The UK stock market has been struggling for some years now. London-listed equities declined 30% since 2007 while the US market value tripled. Last year was the worst since 2009 for UK initial public offerings (IPOs), raising only £1bn.

In early 2023, France overtook the UK by total exchange market capitalisation and the gap has widened since. The UK is now the seventh largest market in the world, after the US, China, Japan, Hong Kong, India and France.

But while many UK companies consider jumping ship for US shores, one in particular is finding its fortunes at home.

Pricey but with solid financials

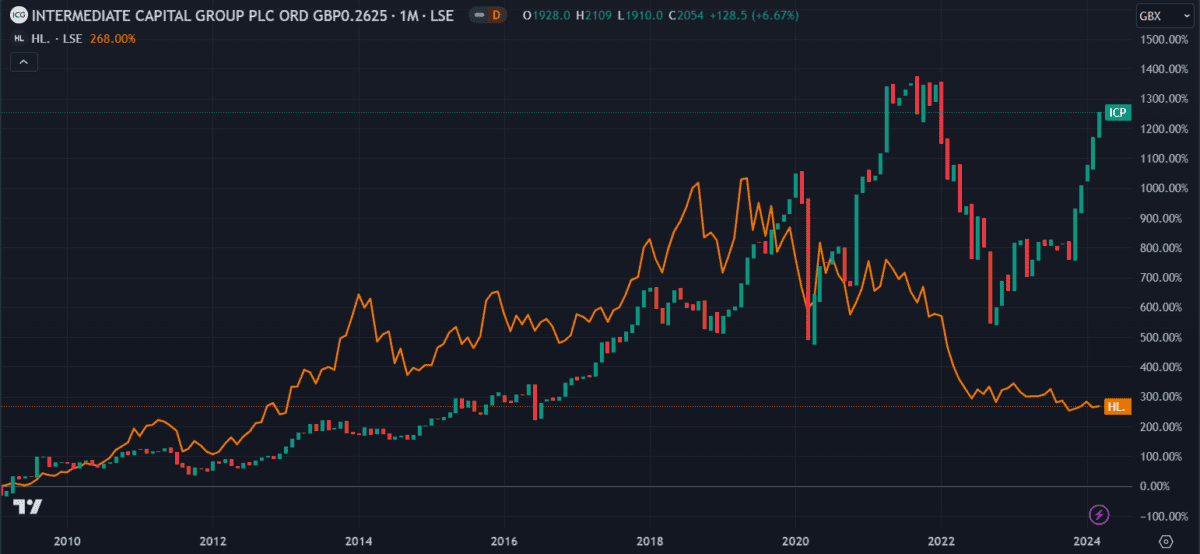

Intermediate Capital Group (LSE:ICP) is a private equity investment firm specialising in mezzanine finance and leveraged credit. It entered the FTSE 100 in October last year following months of strong growth, taking over a spot from the financial services firm Hargreaves Lansdown (LSE:HL.).

With a £5.9bn market cap and assets that outweigh liabilities, the company appears to be in a good position. It holds £2.1bn in shareholder equity with future return on equity (ROE) forecast to be 19.2% in three years — comparatively low but still higher than the industry average of 6.9%.

The rising share price is now trading at 12.5 times earnings, somewhat lower than the industry average of 16.8. Despite the recent price appreciation it’s still estimated to be undervalued by 25% using a discounted cash flow model. This is reflected in a price/earnings-to-growth (PEG) ratio of 0.25.

More room for growth?

Despite the strong performance so far, future forecasts for ICP aren’t great. The average 12-month price increase of analysts evaluating the stock is only 2.3%. This is not unusual for a stock that’s grown rapidly in a short time but I think it has more potential than they give it credit for.

You see, ICP not only funds IPOs but makes a lot of its money by funding acquisitions and buyouts. With the UK economy faltering, US firms are circling British companies like vultures. ICP stands to benefit if it can get involved in financing this wave of new acquisitions.

Competitive comparisons

Hargreaves Lansdown isn’t a direct competitor of ICP as it provides a different suite of financial services. However, since the two swapped their FTSE places last year, it makes for an interesting comparison.

Hargreaves Lansdown certainly hasn’t enjoyed the same recent price growth — it’s down 7.2% over the past year and has been in decline since 2019.

But the low price could provide a better short-term investment opportunity.

While earnings and revenue aren’t predicted to grow significantly, its ROE is estimated at 33.2% in three years. Not only does Hargreaves Lansdown have a lower P/E ratio of 11.5 but it pays higher dividends. At 5.7%, its yield is almost double that of ICP and future cash flow estimates indicate it’s undervalued by 33.8%.

But until Hargreaves Lansdown can compete with lower-priced competitors like AJ Bell and Interactive Investor, price recovery could be limited. Short-sellers remain confident that the price could fall further.

I’m not looking to add more finance-related shares to my portfolio right now. However, if I had to choose between the two, I’d say ICP would be the better option as a reliable long-term investment for me.