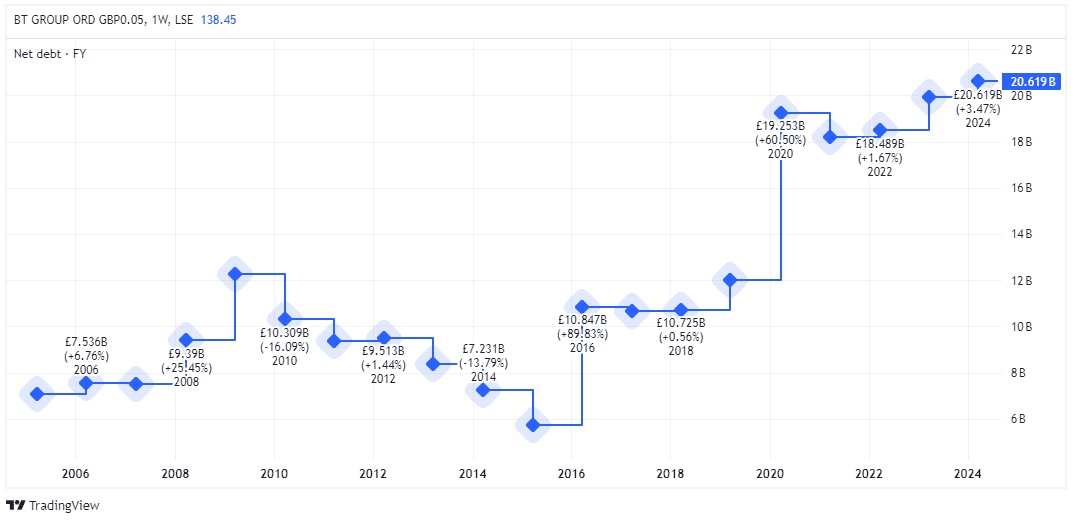

First, it’s operating in a mature telecoms industry with low growth prospects. There’s also long been a massive underlying debt issue, while its long-term record of growing the dividend is simply dreadful.

BT dividend per share (2005-2023)

Smart investors see value

Since I last considered BT shares in April, they’ve soared by 32%. And they jumped 6.2% to 138p today (12 August) after it was announced that Indian billionaire Sunil Bharti Mittal’s conglomerate would buy a 24.5% stake from BT’s largest shareholder.

Commenting on the investment, Bharti said: “BT has a strong portfolio of market leading brands, high-quality assets and an experienced management team…BT is playing a vital role to expand access to full-fibre broadband infrastructure for millions of people across the UK.”

This stake, valued at about £3.2bn, is obviously a positive development for shareholders. Interestingly, the Bharti conglomerate hasn’t asked for a seat on the BT board, which is a vote of confidence in the turnaround underway by new CEO Allison Kirkby.

In June, Carlos Slim, the Mexican telecoms billionaire, separately paid £400m for a 3% stake in BT. So multiple industry veterans see great value here. I’m now wondering whether I should get onboard too.

A FTSE 100 bargain?

Looking at BT’s revenue, the one thing you have to admit is that it’s remarkably consistent.

| Financial year (ending March) | Annual revenue |

| FY26 (forecast) | £20.9bn |

| FY25 (forecast) | £20.8bn |

| FY24 | £20.6bn |

| FY23 | £20.7bn |

| FY22 | £20.8bn |

Despite this lack of top-line growth, the stock could still be a solid investment. That’s because BT’s free cash flow is expected to improve now that its massive investments in expanding full-fibre broadband have likely peaked.

Indeed, the group sees normalised free cash flow reaching £3bn by 2030, up from £1.3bn last year. This is vital because BT still has a massive net debt position of approximately £20bn.

As well as paying down debt, this cash could also support a rising dividend. The forward yield is currently 6% and appears well-covered.

Meanwhile, the forward-looking price-to-earnings (P/E) multiple is around 7.5. That’s cheaper than both the wider FTSE 100 and BT’s peer group. So I can see why sector investors are licking their chops at a potential bargain here.

However, I can’t ignore BT’s debt pile when this exceeds its £13.8bn market capitalisation. It remains a big concern, as does stagnant revenue growth and rising competition.

All things considered, I reckon there are better opportunities elsewhere for my money.