Harbour Energy (LSE:HBR) is a FTSE 250 stock that looks set to re-join the FTSE 100 in 2024. Not because of exceptional growth in its share price but due to an impending deal that’s likely to transform the scale of its operations.

Although the transaction is still subject to shareholder and regulatory approval, both are expected to be forthcoming.

Scaling up

The largest energy producer in the North Sea has agreed to acquire the upstream assets of Wintershall Dea. The transaction will be funded through a combination of cash (£1.7bn), the issue of new shares (£3.3bn), and the taking on of debt (£3.9bn). Excluding the loan notes, the company is valued at £5bn.

Add this to Harbour Energy’s current market cap of £2.2bn and it should be enough to see it return to the premier league of listed companies. The company was previously relegated from the index in December 2022.

Under the proposed terms, the current owners of Wintershall will receive 921m new shares, bringing the total post-transaction number in issue to approximately 1.69bn. The share price should then be 426p — a premium of approximately 48% to its current value.

The deal is expected to increase Harbour Energy’s annual production by 2.5 times and improve its margin. Post-merger reserves should nearly quadruple.

Falling out of fashion

But oil and gas stocks are out of bounds for ethical investors.

And as the world moves towards net zero, the demand for fossil fuels will inevitably decline. However, according to most experts we still haven’t reached peak demand for oil. Daily consumption of ‘black gold’ is currently around 100m barrels a day.

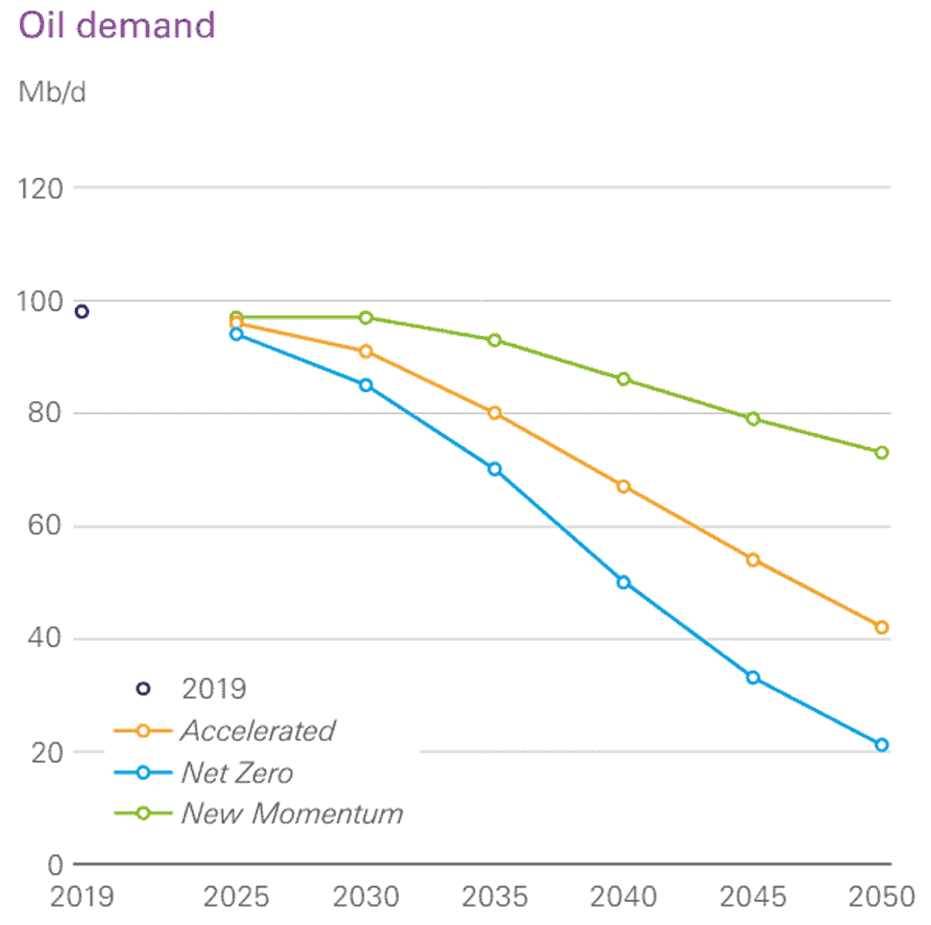

In 2023, BP prepared a forecast for oil consumption through until 2050. It used three different scenarios to see what impact each might have on demand. Using the ‘new momentum’ assumption, which is based on “the broad trajectory along which the global energy system is currently travelling”, a reduction of only 25% is predicted.

What impact this is likely to have on global warming is uncertain. But in all three scenarios, whether we like it or not, oil is still going to be needed for some time to come.

Taxing times

As a result of extraordinary profits being earned following Russia’s invasion of Ukraine, output from the North Sea is currently taxed at 75%.

The government has promised to end one element of this — the energy profits levy — when Brent crude falls to below $71.40 and gas drops to 54p a therm, for a prolonged period. These are currently trading at $90 and 74p, respectively.

All of the assets being acquired are in regions where taxes are lower.

The earnings of energy companies can be volatile due to sudden fluctuations in the wholesale price of oil and gas. And it’s virtually impossible to accurately predict future prices. That’s why shareholders usually demand a generous dividend to compensate for the additional risk.

In respect of its 2023 financial year, Harbour Energy declared a dividend of $0.25 (20p). This means the share are presently yielding a healthy 7%. And the directors said the deal should facilitate a 5% increase.

That’s why — even though dividends are never guaranteed — as a shareholder, I’m going to vote in favour of the merger.