IAG’s (LSE:IAG) stock might be surging, but those of us who invested just before the pandemic hit would have lost a lot of money. That’s because the share price is down 45.5% over five years.

To be more precise, the IAG share price remained strong until around 14 February 2020. Until then, we knew little about the virus that would send us into lockdown. The airline stock started the week of 14 February at 435.97p.

If I had taken the plunge on 14 February, I’d be down 57.9%. My £1,000 then would be worth just £431 today, despite the recent rally. A poor return by any standards.

It must be cheap, right?

I think a common misconception among novice investors is to assume that, historically, valuations have a bearing on how much a stock should be worth in the current market.

As such, just because IAG was trading above 400p a share four years ago, doesn’t mean this figure should have a bearing on the current valuation.

Below, I’ve used two charts to explain some things that have changed.

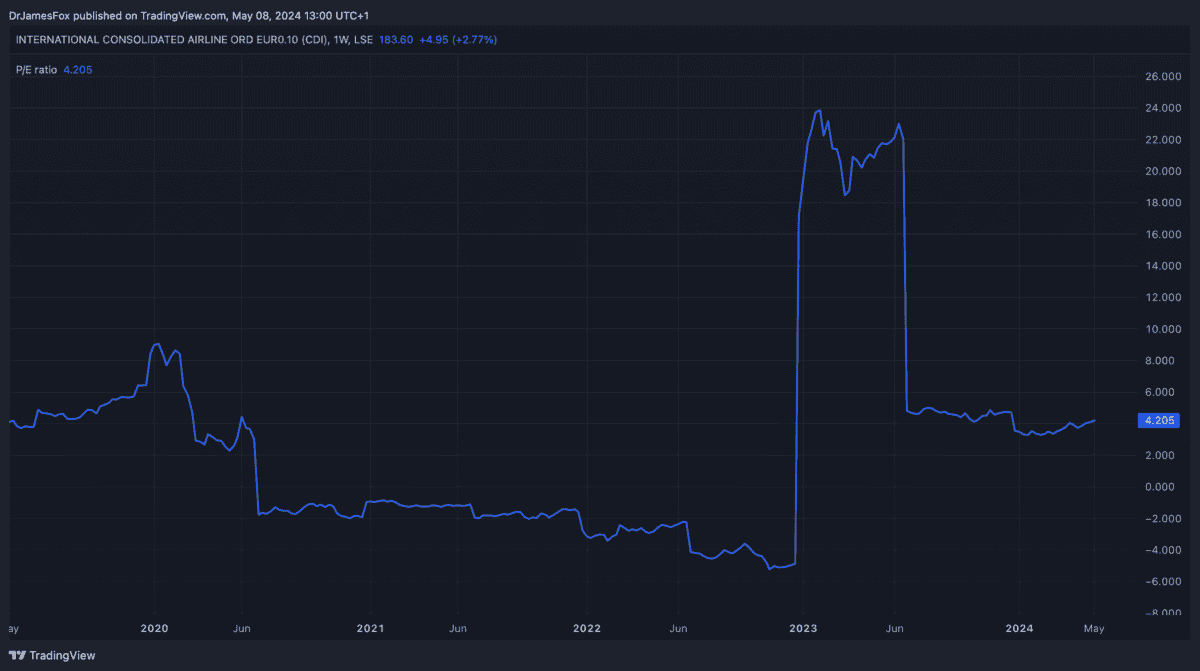

In the first chart, we can see the evolution of IAG’s price-to-earnings (P/E) ratio over the past five years. It used to trade around eight times earnings before the pandemic, and it’s now trading around four times earnings.

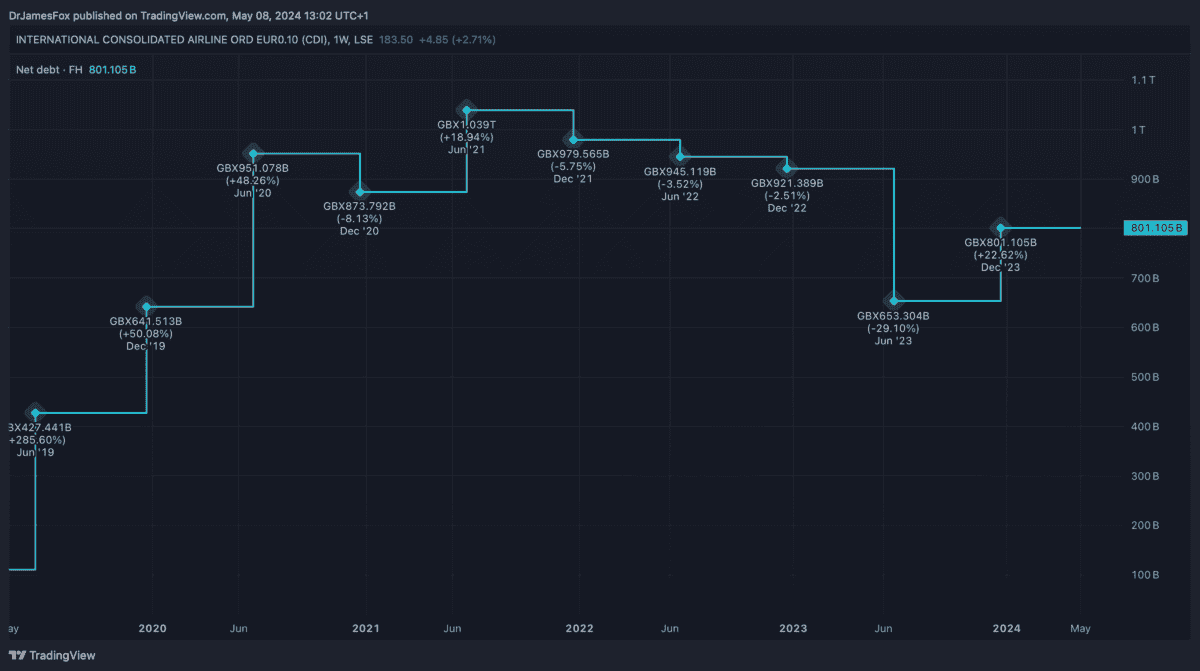

Spoiler alert, I do think IAG’s undervalued. However, the evolution of the P/E ratio doesn’t show the whole story. And debt’s one of the reasons for this. Unsurprising, IAG’s net debt position rose during the pandemic, as we can see below. As of 31 September 2023, net debt stood at €8bn.

There’s more

We don’t just invest because of a company’s earnings today, but because of a company’s earnings in the future. This is why the price-to-earnings-to-growth (PEG) ratio is so important — for me at least.

While IAG’s current growth forecast is pretty positive, there are some clouds on the horizon. For one, fuel prices are high, and ongoing geopolitical concerns including Russia’s war in Ukraine and conflict in Palestine. Both these events threaten to push fuel prices higher. Fuel represents around a quarter of IAG’s costs.

Back in February 2020, fuel prices were significantly lower and WTI was trading for around $50/b. Oil and fuel prices were typically much lower in 2019 as well.

The bottom line

While the aviation industry’s facing several challenges, IAG has plenty of tailwinds. Firstly, demand for travel has recovered since the pandemic and is likely to surpass 2019 levels in 2024.

Of course, it’s worth noting that some markets are stronger than others. IAG serves those that have typically recovered faster. European travel expenditure is set to hit new records in 2024.

Moreover, artificial intelligence (AI) offers significant efficiency gains — British Airways is already using AI to predict faults before they appear. I imagine AI is being employed to optimise fleet allocation.

However, in short, I own shares in IAG because it’s considerably cheaper than its peers, offering similar growth trajectories, albeit with a higher debt burden.