I’m researching penny stocks and Metals Exploration (LSE:MTL) is a UK-based company that’s risen 154% over the past year, climbing from 1.6p to 4p since last March.

The £85m mining company identifies and extracts precious metals and base metal deposits in the Philippines. Headquartered in London and operating since 2004, the company has been struggling to reach the highs it enjoyed in the early days.

Back in 2006, the share price climbed as high as 47p. The following years were very volatile but by 2013 it had fallen below 10p and by 2019 it was under 1p.

A turning tide

The company recently finalised a share purchase agreement that could turn its fortunes around. The purchase would give it a controlling share of Yamang Mineral Corporation (YMC), a firm that holds prospecting rights to the 16,000ha gold-rich Cordillera area of the Philippines.

Mining is expected to begin in the second half of 2024 pending agreements with local communities and initial exploration efforts.

“If we have the exploration success we are targeting, we aim to focus on developing a high-grade, smaller-scale gold production-ready project as soon as possible,” said interim chairman Steven Smith.

The share price has been rising steadily since news of the agreement first surfaced in late January. It’s now at its highest level in seven years and is predicted to continue climbing.

Financials

Independent analysts estimate Metal Exploration shares to be undervalued by as much as 76%. This is likely based on the company’s impressive performance so far, with earnings growing at an annual rate of 68% — seven times the industry average.

That’s helped push its profit margins to 28.7%, up from 4.9% last year. Using a discounted cash flow model, we can see that the undervaluation thesis is supported by a forward-looking price-to-earnings (P/E) ratio of 2.4 times.

But growth like that comes at a price.

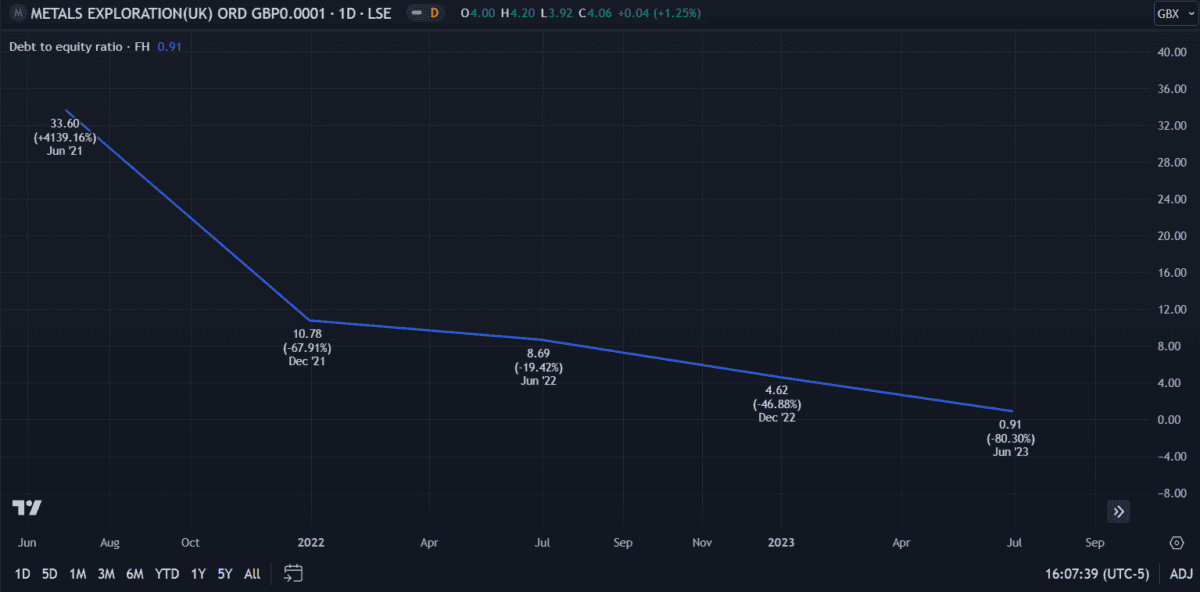

Metals Exploration has spent the past few years climbing out of a deep debt hole. Only recently did its debt-to-equity (D/E) ratio drop below 1, putting it in a stable position.

Back in June 2021, the company was drowning in debt 33.6 times higher than its equity. It now holds £54.2m in equity and only £49.3m in debt. That’s an impressive turnaround — although still risky as it’s a fairly high level of debt for an £85m company.

Gold demand

To evaluate a business’s future prospects we need to consider demand for its products. Looking at the broader gold mining industry, demand has remained relatively stable over the past 10 years, barring a minor dip in 2020 during Covid.

Gold is one of the most precious metals in the world – thought to be the first metal discovered by humans. With such a long history, it’s unlikely demand will reduce in the near future. Should Metals Exploration continue to secure valuable gold deposits, it will be in a good position to benefit from this industry.

Current forecasts still expect revenue and earnings to decline by 11.4% and 23.6% per year, respectively. However, if the new Cordillera mine proves profitable, I expect these figures to turn positive.

For now, I’m putting Metals Exploration on my penny stock watchlist with the intent to buy if the forecast improves.