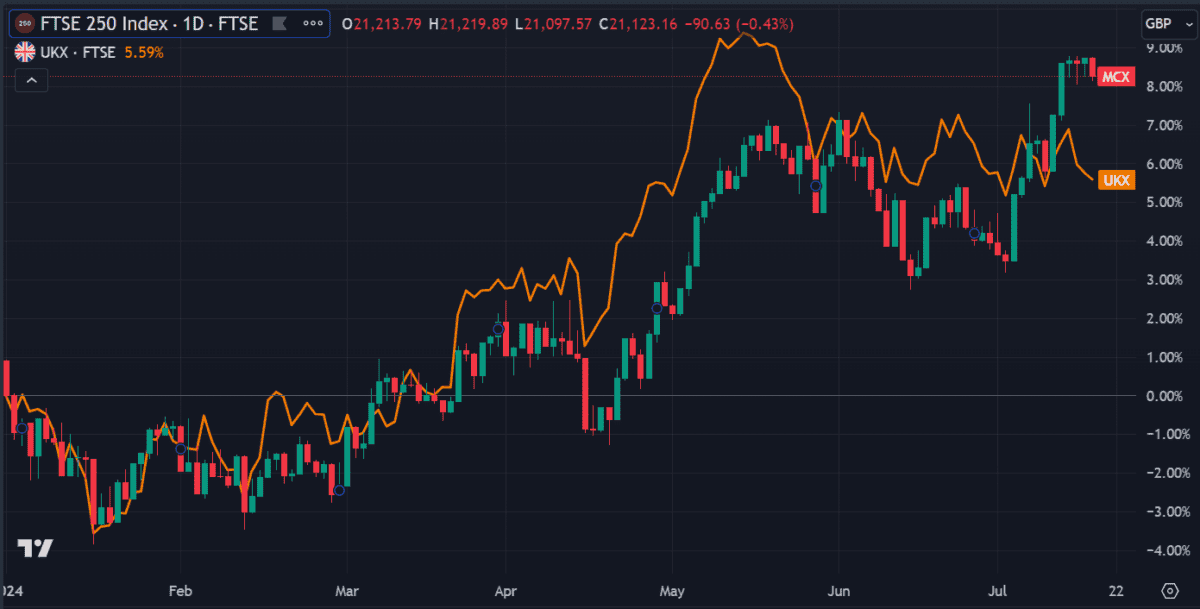

The FTSE 250 is up 8.2% so far this year, outperforming the FTSE 100 by almost 3%. It recently hit a two-year-high above 21,200 points, the highest since April 2022.

It’s not uncommon for it to outperform its bigger brother. The smaller-cap stocks it lists often have more room to grow. So digging for undervalued stocks on the 250 is a great way to take advantage of the extra growth potential.

What’s more, the index’s average price-to-earnings (P/E) ratio is 19.8, near the lowest it’s been in two years.

With that in mind, here’s one FTSE 250 stock that exhibits growth potential as we head into H2 of 2024.

Tipped to win

IntegraFin Holding (LSE: IHP) is a British investment company and operator of the Transact trading platform. It caught my attention when Berenberg put in a ‘buy’ rating for the stock yesterday. I also see that Barclays has an ‘overweight’ rating on the stock.

It seems brokers are positive about the company’s future. But what has prompted this recent interest?

The stock has been doing well this year. So well, in fact, that I’m kicking myself for not noticing it sooner. It’s up 34% since hitting a year-to-date (YTD) low of £2.67 in late February. Have I missed out?

Not exactly.

On a five-year chart, there remains much room to grow. Despite the recent growth, it’s still down 40% since its all-time high of £5.99 in November 2021.

A value play

A balance sheet is always a good place to start when evaluating a company. If it has a potentially unmanageable debt level, it’s already a non-starter for me. IntegraFin is looking good to me with no debt, high cash holdings, and assets that outweigh liabilities.

Looking at its latest quarterly earnings results released this week, things look good. Funds under direction (FUD) hit a record high of £62.42bn, a 14% increase since last year.

Net flows increased 6.8% and clients on the platform grew by 1.9%.

With the share price underperforming earnings over a three-year period, there is an argument that the shares are undervalued. If the company continues to attract positive attention from brokers, this could help drive the price up further.

Price pressure

Not all metrics play in its favour, though.

Using a discounted cash flow model, analysts estimate the shares to be slightly overvalued. This is based on future cash flow estimates, which are unusually high for the company. Most likely, this is due to the large amount of capital inflows typically seen on investment platforms of this nature.

As such, the metric may be skewed.

But it’s not the only metric suggesting it’s overvalued. It also has a slightly higher-than-average P/E ratio of 23. Some analysts feel that a ratio of 15 would be fairer but that would require a significant earnings increase — or a big fall in price.

Furthermore, lingering inflation and an uncertain economic outlook could reduce trading activity, as consumers reduce unnecessary spending. That adds another level of risk to the stock.

On balance, I’d say the strong financials work in its favour, making it a stock worth considering for long-term growth potential.