The FTSE 100 is home to a wide selection of top dividend stocks. The average forward yield for UK blue-chip shares sits at 3.6%. But with some careful research, I think investors can do much better than this.

Right now, WPP (LSE:WPP) and Legal & General Group (LSE:LGEN) both offer a larger dividend yield than the broader index. If investors choose to buy these Footsie shares instead of an index tracker fund, the difference it could make to their passive income could be considerable.

An equal £20,000 investment spread across these shares could provide an income stream of £1,460 over the next 12 months. This is more than double the £720 that a tracker like the iShares Core FTSE 100 UCITS ETF might provide over the same timeframe.

I also feel that these three blue-chip shares will provide a growing dividend over time. Here’s why I think they’re worth serious consideration today.

WPP: dividend yield: 5.2%

WPP has suffered more recently as higher interest rates have whacked advertising budgets. Trading has been especially hard in North America and China, meaning City analysts expect a slight reduction in this year’s annual dividend.

But income investors should remember that WPP’s near-term yield still beats the market average. And the ad agency looks in good shape to pay the dividend analysts are expecting, too.

Predicted earnings for 2024 cover the expected dividend 2.3 times. This is well ahead of the widely regarded safety benchmark of 2 times.

There’s good news for WPP investors beyond this year too. City analysts expect dividends to start growing again from 2025 as the advertising sector rebounds. So the yield rises to 5.4% for next year and 5.6% for 2026.

WPP is a share that could deliver terrific returns over the long haul. I expect its growing exposure to fast-growing emerging markets to pay off handsomely. I also like its focus on the booming digital advertising sector.

Legal & General Group: dividend yield: 9.4%

Unfortunately, Legal & General doesn’t have the same level of dividend cover as WPP. For 2024 this sits at 1.1 times, meaning shareholder payouts could be at risk if earnings miss the mark.

I’m not certain, but the financial services giant could still be in good shape to keep growing dividends, as City analysts expect. Even if profits disappoint, it has a cash-rich balance sheet to help it meet broker expectations. Its Solvency II capital ratio stands at a formidable 224% right now.

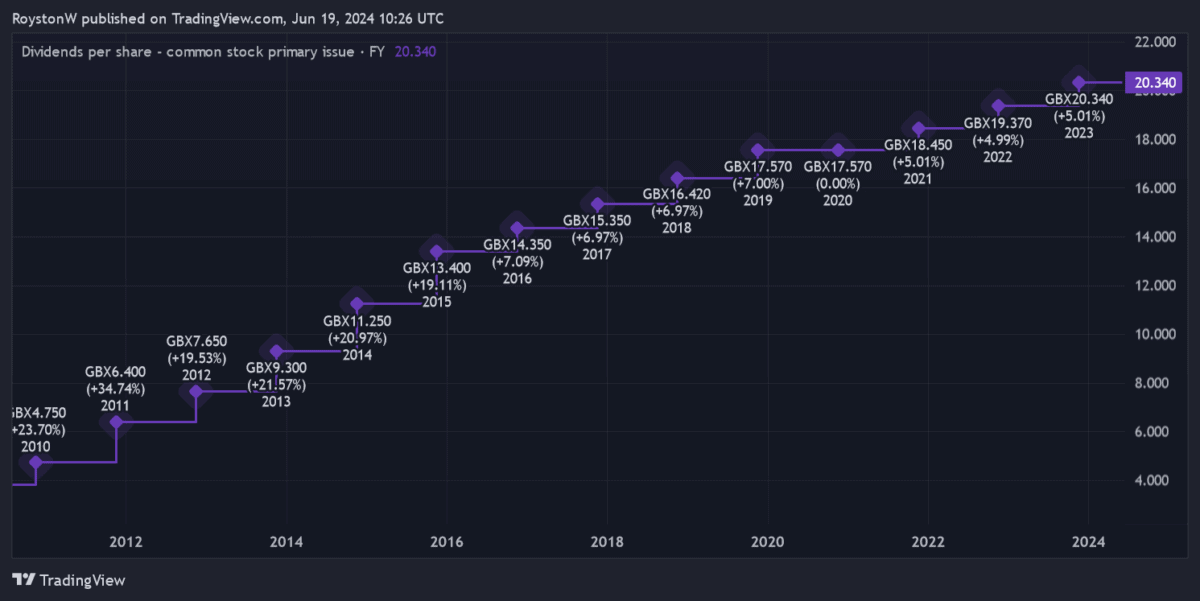

Legal & General certainly has a long-standing commitment to raising dividends, as shown in the graphic above. And in recent days the firm affirmed its intention to continue raising dividends (at a rate of 5% this year, and 2% between 2025 and 2027).

This means the dividend yield on its shares rises to 9.8% for next year, and bursts into double-digit territory at 10.2% for 2026.

I think Legal & General’s impressive record of dividend growth will continue for many years to come. Rising demand for retirement and wealth products should keep driving profits steadily higher.