With the UK stock market enjoying renewed growth this week, I’m looking for small local businesses with promising futures.

One FTSE 250 stock that’s been on my radar for a while is the famous British baker Greggs (LSE:GRG). The hugely popular high street chain is known for its sausage rolls but sells everything from doughnuts and sandwiches to ready-made salads.

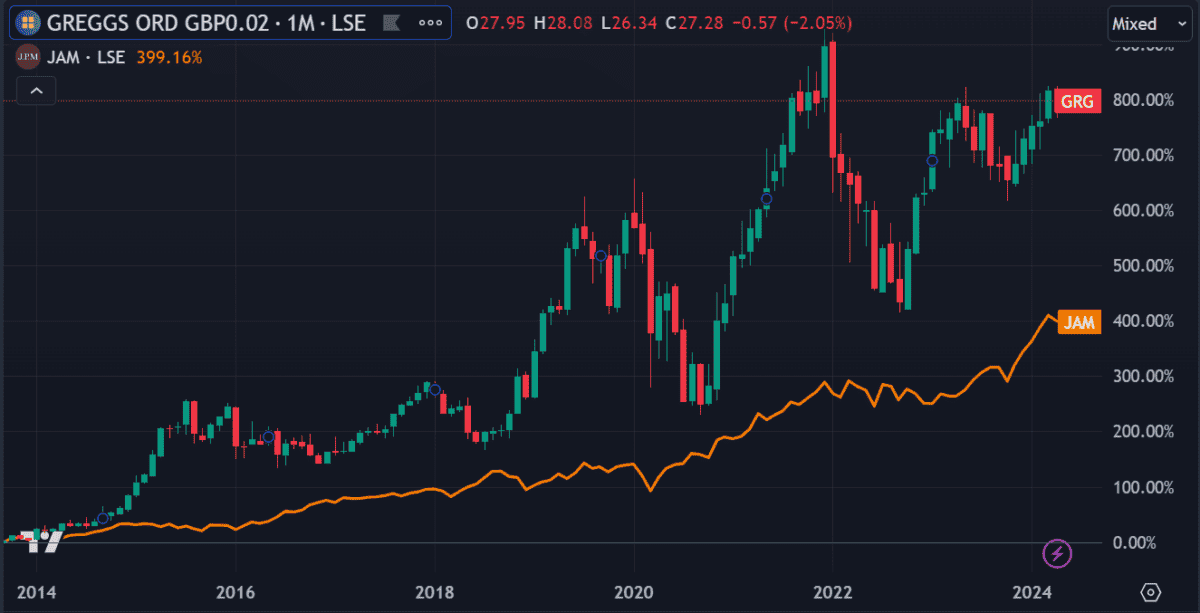

One lesser-known fact about the firm is its incredible share price performance. It’s up 433% in the past 10 years, delivering annualised returns of 18.22%. For comparison, one of the best-performing trusts on the FTSE 250, JPMorgan American Investment Trust, is up only 315% in the same period. It has annualised returns of 15%. Both Sainsbury’s and Tesco are down in the same period.

But with the share price now so high, is there still time to grab a piece of the pie (or steak bake, for that matter)?

A winning formula

The number of Greggs outlets has exploded since its IPO in 1984, growing almost ten-fold from 261 to 2,500 today. It would seem the nation’s appetite for cakes and pastries is insatiable, and Greggs knows exactly how to meet that demand. Admittedly, the combination of low-cost and high-carb comfort food is not exactly a ground-breaking idea – but if everyone could do it, they would.

Greggs is the type of company that I think world-famous investor Warren Buffett might appreciate – simple and consistent, with constant demand resulting in steady growth. Just like the products that the baker sells, it’s a winning formula.

Competitive market

It’s not all sugar and sweets in the pastry shop, though. Greggs is faced with rising ingredient costs due to inflation, threatening its low-cost business model. It also faces competition from local supermarket chains that offer lower prices due to larger wholesale ingredient purchases. While admittedly Greggs has an unmatched flavour, I’m sure other pasty fans have noticed cheaper offerings in high street grocers.

Recent health trends also threaten its future prospects. Younger people are becoming more concerned with their diet, with social media influencers pushing carb-free keto diets and vegan lifestyles. While Greggs has added many healthier options to its menu in recent years, its core business is based around traditional, meat-filled and carb-heavy pastry items.

With lots of new stores popping up all around the country, declining sales could spell losses if stores become unprofitable. Although revenue continues to grow, company expenses are eating into a large percentage of profits. In its latest report, it was left with only £142m in earnings after expenses to the tune of £956m depleted most of its £1.1bn of gross profit.

There’s a strategy for that too

To continue expansion while limiting exposure to the high costs associated with store management, Greggs operates a profitable franchise scheme. These stores are typically found in large train stations or motorway services, making up approximately 20% of the entire estate.

This kind of strategic planning is evident across the company, leaving the impression of a stable and well-managed operation. Despite the risks mentioned above, I’m more than confident to add Greggs to my buying list for May.