The hottest investing trend to have come along in many years is undoubtedly artificial intelligence (AI). Most experts predict this revolutionary technology will transform multiple industries. Naturally then, many investors starting out today will have been wondering which is the best stock to buy in the space.

So far, Nvidia (NASDAQ: NVDA) has been the standout winner. Shares of the AI chipmaker have risen by a stonking 2,473% over five years — even after a 16% drop in July!

While Nvidia’s chips hold a dominant position in AI-accelerated data centres, competition is mounting. Not just from old rivals like Advanced Micro Devices, but also its own customers, including Alphabet and Amazon. Both are developing their own custom AI chips to reduce reliance on outside suppliers.

Will Nvidia still be at the top of the AI pile in five years time? Perhaps, but we don’t know for sure, especially given how rapidly the industry is developing.

My strategy here then is to invest in the firm doing most of the chipmaking on behalf of all these customers. That is Taiwan Semiconductor Manufacturing (NYSE: TSM), the world’s largest chip foundry.

As I write, the stock has dropped 19% inside a month. Here’s why I plan to buy more shares in August.

Deep moat and eye-popping margins

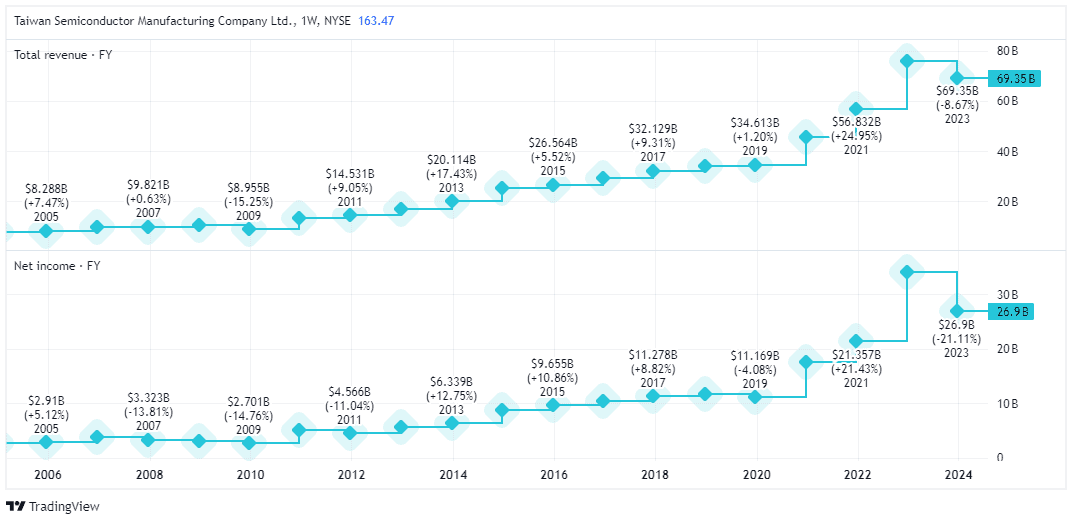

TSMC, as the firm is known, has delivered a 17.7% compound annual growth rate (CAGR) in revenue since 1994. Its earnings CAGR? 17.2%!

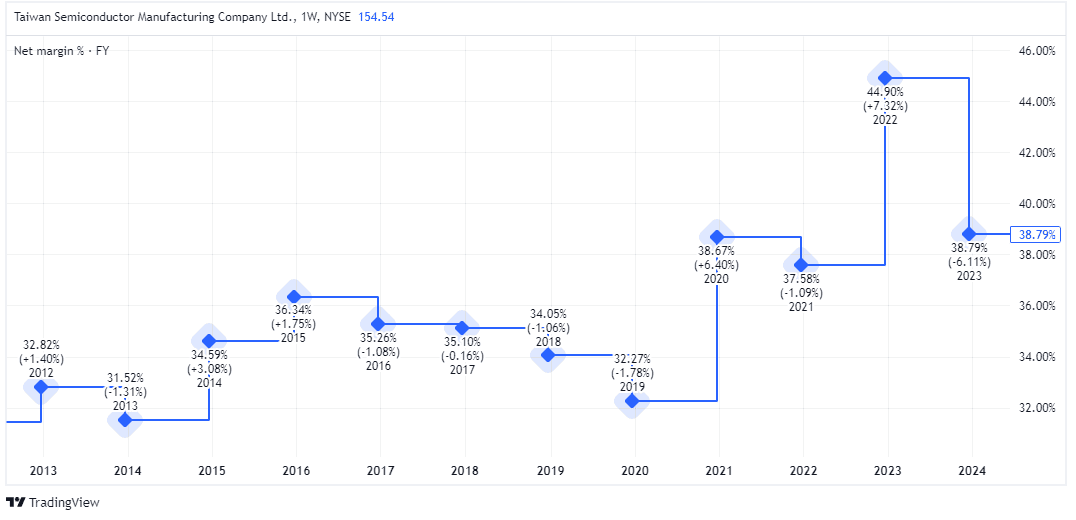

This indicates that the company has a powerful competitive advantage (or moat). Indeed, its net profit margin is an incredible 38%.

I doubt a $100bn war chest would compete with TSMC. I mean, a single modern foundry costs $10bn-$20bn or more. Before that, you’d have to build the supply chain, attract top talent, then match TSMC’s economies of scale and massive annual capital expenditure and R&D budget. Good luck with that!

That’s not to say it has no competition. It does, mainly in the shape of Intel and Samsung Foundry, a division of Samsung Electronics. But it remains the global leader, with a 60% market share and a fortress balance sheet.

Strong AI demand

In Q2, revenue surged 32.8% year on year to reach $20.8bn. Net income and diluted earnings per share both increased 36.3%.

As mentioned, most top tech firms use TSMC. Apple and Nvidia are among its largest customers. And chief executive C.C. Wei recently told analysts: “AI is so hot; right now everybody, all my customers, want to put AI functionality into their devices.”

Given this, you might expect TSMC to be trading at some crazy AI-fueled multiple. But the stock’s forward price-to-earnings (P/E) ratio is currently under 20, based on 2025’s analyst estimates.

That’s far cheaper than Nvidia and most other AI-related tech stocks.

As with all investments though, there’s risk. The main one is China invading Taiwan, where most of TSMC’s production capacity is located. Another would be a slowdown in AI spending, which would hurt growth.

Still, TSMC has around a 90% share in making the most advanced chips. So it’s perfectly placed to benefit from the AI revolution, regardless of which individual firms end up reigning supreme.

With the stock looking great value again, I intend to buy the dip in August.