Engine-builder Rolls-Royce Holdings (LSE:RR.) has been one of the FTSE 100‘s best performing shares following the pandemic. At 427.5p per share, it’s risen a stunning 335% in value in the past two years alone.

In this article I’m considering whether the company’s shares still offer decent value following their electrifying rise. Let’s take a look at the charts!

Earnings

There are two methods I’ll use to measure Rolls-Royce’s share price relative to predicted earnings: the price-to-earnings (P/E) ratio and the price-to-earnings growth (PEG) ratio.

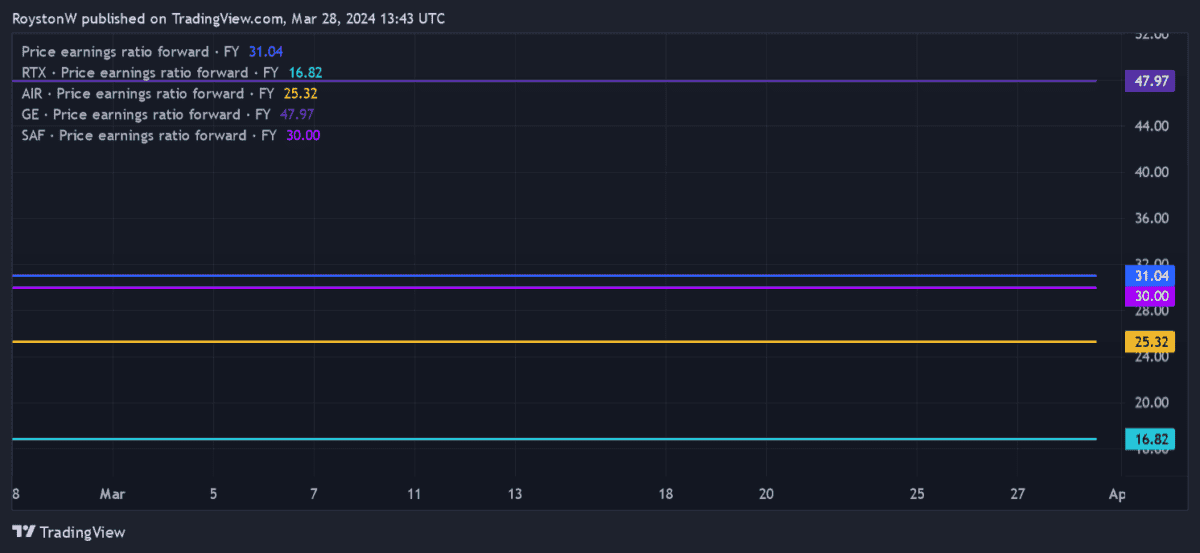

The P/E ratio is the most widely used metric, and for this financial year Rolls trades on a ratio of 31 times. This looks expensive compared to the broader FTSE 100, whose forward average comes in at 10.5 times.

I also want to see how the engineer measures up compared to the broader aerospace and defence industries. As you can see, General Electric — which makes more than half of the world’s aircraft engines — trades on a much higher P/E ratio of 48 times.

Rolls shares, however, are more expensive using this metric than those of — in descending order — Safran, Airbus, and RTX Corporation (which owns engine-maker Pratt & Whitney).

But what about the company’s PEG ratio? Does the firm offer attractive value using this earnings-related metric?

City analysts think earnings will soar 23% in 2024, leaving the business trading on a ratio of 1.3. At more than one, this also suggests the aerospace giant is trading at a premium.

Sales

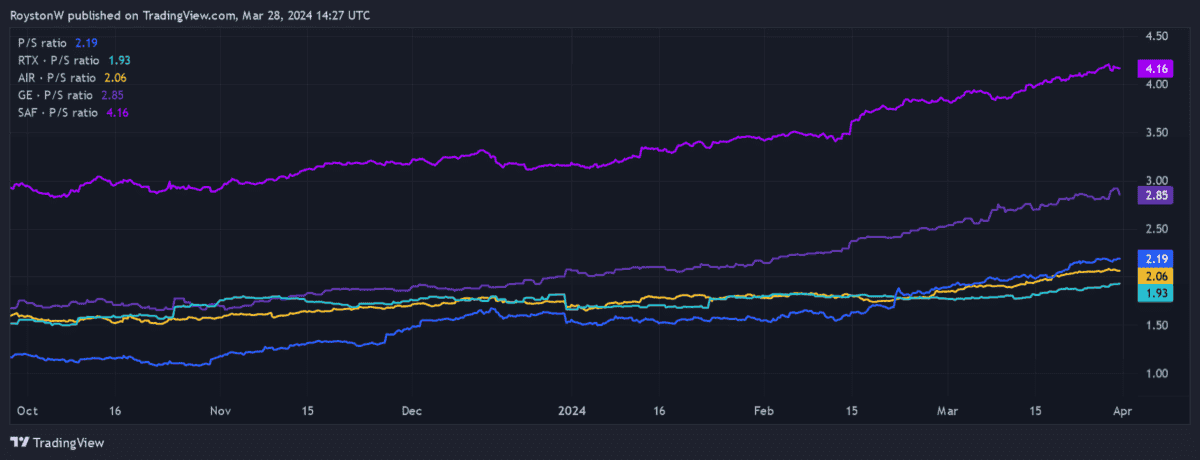

The next step is to gauge the value of Rolls-Royce shares in relation to its revenues using the price-to-sales (P/S) ratio.

As the chart shows, each of the industry’s major players is trading at a premium to their sales generation, with Rolls sitting in the middle of the pack. These are, in descending order, Safran, General Electric, Rolls, Airbus, and RTX.

With Rolls, investors are currently willing to pay $2.19 for every dollar of the company’s sales revenue.

Dividends

The last step is to consider Rolls’ value in relation to predicted dividends. The engine-builder hasn’t delivered any cash rewards since the onset of the pandemic. And City analysts are split on when they will likely return as the business rebuilds its balance sheet and seeks to reclaim its investment-grade status.

That said, dividend forecasts across all brokers with ratings on the stock produce a forward yield of 0.6%. To put that in context, the FTSE 100 average sits way ahead at 3.7%.

Furthermore, Rolls’s dividend yield also falls well short of the rest of the industry, as the table below shows.

| Stock | Forward dividend yield |

|---|---|

| General Electric | 2.2% |

| Airbus | 1.4% |

| Safran | 1.6% |

| RTX | 2.7% |

Should I buy Rolls shares?

The sky is still the limit when it comes to Rolls-Royce’s share price. While it looks expensive, I wouldn’t be surprised to see the engineer continue soaring given the resilience of the global airline industry.

But that doesn’t mean I’ll buy the company for my portfolio. At current prices, there’s little value to be had here, in my opinion. In fact, its high earnings ratios in particular leave it in danger of a share price correction if news flow suddenly disappoints.

This is certainly a possibility in my opinion, given the fragile state of the world economy and the potential for a fresh downturn across its cyclical end markets.