We’ve seen many UK shares hit record highs this year. In the FTSE 100, these include quality stocks like RELX and 3i Group, as well as more outperformance from Rolls-Royce. In the FTSE 250, shares as varied as fintech outfit Plus500 and branded merchandise firm 4imprint Group have also reached new peaks.

Another surging mid-cap stock that has caught my eye recently is QinetiQ Group (LSE: QQ). Shares of the defence company have powered 51% higher in 2024 and now sit just beneath a record 481p.

But is there any value left after such a strong run? Here’s my take.

Geopolitics

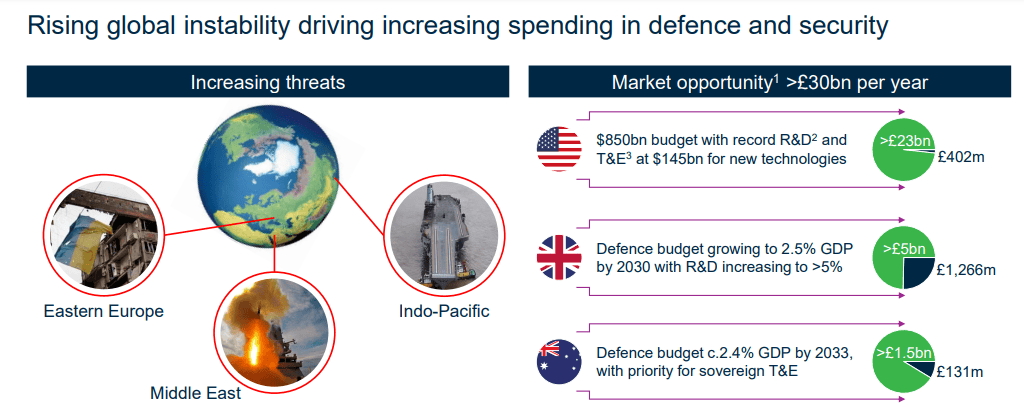

QinetiQ is a defence stock, so it’s probably not surprising to see it surging recently. After all, we’re living in perhaps the most dangerous period since the end of the Cold War. The dreadful conflict in Ukraine reminds us of this, while the US and China continue their sabre-rattling.

Consequently, global defence spending is heading higher, which benefits firms like QinetiQ and BAE Systems (another stock hitting record highs this year).

Somewhat surprisingly though, the QinetiQ share price was lower in April than it was back in early 2020. It was only in May when the stock took off like a rocket.

Strong financial performance

This followed the firm’s raising of its annual guidance for the year ending 31 May (FY24). It said revenue rose 21% year on year to £1.9bn, while underlying operating profit jumped 20% to £215m.

Meanwhile, order intake reached a record high of £1.74bn, lifting its order backlog to £2.9bn. It also launched a £100m share buyback programme and hiked the dividend by 7% (though the yield is currently a modest 1.7%).

CEO Steve Wadey said: “We are…on track to deliver our FY27 outlook of circa £2.4bn organic revenue at circa 12% margin…we are well positioned and have a clear strategy with optionality for investment in sustainable growth.”

Growing market opportunities

One risk here would be a sudden reduction in defence spend by Western nations, especially with Australia, the UK and US collectively representing 94% of its revenue. The UK alone makes up 66%, so there’s an element of overconcentration.

Unfortunately though, a move towards global disarmament doesn’t seem likely. Indeed, world military expenditure is expected to rise for the 10th straight year in 2024, reaching a record $2.47trn.

The UK government is aiming to increase defence spending to 2.5% of GDP. And NATO has pledged to spend 2%+ of GDP on defence every year (23 of 32 members are set to achieve the target this year).

Consequently, QinetiQ sees large opportunities in all its markets, especially in the US. It made just over £400m in revenue there in its last financial year but now sees a £23bn+ total market opportunity.

More potential

The last time I wrote about the stock in April, I said it looked good value. It still does, in my view, trading at 14.9 times forward earnings. That’s around half that of peers.

Plus, QinetiQ’s market cap of £2.7bn is a fraction of BAE System’s £38.7bn, so in theory has a lot more scope to grow.

I already have shares in BAE. But if I didn’t and if I was looking to invest in a defence stock, I’d consider buying QinetiQ.