I’ve previously bought and sold NIO (NYSE:NIO) stock, but I’m less tempted to buy it now. NIO, as a company, had huge promise, but it’s failed to deliver over the past 24 months. Let’s take a closer look.

Under-delivering

The Chinese electric vehicle (EV) manufacturer delivered 18,012 vehicles in December, marking the third-highest monthly delivery on record, following July’s 20,462 and August’s 19,329.

This reflected a 13.9% increase from the 15,815 vehicles delivered in the same period in 2022 and a 12.9% increase from the 15,959 delivered in November. While this may sound like impressive growth, it really isn’t that strong compared to its peers.

By comparison, Li Auto delivered 50,353 vehicles in December. That’s up 137.15% from 21,233 units in December 2022 and up 22.72% from 41,030 units in November. What’s more, Li Auto’s now profit-making.

While February was a slow month for all new-energy vehicle makers in China, it was particularly slow for NIO. The company delivered 8,132 vehicles in February, down 33.11% from a year earlier, and down 19.12% from January. NIO has under-delivered and underperformed.

Profitability moves further away

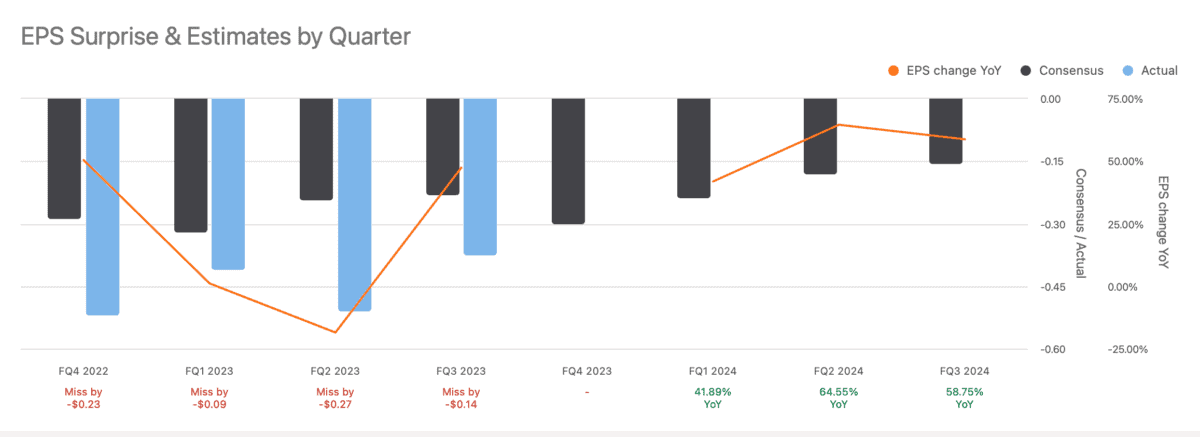

With deliveries failing to impress, NIO hasn’t met its financial targets and has fallen short of analysts’ expectations in each of the last four quarters. When I started following NIO, the company suggested it could break even in 2024. However, that’s now been pushed back for at least for another two years. If everything goes to plan, NIO may now turn a profit in 2027.

Can the stock recover?

NIO has $6bn in cash and cash equivalent and burnt through $600m during the last quarter. In turn, this still means NIO has more than two years’ cash left at the current burn rate.

However, there is likely to be a rise in costs over the next 12 months with the car manufacturer planning to open over 1,000 battery-swapping stations over the next year. According to the firm, each of these stations costs an estimated $420,000.

It’s also worth highlighting that NIO’s unique selling point (USP) is its battery-swapping technology. The company claims that drivers can swap empty batteries for a new one in a matter of minutes.

However, charging technology’s improving considerably, and so are batteries. Li Auto’s first EV — the MEGA — can be charged in just 12 minutes and has a claimed range of 720km.

So personally I’m a lot less convinced that NIO is part of the future of transport in China. It’s an increasingly competitive market, and the company’s USP is becoming less valuable as technology develops.

Nonetheless, I think the company has a great range of vehicles and has clearly made impressive strides in developing a strong brand. Its fans can buy a whole range of products with its logo from NIO shops.

So with the company currently trading at 24.9 times predicted earnings for 2027, I’m not sure it’s worth the risk. I certainly don’t think it’s the bargain some people are claiming it to be.