Investors don’t like unexpected announcements. That’s why the National Grid (LSE:NG.) share price fell 10.8% on 23 May. It plummeted after the company said it was going to ask shareholders for more money to help fund its capital programme.

To compound matters, its share price fell another 11.5% the day after.

But despite this, it’s still over 20% higher than it was in May 2019.

A privileged position

National Grid enjoys monopoly status in its key markets. That’s because it’s not practical to have more than one company building, maintaining and operating the infrastructure necessary to supply gas and electricity.

It means the company doesn’t have to keep finding new customers. Instead, its staff only have to focus on keeping the lights on and homes heated.

But the downside is that it’s subject to regulation. And although it’s allowed to make a profit within pre-agreed parameters, meeting its obligations can be expensive. That’s why the company’s seeking £7bn to help fund its anticipated £60bn capital programme through to March 2029.

Shareholders are being given the chance to buy seven new shares for every 24 currently owned, at 645p each. That’s 27% below the current share price.

Once they’ve got over the shock of having to reach into their pockets to maintain their ownership percentage, they might consider they’ve been offered a good deal.

A class act

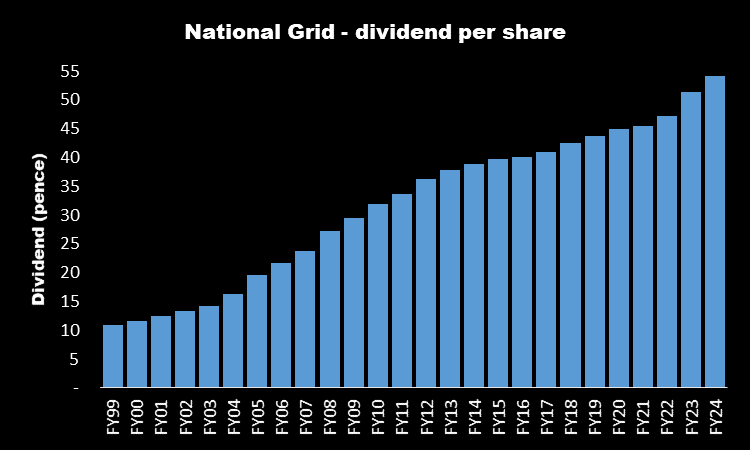

Despite the bad news, National Grid has an impressive track record of growing its dividend each year. And the recent fall in its share price has pushed its current yield to over 6%.

Forgetting about share consolidations and rights issues for the moment, the company has increased its payout to shareholders during each of the past 25 years.

This means it qualifies as a Dividend Aristocrat. Nobody seems to know exactly how many UK stocks meet this definition, but it’s not very many.

Of course, dividends are never guaranteed. But National Grid is the sort of stock that, in my opinion, has a better chance than most of maintaining a generous return to shareholders. That’s because of its stable – albeit regulated – earnings.

Another reason why I’m confident that the dividend will continue its upwards trend is an anticipated increase in profits. Over the next five years, the rights issue is expected to support annual growth in the company’s earnings per share of 6%-8%.

Highly geared

Critics will point out that the company is carrying lots of debt. At 31 March 2024, its net debt was £43.6bn. That’s nearly 10 times its operating profit for its 2024 financial year.

Also, utility stocks tend to do better during an economic downturn. Investors generally like the steady and predictable earnings that the sector offers. But with the US economy growing rapidly and the green shoots of a recovery perhaps becoming evident in the UK, it could fall out of favour.

However, for its steady and reliable dividend, anticipated growth in earnings and the absence of competition, if I had some spare cash I’d seriously considering taking a position. But not until after 10 June. That’s when the company will know how many shareholders have taken up their rights and its share price is likely to stabilise.