Legal & General Group‘s (LSE:LGEN) rock-bottom share price has attracted renewed interest from bargain hunters in recent sessions.

In the seven days to Friday (17 May), the FTSE 100 life insurer was the eighth most popular stock to buy among Hargreaves Lansdown customers. Among AJ Bell clients, it came in at number five.

I’m not surprised that the stock is in high demand. I bought it for my Self-Invested Personal Pension (SIPP) last month. I think it’s one of the Footsie’s best bargain shares, and here’s why.

PEG ratio

There are two ways to assess the cheapness of a share based on predicted profits. One popular metric is the price-to-earnings growth (PEG) ratio, which values a share based on its growth trajectory.

Higher-than-usual interest rates pose a threat to the entire financial services industry. Yet Legal & General is still tipped by City analysts to increase annual earnings by 236% in 2024.

This leaves it trading on a forward-looking PEG ratio of below 0.1. Any sub-1 reading indicates that a share is undervalued.

P/E ratio

The other thing to look at is the company’s price-to-earnings (P/E) ratio, which sits at 10.2 times. As the table above shows, its multiple is lower than many of its industry rivals, as well as the average for FTSE 100 shares.

| Forward P/E ratio | |

|---|---|

| Aviva | 11.2 times |

| AXA | 9.6 times |

| Prudential | 10.6 times |

| Allianz | 10.8 times |

| MetLife | 8.6 times |

| Aegon | 8.3 times |

| FTSE 100 | 11 times |

Dividend yield

On top of this, Legal & General’s also an attractive buy for value investors who are seeking a passive income. Its forward dividend yield 8.5% is more than double the FTSE 100 average, as the table below shows.

It also beats all of its rivals based on this metric.

| Forward dividend yield | |

|---|---|

| Aviva | 7% |

| AXA | 6.3% |

| Prudential | 2.2% |

| Allianz | 5.6% |

| MetLife | 2.9% |

| Aegon | 5.5% |

| FTSE 100 | 3.5% |

The verdict

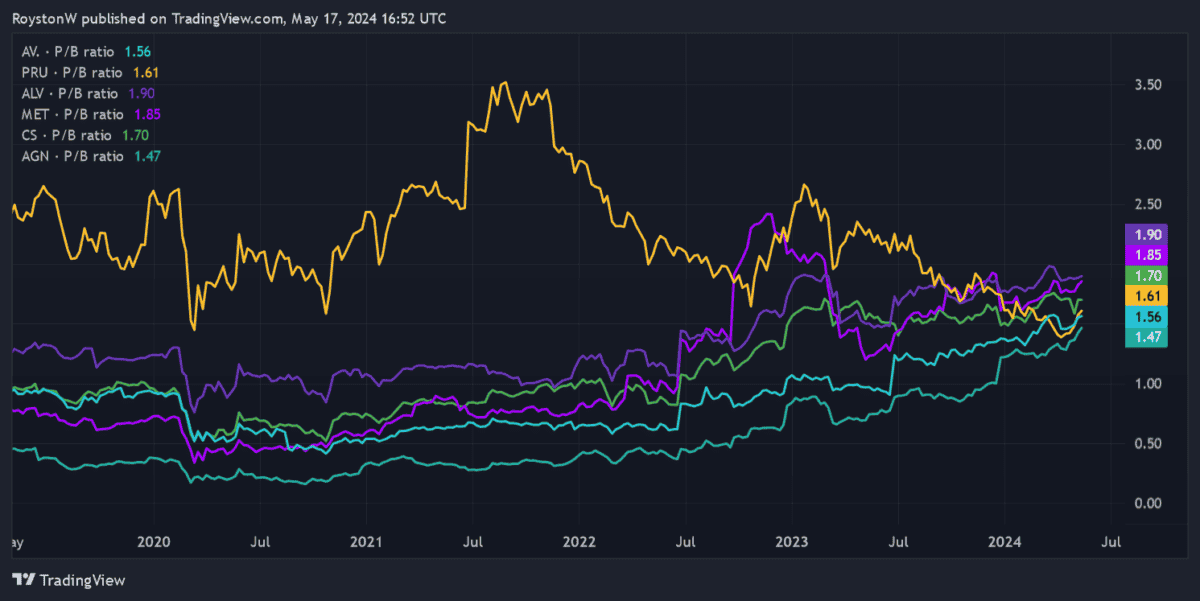

Unfortunately the Footsie company doesn’t look as attractively valued in respect of its assets.

Its price-to-book (P/B) ratio sits at 3.5. As the chart shows, this towers above the corresponding readings for its major rivals.

My verdict, however, is that Legal & General shares still offer excellent all-round value. On the downside, it will have to overcome tough trading conditions to deliver strong profits growth. It also faces substantial competitive pressures from the companies described above.

But the financial services giant still has significant growth opportunities over the long term. I don’t think these are reflected by the cheapness of its shares.

A bargain?

Take the asset management sector, for instance, a sector in which the firm is a major player. PwC expects global assets under management across the industry to hit $145trn by 2025. That’s almost double the amount recorded in 2016.

The outlook is equally bright for the firm’s insurance and retirement products divisions. Demand in these categories will also be boosted by factors like ageing populations, wealth accumulation, technology and innovation, and growing concerns over state benefits.

I believe Legal & General has the expertise and the brand power to effectively capitalise on this improving backdrop. And at 252.8p, I don’t think its share price properly reflects this.