When Warren Buffett buys shares, investors take note. At least, they do when they can, which has been hard as Buffett’s Berkshire Hathaway (NYSE:BRK.B) has been quietly buying an undisclosed stock.

The company’s latest release reveals that stock to be Chubb (NYSE:CB). It’s tempting to try and do the same (as many are) but I think there’s a better way to invest like Buffett.

What is Chubb?

Like Berkshire Hathaway, Chubb operates in the insurance industry. Over half the firm’s revenues come from its property & casualty operations in the US.

Insurance businesses can make money by investing the cash customers pay to earn a return. Doing this well over a long period of time has been the secret to Buffett’s success.

The thing is, this only works if the company’s underwriting is sound. It doesn’t matter if an insurer has great investments if it has to keep selling them constantly to settle claims.

Underwriting well is what gives insurance businesses opportunities to make money through investments. And this is an area where Chubb excels.

Combined ratio

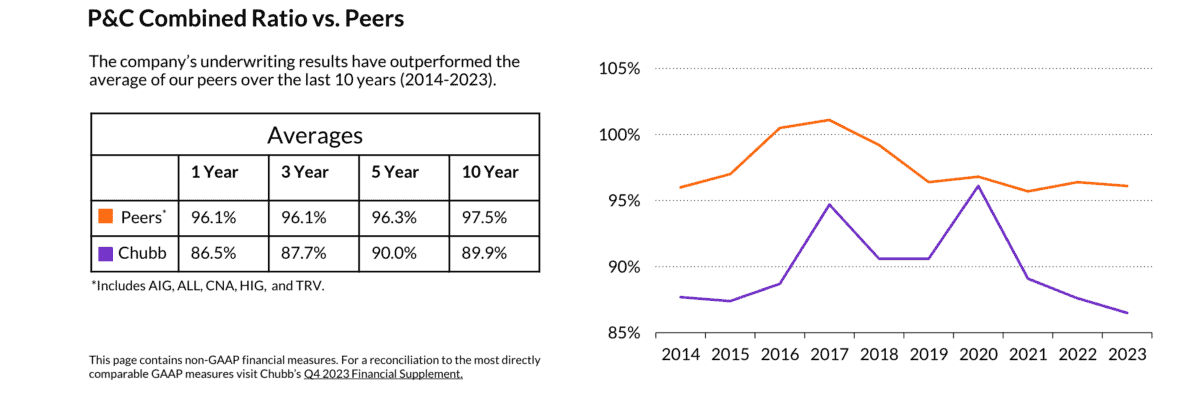

The Combined Ratio is a key metric in insurance. This measures how much a company pays out in costs and claims as a percentage of the premiums it collects.

On average, US insurers have managed a Combined Ratio of 97.5% over the last 10 years. This implies their underwriting hasn’t done much more than break even.

Chubb Combined Ratio vs. Peers 2014-23

Source: Chubb Corporate Presentation Q4 2023

Chubb, however, has done much better. Each year, tts underwriting has outperformed the wider industry, achieving an average Combined Ratio of 89.9%.

That makes Chubb an unusually good business. And at a price-to-earnings (P/E) ratio of around 12, its stock is trading at a significant discount to the S&P 500 average.

Should I buy the shares?

Buying shares in Chubb might be a good idea for someone like Warren Buffett. Berkshire’s insurance operations give its CEO an unusually good insight into the insurance industry.

It’s different for other investors, though. Not having a similar background in the sector makes buying the stock significantly more risky for someone like me.

Buffett investing in Chubb is clearly a positive sign, but the share price is now higher than it was when Berkshire was buying. And what if something changes with the business?

If I buy the stock just because the billionaire investor did, I won’t know how to react if things change and it could be months until I find out what Berkshire has done. That makes Chubb risky for me.

What about Berkshire Hathaway?

Buying shares in Berkshire Hathaway is the best way of investing like Warren Buffett, I feel. No guessing at which stocks, no trying to understand why, and no wondering when to sell.

It comes with the risks of owning the company’s other subsidiaries. This includes the threat of regulation associated with its utilities business and the railroads.

Berkshire’s culture and balance sheet reduce the risk of permanently losing money, though. It’s the largest stock in my portfolio and one I plan to continue buying.