LondonMetric Property (LSE:LMP) has been promoted from the FTSE 250 to join the premier league of UK listed companies. Going in the other direction, is Ocado Group.

Relegation

It’s been a sad — albeit inevitable — decline for the online grocer.

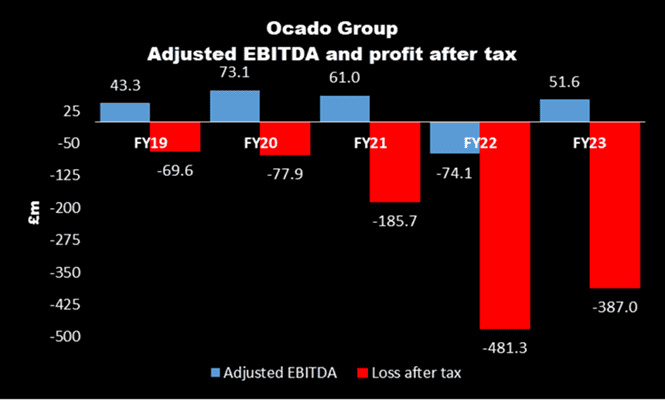

The company has been in existence for 23 years and has only recorded an annual post-tax profit during three of those years. Over its past five financial years, it’s racked up over £1.2bn of losses.

Even the most tolerant investors appear to have run out of patience. Since June 2019, its share price has crashed by 67%.

In my view, a return to the FTSE 100 is dependent on the company being able to licence its innovative technology to others around the world.

Promotion

By contrast, LondonMetric Property is profitable and growing.

It’s a real estate investment trust (REIT) which means it makes money from leasing properties to third parties. And it appears to have lots going for it.

During the year ended 31 March (FY24), its earnings per share (EPS) were 10.9p, compared to 10.3p, for FY23.

Currently, its properties have an occupancy rate of 99.4%. And 80% of its rental income is covered by contractual uplifts.

It also has a weighted average unexpired lease term of 19.4 years, compared to 5.4 years for the maturity of its debt. This means it has the potential to be highly cash generative after its debt has been paid down.

However, I suspect it will want to keep borrowing to fund its expansion plans.

Growth

The company has recently concluded two deals that should transform the size and scale of its operations. Analysts are forecasting EPS of 13.02p in FY25, and 13.47p, for FY26.

Like all REITs, to avoid having to pay corporation tax, it must return at least 90% of its profits to shareholders each year.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Based on its FY24 dividend of 10.2p, its shares are presently yielding 5%. However, it has a target to pay 12p in FY25, which implies a yield of 5.8%. The average for the FTSE 100 is 3.8%.

And while I prefer to do my own research, it’s comforting to know that of the 13 brokers covering the company, eight rate its stock as a Buy, five are neutral and none are advising their clients to sell.

Areas of concern

But there are risks.

According to its most recent accounts, at 31 March, the trust’s net assets were equivalent to 191.7p a share.

Today (10 June), its share price is 199.5p — a premium of 4.1%. This could limit future growth in its stock market valuation.

Also, the commercial property sector can be volatile. There was evidence of this in FY23, when LondonMetric Property had to write down the value of its portfolio by £563m.

However, on balance, I think the trust’s shares would make a good long-term investment. Over 40% of its assets are in the logistics sector. These properties are likely to remain in high demand and should give it some protection against a general downturn in the property market.

I also like its ambitious growth plans.

And the above-average yield is attractive to an income investor like me.

For these reasons, I’m going to put the REIT on my watchlist for when I next have some spare cash.