The FTSE 100 does not have many high-profile tech stocks. One of the few is Ocado (LSE: OCDO). Is it a growth stock? Comparing the 70% fall in the Ocado share price over the past five years to a US growth stock like Nvidia (up 2,903% in the same period), it does not look like the sort of growth stock most investors get excited about!

Still, Ocado has a sizeable, growing business and is well-regarded in the retail industry. The company announced today (8 July) that it is set to build a third fulfilment centre in Japan for local retail giant Aeon.

So, has the Ocado share price fallen too far, presenting me with a buying opportunity? Or could things get even worse from here?

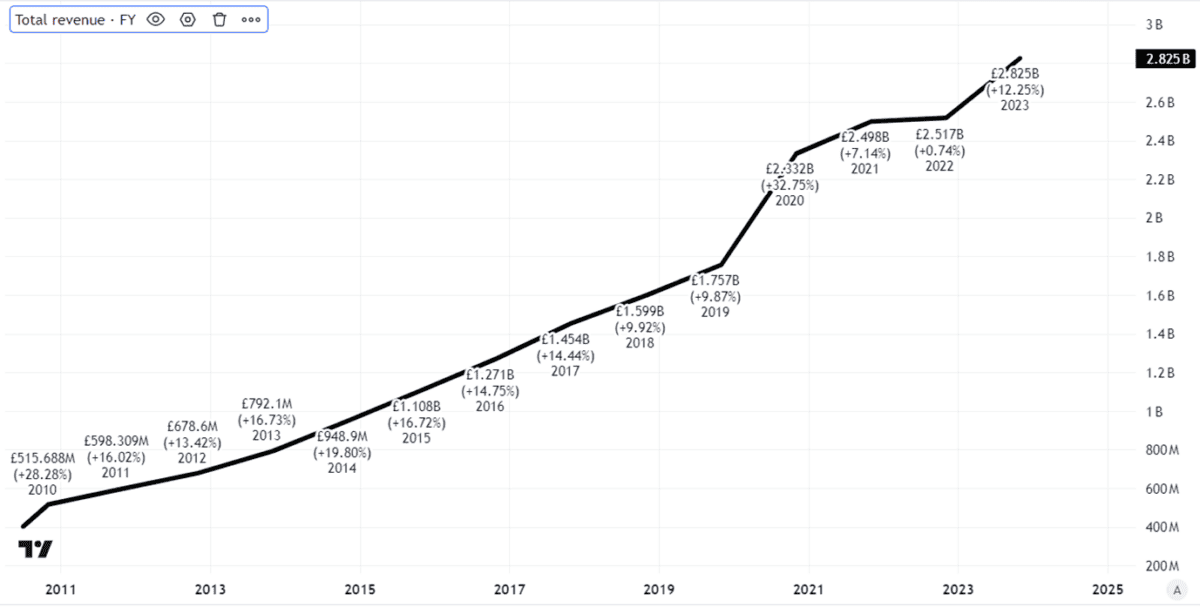

Solid revenue growth

Ocado is a business with growing revenues. The Aeon deal is just the latest in a series of agreements it has made with retailers worldwide as it expands the scale of the service it offers to help manage their online fulfilment operations.

Created using TradingView

But while a growing sales trend can be seen as positive sign a company has identified a potentially lucrative market, it is not always a good thing.

Why?

Revenue is one thing. A company can often boost revenue just by cutting prices and achieving higher sales volumes, for example. But at the end of the day, what matters to long-term investors is whether a company can make profits.

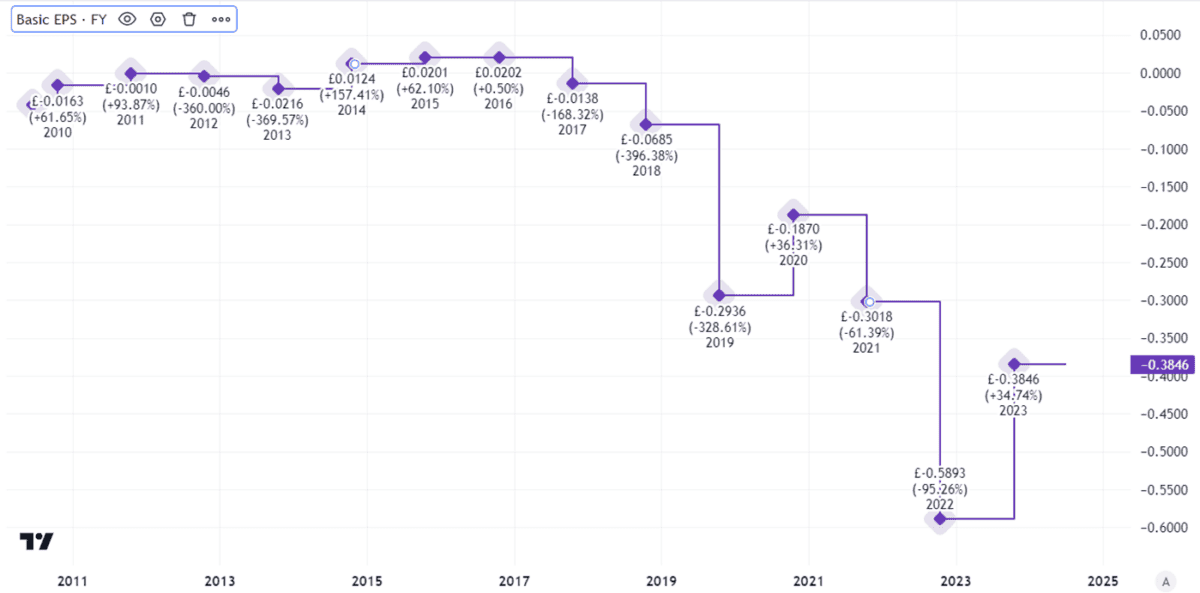

Red ink in abundance

This is where I think the investment case for Ocado looks weaker.

Yes, it has a growing customer base and impressive proprietary technology. But at the end of the day, while the Ocado outsourcing business relies on tech (that has been expensive to build) it is also heavily dependent on the company building and operating a lot of distribution centres. Again, that is expensive.

Add into the mix the fact that it needs to do that in diverse locations worldwide and it become apparent why the company has been spilling a lot of red ink in the past few years.

The story is pretty clear from the firm’s basic earnings (or losses) per share.

Created using TradingView

To help counter the costs, the company has issued more shares, diluting existing shareholders to raise funds. I see that as a risk for future too.

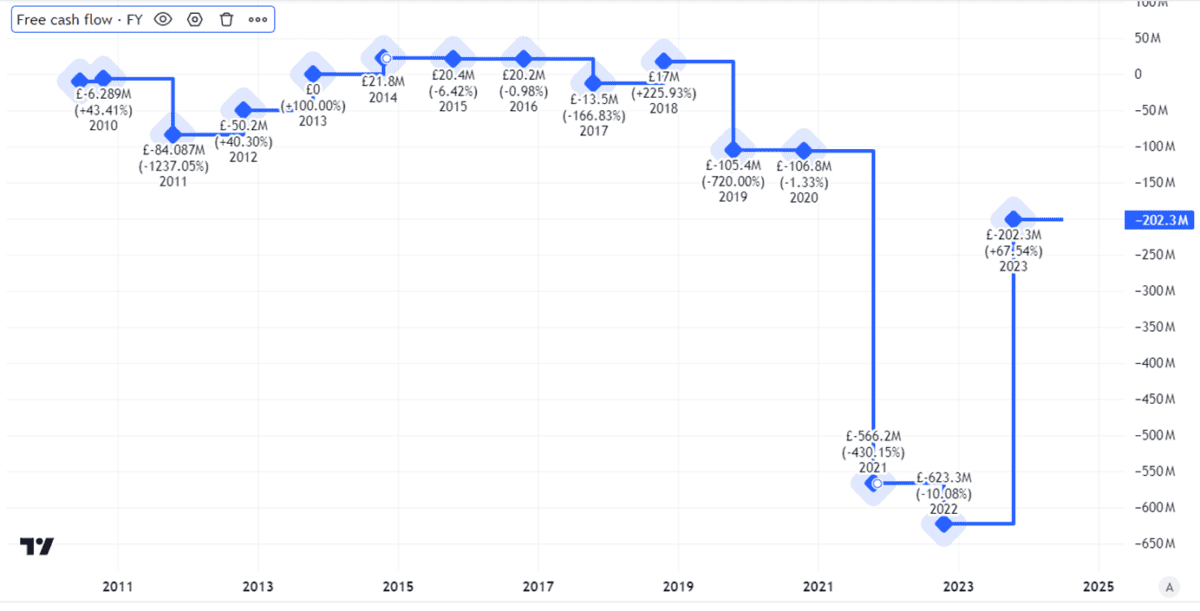

But despite the inflow of cash from that, the overall free cash flow has still been heavily negative of late.

Created using TradingView

Lots still to prove

That investment in infrastructure could pay off as it enables Ocado to deliver on decades-long customer contracts.

If free cash flows improve markedly and the business can prove its model is able to generate profits consistently, I reckon today’s Ocado share price could turn out to be a bargain.

That has not yet been proven, though.

The investment case remains heavily tied to buying into Ocado’s idea of what it wants to do, rather than the current financial performance.

Not only does that explain today’s Ocado share price, it could also mean that if the idea cannot be convincingly proven to be a money spinner, the share may be overvalued even at its current level.

I have no plans to buy.