I don’t have to invest any money I park in my Stocks and Shares ISA right away. But why wait? There are stacks of brilliant value stocks waiting to be snapped up at the moment.

So, rather than sit on the cash before the 5 April deadline, I’d rather put it to work right away. This way, I can get my money working for me immediately. And as I say, there are some top shares looking massively undervalued at this moment.

Here are three I’m thinking about buying before the ISA deadline.

Atlantic Lithium

Atlantic Lithium‘s (LSE:ALL) share price has tumbled as prices of the silvery-white metal have fallen. It could remain on a downward slant a little longer too if China’s economy continues to splutter.

I think this could be a great dip buying opportunity for long-term investors, however. The AIM company is developing the Ewoyaa project in West Africa, an asset that could deliver spectacular profits growth.

Fresh drilling news on Tuesday (19 March) has reminded the market of its brilliant potential. Atlantic has said high-grade assay results in 2023 revealed “impressive intersections” that it notes should help it deliver another mineral resource estimate (MRE) upgrade in the second half of this year.

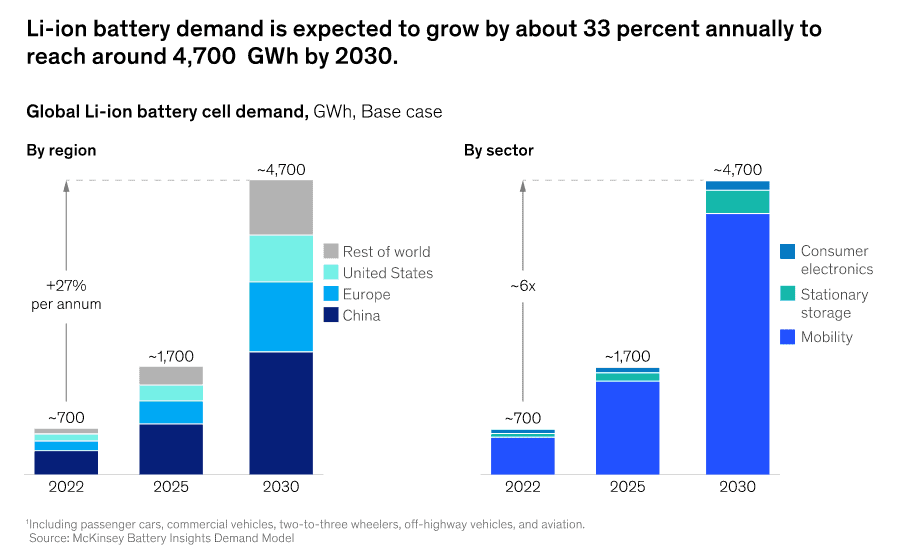

Atlantic Lithium could find itself in a strong position to exploit the electric vehicle boom once Ewoyaa comes online. Adoption of cleaner cars is tipped to supercharge long-term lithium consumption, as the graphic below shows.

Central Asia Metals

Central Asia Metals (LSE:CAML) is another top mining stock on my radar today. This is thanks to its exceptional all-round value.

Today, the Kazakh miner trades on a forward price-to-earnings (P/E) ratio of 8.7 times. It also carries a large 9.2% dividend yield for 2024.

Central Asia Metals’ flagship asset is the Kounrad copper mine in Kazakhstan. It also owns the Sasa lead-zinc mine in North America. As with lithium, demand for these base metals is tipped to rocket as the green revolution picks up momentum.

Mining for metals is an unpredictable and costly business. Still, at current prices I think this AIM share is worth serious attention.

Warehouse REIT

I’m also considering adding Warehouse REIT (LSE:WHR) shares to my portfolio before the ISA deadline. The real estate investment trust (REIT) has fallen in value again as hopes of imminent interest rate cuts have receded.

This remains a threat going forwards. But I’m attracted by the boost recent share price falls have given to the FTSE 250 firm’s dividend yields. For this financial year its yield now stands at 8.2%.

I’m confident profits at Warehouse REIT will rise strongly in the years ahead. Rising e-commerce activity and supply chain evolution will drive strong demand for warehouse and distribution hubs even higher. The rents that REITs like this charge should, therefore, remain on a healthy uptrend, helped by a chronic shortage of new developments across the industry.

Warehouse REIT’s like-for-like rental growth accelerated to 3.7% in the December quarter.