Laying the right foundations is important when building a house. The same is true for building a business. Take Howden Joinery (LSE: HWDN) as an example. Its well-honed commercial model has helped the share price move up 66% over the past five years. On top of that, it offers a 2.4% dividend yield.

But after that sort of increase in the price, could Howden Joinery still offer me an attractive investment opportunity?

Strong business, proven model

Demand for building materials will be here for the foreseeable future. But it will likely move around, as economic conditions can push the amount of building projects up or down.

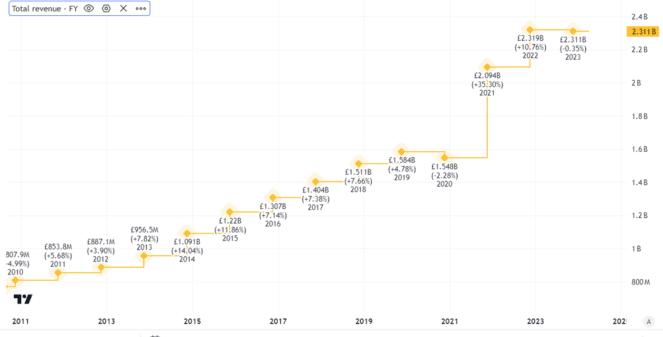

That is a long-term risk for Howden. Looking at its track record of revenue, though, the company has done a good job of building sales despite the wider market conditions.

Partly that has come from opening new depots. So far this year, the business has opened six new UK depots out of a planned 2024 total of 30.

And partly it has been thanks to rolling out the company’s proven format overseas. Last year saw international revenues grow 11% compared to 0.7% for the UK, albeit from a far smaller base. Five to 10 new international depots are planned for 2024.

Inflation in recent years has helped too when it comes to improving sales, although it poses an ongoing risk to profits.

But I think the key driver for Howden’s success has been its strategy. A focus on trade customers, with marketing support such as specialised seminars, has built up a loyal customer base of regular big spenders.

Valuing the shares

That approach continues to deliver.

In a trading statement today (30 April), the FTSE 100 company said that UK depot revenue for the first 16 weeks of this year grew 5.4% compared to the same period last year.

International revenue also grew overall, but on a like-for-like basis it fell slightly. I see that as a risk for the business, as international expansion costs only make sense to me if they bring sustained growth opportunities.

While the company has done well growing sales, how well has that translated into profits?

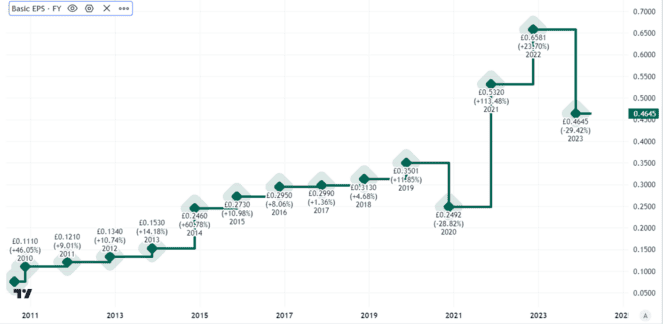

Basic earnings per share moved up consistently over many years, but the period since the pandemic has seen a more erratic pattern.

That reflects a combination of demand swings and inflationary pressures. Demand is now back on a more normal footing, although I think inflationary pressures could continue to affect profitability over the next several years.

As a long-term investor, I like Howdens’ proven business model in an area that I expect to see strong future demand. It still has substantial scope for expansion both in Britain and internationally.

I think that is reflected in the current Howden Joinery share price. Trading on a price-to-earnings ratio of 19, I do not think the shares are very attractively priced.

That valuation leaves limited room for share price growth in coming years, I feel, unless the business booms. For now, I will not be buying.