The commonly accepted definition of a stock market correction is a decline of at least 10% from a recent peak. If the decline extends to 20% or more, then it’s characterised as a crash — or bear market.

A full-blown market crash is pretty rare, with only a handful occurring in the past century. Corrections are far more common, typically occurring every few years. Stock exchanges around the world have experienced several corrections since the 21st century began.

It’s impossible to predict exactly when a correction will happen. It seems logical to assume one might occur after a long period of consistent growth. But as the adage goes: “The market can stay irrational longer than you can stay solvent“.

In other words, there is no guaranteed way to predict a market’s moves and many have gone broke trying. But history has shown that in most cases, corrections are temporary. So rather than something to fear, they should be viewed as an opportunity.

Keeping cash aside

I have a fair amount of cash put aside in an easily accessible savings account. It only returns around 5% on average per year but it’s stable and reliable. I could dump all this cash into whatever tech stocks are trending this month but if things go south, that money is tied up — unless I sell at a loss.

I prefer to have it on hand for when an unexpected market correction serves up a wealth of good investment opportunities. If I don’t, I could miss out.

Making good choices

It can be a bit daunting choosing to invest during a market correction. Nothing really looks like a good option when prices are all falling. Which stocks should I choose? How can I know when the prices will stop falling?

Unfortunately, there’s no guaranteed one-size-fits-all solution. But some preparation can help. Having a good idea of what stocks you’re interested in beforehand is a good start. That way, I can hone it down to four or five and decide from there.

Here’s one stock on my wishlist that I’m ready to buy when the market corrects.

ARM Holdings

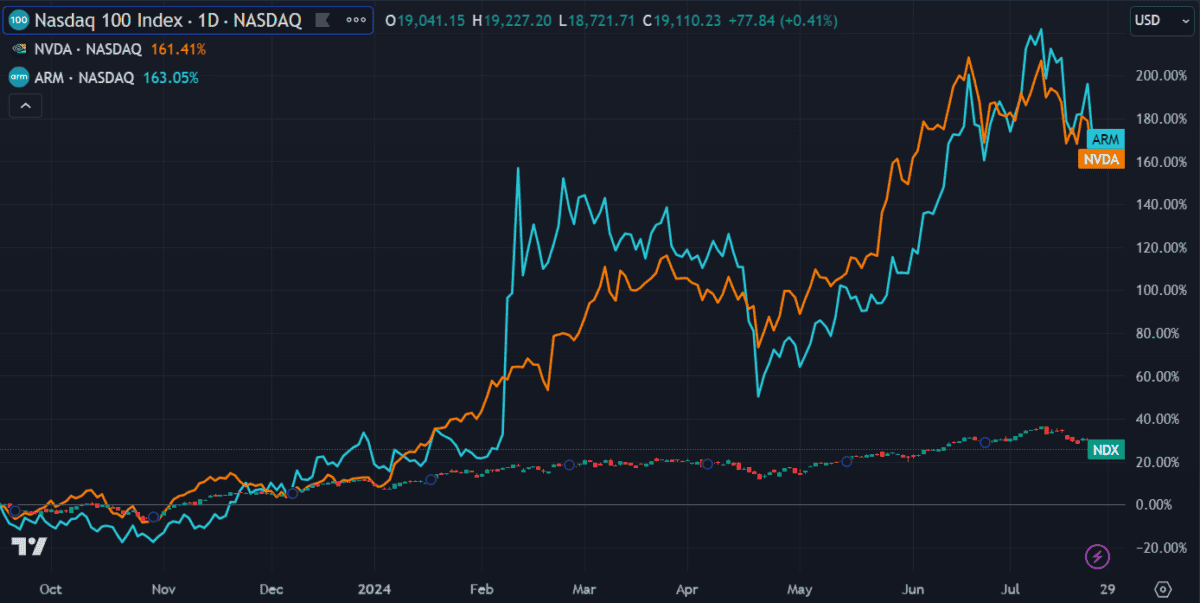

Although listed in the US, ARM Holdings (NASDAQ: ARM) is a British semiconductor and software design company. It capitalised heavily on the AI boom — and did spectacularly well.

The share price is already up 150% since its IPO less than a year ago. That’s almost identical to the parabolic growth of Nvidia. Not surprising, considering the semiconductor giant is one of ARM’s biggest customers.

There’s no denying it’s done well since going public. But that may all change soon. Profit margins this year are already down to 9% from 19%. And with earnings only a fraction of the market cap, some analysts are calling the stock “grossly overvalued”.

I think I might get my cheap buying opportunity soon. One analyst has set a 12-month price target of $66 per share on the stock — a 52% decline from current levels.

ARM is set to report its fiscal first-quarter earnings in a few days, on 31 July. Once those results are posted, I’ll have a better idea of where the stock is headed.

Until then, I’ll be ready and waiting.