I don’t treat the stock market plunge of recent days as reason to panic. Instead, I see it as a perfect opportunity to buy great UK shares at knock-down prices.

I invest based on what returns I can expect to make over the long term. This is because stock markets always have a way of bouncing back strongly following corrections and crashes.

Buying in at the bottom gives me a chance to enhance my eventual returns. So which shares am I looking at today? Here are two of my favourites — along with a top-class exchange-traded fund (ETF) — that I’ll consider buying when I next have cash to invest.

All-rounder

Vodafone Group (LSE:VOD) shares look dirt cheap across a variety of different metrics. Its forward price-to-earnings (P/E) ratio clocks in at just 9.9 times, while its corresponding dividend yields stands at 7.3% for this year.

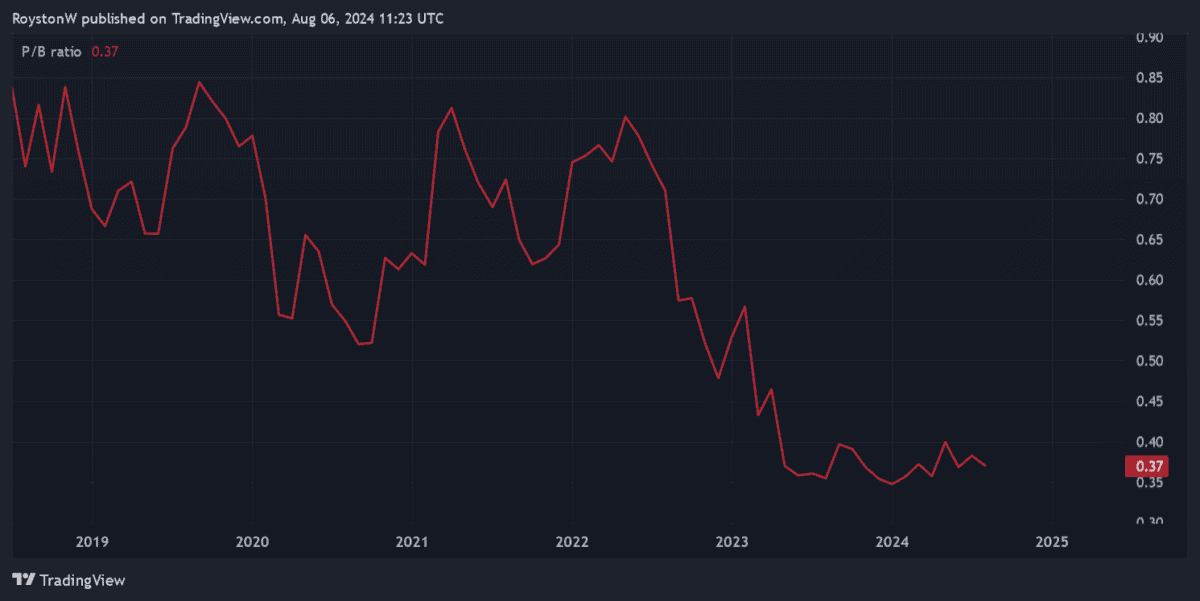

And the FTSE 100 telecoms giant trades on a price-to-book (P/B) ratio of just 0.4. Any reading below 1 indicates that a share is undervalued.

Vodafone’s share price has plummeted on worries over a US recession and its impact across the globe. However, telecoms profits tend to remain broadly stable across the economic cycle, suggesting to me that this sell-off is unwarranted.

On the other hand, the business does face significant competitive pressures. However, I still think Vodafone has excellent investment potential as our increasingly digitalised lives drive telecoms demand.

Defence star

Babcock International Group‘s (LSE:BAB) shares also look very cheap at current levels. City analysts think annual earnings here will soar 42% this financial year. And so the defence giant trades on a price-to-earnings growth (PEG) ratio of 0.3.

Like the P/B ratio, a value below 1 indicates exceptional value.

Just like Vodafone, Babcock operates in a highly defensive sector, and so earnings should be unaffected by broader economic conditions. In fact, the outlook here is pretty encouraging as the worsening geopolitical landscape prompts companies to rapidly rearm.

But I have to remember that defence timing contracts can be unpredictable. It’s a problem that can adversely affect share prices along with dividends.

A top fund

The iShares Edge MSCI World Value Factor UCITS ETF (LSE:IWVL), in its own words, was established to “capture undervalued stocks relative to their fundamentals.” Today it holds positions in 399 shares spread across North America, Europe and Japan, which in turn gives investors a great way to spread risk.

The fund isn’t immune to bouts of extreme volatility, as the last few days have shown. But its focus on cheap stocks could limit price falls if market conditions worsen.

For example, it’s keen on the semiconductor industry but has steered clear of expensive Nvidia shares. Instead it’s opted for the likes of Intel and Qualcomm.

These business trade on forward P/Es of 19.9 times and 16.1 times, respectively. Both readings are far below the multiple of 39.5 times for Nvidia shares.

Just under a quarter of the ETF’s money is locked into information technology stocks. So it could be very vulnerable in the event of a US recession. But on balance I still think it’s a great fund to consider.