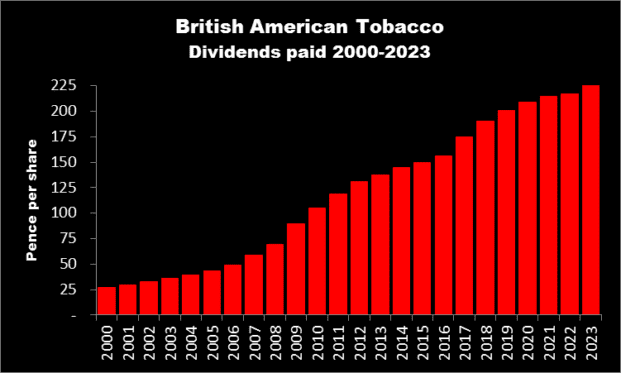

British American Tobacco (LSE:BATS) is a remarkable FTSE 100 stock. The tobacco giant has a long track record of handsomely rewarding its shareholders. As the chart below shows, it’s increased its dividend every year since 2000.

And the trend looks set to continue in 2024. In February, the directors confirmed they were “committed to dividend growth in sterling terms”.

No wonder it remains a firm favourite with income investors.

Those investing £10,000 at the end of 2006, would have been able to buy 700 shares. Since then, they’ve received £18,564 in dividends.

Those shareholders have also seen some capital growth. Their initial stake would now be worth £16,772. Although it should be noted that the company’s share price has fallen 22%, over the past five years.

British American’s generous dividends demonstrates the huge volumes of cash that can be generated from the sale of an addictive product that’s cheap to make.

A change of direction

But several years ago, it realised that the writing was on the wall for traditional cigarettes. It started investing in alternatives with a view to creating “a predominantly smokeless business” by 2035.

That was clearly the right decision.

In March, the Department of Health published its draft bill intended to ensure that anyone currently aged 15 or younger, will never be able to legally buy cigarettes.

And anti-smoking sentiment on the other side of the Atlantic resulted in the company writing-down the value of its US combustibles division by £27.3bn in 2023. For context, that’s equal to 50% of the group’s current stock market valuation.

New products

The company’s ‘New Categories’ division achieved profitability in 2023, two years ahead of target. Its products — vapes, tobacco-heating and nicotine pouches — accounted for 12.2% of revenue (£3.35bn) and are on target to reach £5bn, by 2025.

But e-cigarettes are already banned in 34 countries, including Brazil, India, Iran and Thailand — nations with a combined population of nearly 1.8bn.

And there’s some recent research to suggest that these so-called reduced-risk products could also have severe health implications. If confirmed, their sale is likely to be further restricted, if not banned altogether.

On 20 March, The Times reported on a study by scientists at University College London, claiming that vaping is linked to cancer and damages the body like smoking. An analysis of cheek cells from a sample of vape users showed similar DNA changes to those of cigarette smokers.

The World Health Organization has urged governments to ban the sale of flavoured vapes. A recent report went further concluding that “urgent measures are necessary to prevent uptake of e-cigarettes and counter nicotine addiction”.

My thoughts

Although I’m sure the company will remain significantly cash generative for some time to come, I have concerns about its long-term viability.

On the positive side, I don’t see the dividend being cut any time soon. Its payout ratio was 63% of earnings in 2023, which suggests there’s still plenty of headroom.

But there’s little point banking large dividend cheques each year, if the share price is going in the wrong direction.

Personally, I doubt the company’s new products will be able to replicate the financial success of cigarettes. Therefore, as attractive as a 9.9% dividend yield might be, it’s not enough to get me to invest.