Shareholders in cybersecurity company Darktrace (LSE: DARK) have had a tumultuous few years. Between a high point in 2021 and a low last year, the Darktrace share price tumbled by three quarters.

Today (26 April) though, the shares leapt 20% in early trading. Why?

A takeover bid. US investment firm Thoma Bravo announced it had reached agreement with Darktrace management on taking over the UK firm at a price equivalent to £6.20 per Darktrace share (at the current exchange rate).

Darktrace shares soon reached almost that level, suggesting that the City expects the cash deal to proceed.

Does this make sense for Darktrace shareholders?

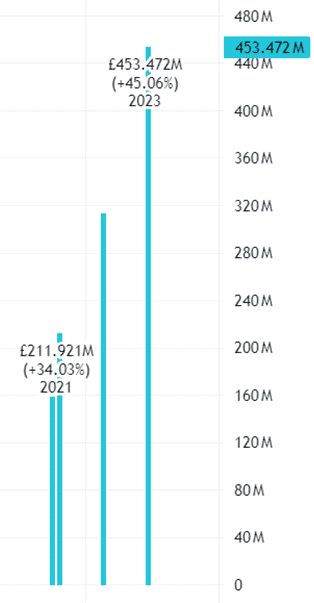

Darktrace has been listed for under three years. In that time, its revenue growth has been impressive.

Source: TradingView

But at the earnings level, things have been less impressive, in my view. Tech firms often like somewhat obscure metrics to communicate their business performance. Indeed, I have often found Darktrace’s reports to be difficult to comprehend for that reason.

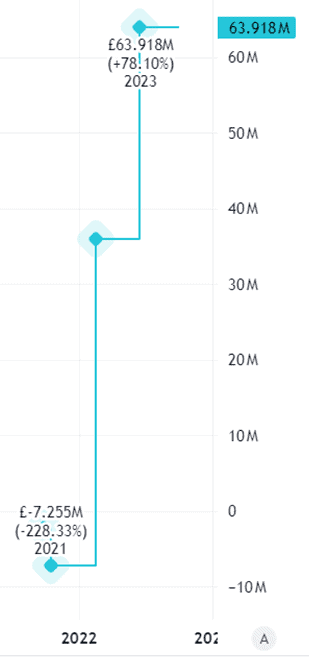

Just as revenue has improved markedly in recent years, so has EBITDA (earnings before interest, tax, depreciation and amortisation).

Source: TradingView

I tend not to pay too much attention to EBITDA though. Costs like interest and tax are real so why exclude them from the financial assessment of a company’s performance?

Instead, I would pay more attention to basic earnings per share. This measure has two attractions, in my view. First, it does not exclude real business expenses like interest. Secondly, looking per share instead of a total means the impact of any share dilution is more obvious.

Looking at basic earnings per share, again, the company has been making sizeable forward strides over the past several years.

Source: TradingView

Still, the company has a very limited track record of profitability. Based on its most recent full-year earnings per share, the Darktrace share price-to-earnings ratio is 46. That is far higher than I am comfortable with and is one reason I have not bought the shares at any point.

Where things go from here

Thoma Bravo clearly sees value however. No doubt that will lead other companies to run their slide rules over Darktrace and it may be that another bidder emerges, pushing the share price up further.

That is not guaranteed though. Nor is it certain that Thoma Bravo’s bid will succeed. Such situations always involve risks like regulatory clearance not being granted.

If that happens, the Darktrace share price could fall again.

Valuation always matters!

If the bid succeeds, some investors will do well out of it. Those who had bought at the start of this year, for example, would now be sitting on an 80% paper return.

But what about long-term investors that bought when the shares hit highs in 2021? They are now looking at a paper loss of 35%.

In a takeover situation, if the bid proceeds, shareholders typically have no choice but to accept. They have to take the loss even if they believe the share price would increase if the company could stay independent.

That is a salutary lesson to all investors about the importance of never overpaying for shares!