Shares in FTSE 100 stalwart Barclays (LSE:BARC) are up 10.1% over 12 months. And all of these gains have occurred in the last month since the bank unveiled its strategic overhaul aimed at reducing costs and focusing on the most productive parts of the business.

Improving business

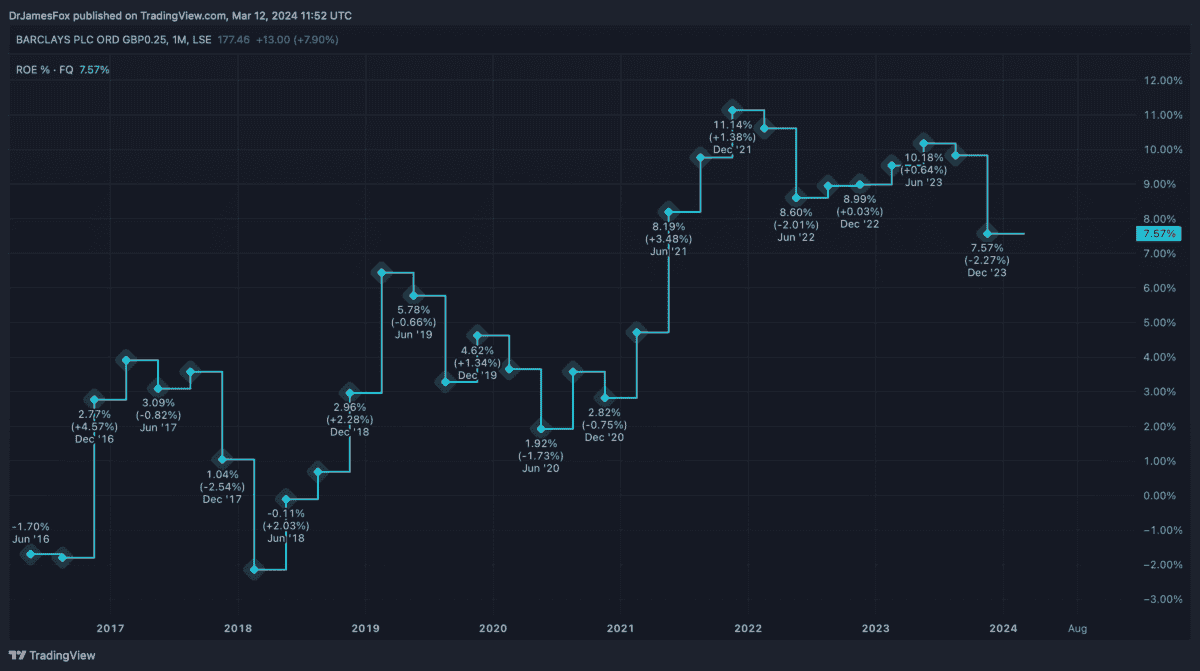

Barclays has undergone something of renaissance behind the scenes in recent years. The firm’s return on tangible equity (RoTE) — a useful measure of profitability for banks — has exceeded 10% in each of the past three years. As we can see from the chart below, returns on equity (RoE) have improved versus long-term averages.

It’s worth recognising that this improved performance is partly a reflection of higher interest rates. But equally, conditions are forecast to remain favourable for some time. Interest rates are only likely to fall into the Goldilocks Zone — around 2.5-3.5% — in the medium term.

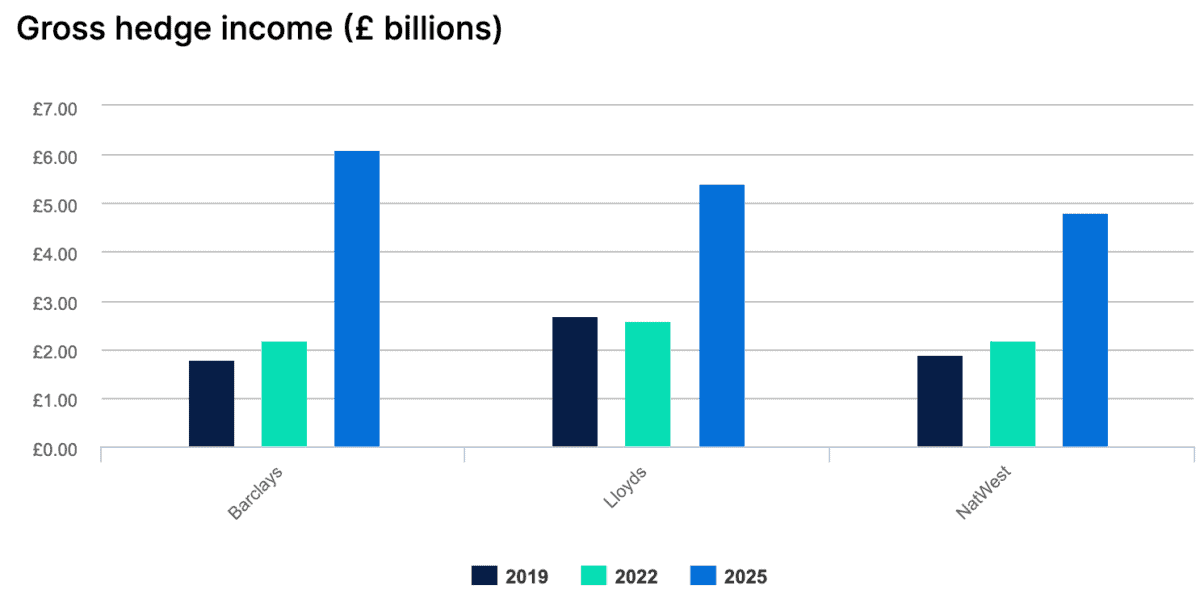

Moreover, hedging practices are likely to extend the positive impacts of higher interest rates without retaining the downside — the risks of defaults by loan customers. According to Hargreaves Lansdown, Barclays gross hedge income could almost triple to £6bn a year by 2025.

Strategic overhaul

In February, the bank announced a huge operational restructure, including substantial cost-cutting, asset sales, and a refocusing of capital allocation.

One of the biggest issues for investors has been that Barclays Investment Bank, which takes up 57% of the company’s risk-weighted assets, has continually underperformed in recent years. The division’s RoTE has averaged 9%.

However, Barclays UK, which lends money to the domestic market, has achieved an average RoTE of 19%, but accounts for just 21% of the group’s risk-weighted assets.

Moving forward, Barclays will look to allocate a further £30bn towards its UK retail operations in an effort to raise the group’s overall RoTE.

In fact, the bank’s already made a considerable financial commitment to its domestic retail operations with the purchase of Tesco‘s banking operations.

Moreover, in addition to cost-saving, Barclays has promised to return £10bn to shareholders between 2024 and 2026. This will be delivered through dividends — the yield’s currently 4.7% — and share buybacks.

Vastly undervalued

But I’m wary of Barclays’ turbulent relationship with regulators. After all, the company’s been marred by scandals and missteps over the past decade. However, the bank’s hopefully turned a corner.

From a valuation perspective, Barclays looks particularly attractive, trading at 6.4 times earnings for 2024, and 5.25 times earnings for 2025.

In fact, it’s now expecting to grow earnings much faster than peers. Analysts are expecting earnings to grow at 15.3% annually over the next three-to-five years.

And this is why analysts over the past three months have an average price target of 232.5p. That’s 33% above the share price, as I write. I believe it’s worth considering.