I’m searching for the best FTSE 100 bargain stocks to buy today. I’m seeking blue-chip shares that offer a brilliant blend of sky-high dividend yields and rock-bottom price-to-earnings (P/E) ratios.

Both British American Tobacco (LSE:BATS) and SSE (LSE:SSE) offer outstanding all-round value, on paper. The cheapness of their shares can be seen in the table below.

| Forward dividend yield | Forward P/E ratio | |

|---|---|---|

| British American Tobacco | 9.9% | 7.3 times |

| SSE | 4.2% | 9.5 times |

| FTSE 100 | 3.8% | 10.5 times |

Both British American Tobacco’s and SSE’s share prices look exceptionally cheap compared with the broader Footsie too. But which would be the better stock to buy right now?

Reliable dividends

The addictive nature of tobacco products has enabled cigarette producers to pay market-beating dividends for years. Sales — and thus cash flows — remain stable at all points of the economic cycle, a common quality among many of the best dividend stocks.

During 2023, British American’s organic revenues (at constant currencies) rose 3.1% year on year, even as the global economy struggled. This enabled it to raise the dividend 2% year on year, to 235.52p per share.

On top of this, the FTSE firm announced a £1.6bn share buyback programme lasting through to the end of 2025.

Under threat

City analysts are expecting company dividends to continue to rise over the next two years too. Yet I’m not convinced enough to buy British American shares today.

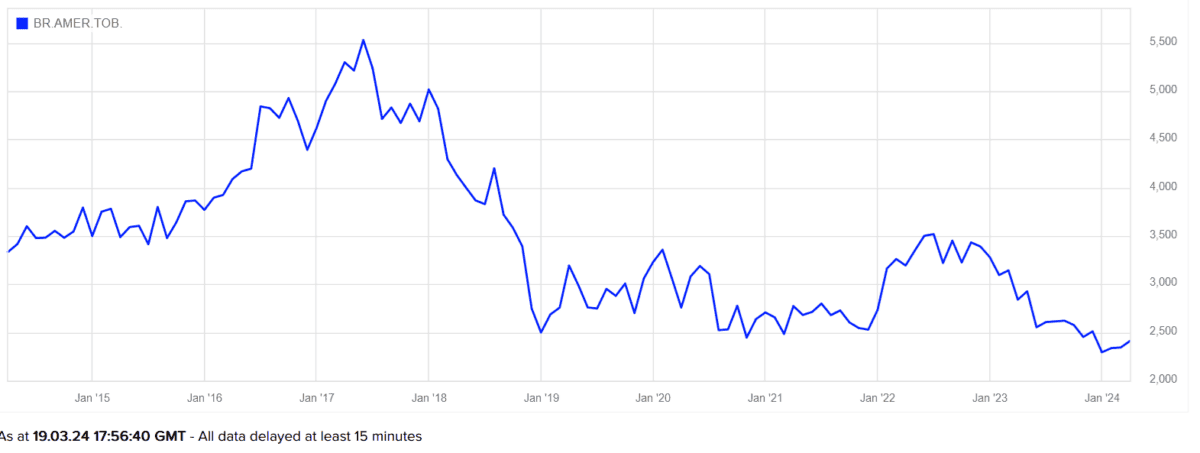

I’m searching for a stock that can provide me with solid capital gains as well as a healthy passive income. And as the chart below shows, the tobacco titan’s share price has fallen sharply in recent years.

Tobacco companies have plunged in value as the future of their traditional combustible products becomes gloomier. It’s hard to see how British American Tobacco (along with fellow Footsie stock Imperial Brands) can break out of this downturn as regulators step up the fight against cigarettes.

Analysts at Citi reckon that the US, UK, Australia and parts of mainland Europe will be ‘smoke free’ by 2050 as consumer habits change. And, worryingly, lawmakers are increasing restrictions on the sale, marketing and usage of next-generation products like e-cigarettes too.

Power play

This doesn’t necessarily make SSE a better share to buy however. The energy producer, like any utility stock, is also under the close watch of lawmakers. And possible changes by regulator Ofgem — from price controls to limiting dividends — are constant threats that could smack investor returns.

At the moment though, the trading landscape remains largely favourable for power generators. In fact, given the company’s rapid investment in renewable energy, I think the potential long-term benefits of owning this FTSE share outweigh the risks.

Like British American, the defensive nature of its operations gives SSE the financial means to pay a stable and growing dividend. But it has a far greater opportunity to grow profits (and thus improve its share price) in the years ahead as the green energy revolution kicks on.

I’m encouraged by the huge investment the firm’s making to capitalise on the decarbonisation theme too, as the chart above shows. While this is expensive, I feel it could pave the way for strong investor returns.

This is why I’ll consider adding SSE shares to my portfolio when I next have cash to invest.