Some UK shares cut their dividends or cancel them altogether. Some keep them flat. Some move them up a few percentage points.

And some grow them by double digits annually, almost doubling them in just a few years.

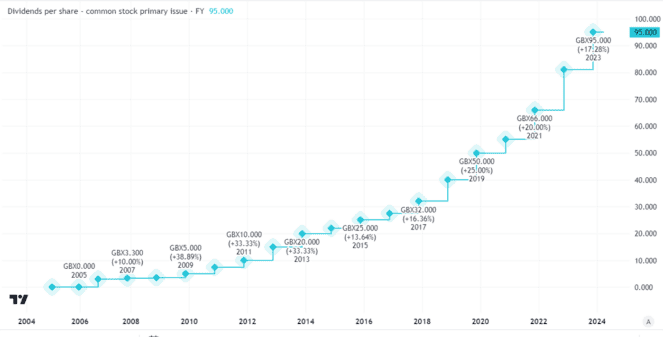

Of course, past performance is not necessarily an indicator of what will happen in the future. Still, one UK share has grown its dividend by 90% in the past four years alone. Not only that, but I reckon it may well keep growing its dividend by double digits annually in percentage terms.

I may be right, although in reality nobody ever knows for sure what will happen when it comes to dividends. So, could now be the time for me to buy?

Buffett-style model

The company in question is not some well-known giant like Shell or Tesco. Rather, it is a business with a market capitalisation of around £740m, called Judges Scientific (LSE: JDG).

What I like about it, setting aside the dividend for a moment, is that it has a simple but proven business model that I think echoes the approach of billionaire investor Warren Buffett.

Judges has identified a lucrative niche: precision scientific instruments. As accuracy matters in this field, customers are willing to pay a price premium. By buying up small and medium-sized instrument makers at attractive valuations, Judges is able to wring out efficiencies by offering centralised services.

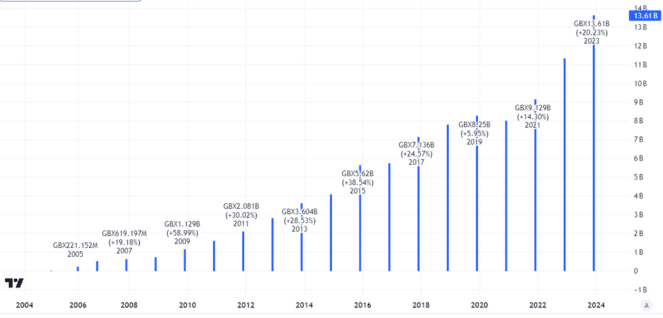

The company has grown quickly through this acquisition model and revenues have also moved up fast.

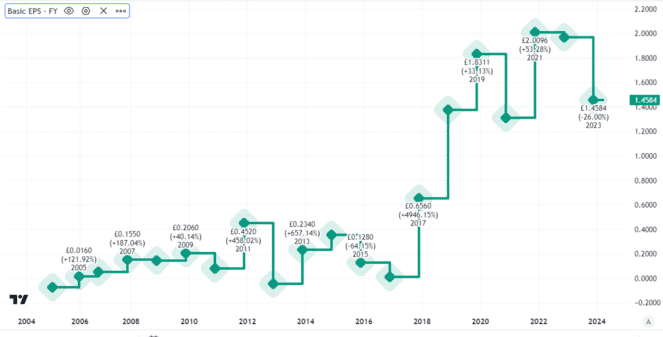

That has helped the company put in an impressive performance when it comes to profits too. This chart shows Judges’ annual basic earnings per share – and I like the long-term direction of travel!

Strong dividend growth

That strategy and profitability have enabled Judges to reward shareholders in the form of dividends. These have grown at quite a clip!

That is a record of dividend increases that leaves most UK shares in the dust.

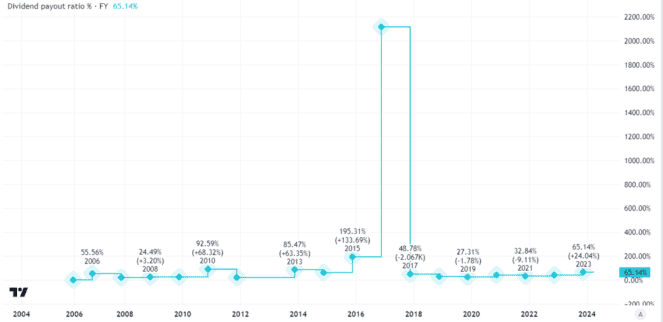

Not only that, but the company has generally been fairly conservative when it comes to paying dividends. Despite the strong per share dividend growth, the shareholder payouts have remained well-covered over time.

What about the valuation?

Clearly, Judges Scientific has a lot going for it.

But there are risks too. Its success could increase competition, pushing up the purchase price for new acquisitions.

As it grows, it may also struggle to find enough companies to buy. So far the business model has been based mostly on buying up small companies. There may be fewer larger firms for sale.

But even recognising the risks, I would happily add Judges Scientific to my portfolio of UK shares, if I could buy it at what I thought was an attractive valuation.

And there’s the rub.

At the moment, this UK share trades on a price-to-earnings ratio of 78. That is far higher than I would be willing to pay.

So, for now, I have no plans to buy. But I will keep watching the stock in case the valuation becomes more attractive.