What do I need to do to become a Stocks and Shares ISA millionaire? With the right investment strategy, creating life-changing wealth with UK shares doesn’t need to be a pipe dream.

There are currently more than 4,000 ISA millionaires. At Hargreaves Lansdown — the country’s largest direct-to-investor platform — there are 813.

Handily, Hargreaves Lansdown analysts are on hand to divulge the investing secrets of these ultra-rich investors. Here are three that have caught my eye.

1. Invest early

ISA investors have £20,000 to invest with each tax year. And the sooner they start investing, the quicker their money will start working.

Last year, 30% of Hargreaves Lansdown’s millionaires maxed out their allowance within the first month. Some 54% used their whole allowance within three months of the new tax year starting.

Analyst Sarah Coles concedes that “not everyone can lay their hands on £20,000 to invest every year.” But she adds that “the principle still works – investing what you can afford as soon as you can afford to.”

2. Be patient

We all love the idea of getting rich quickly. But, in reality, getting rich with stocks requires patience and a level-headed approach.

Coles notes that “there are some exceptions to the rule.” The youngest ISA millionaire on its books is aged 37.

But she adds that “the vast majority of them have built a fortune through the far more reliable approach of getting rich slow.” The average age of millionaire using its services is 75, she says.

3. Diversify

In keeping with this patient approach, Coles notes that successful investors “don’t take enormous risks. Instead, they’ve built diverse and balanced portfolios.“

She says this is one of the most important rules to follow. I agree.

Investing in a wide range of companies, spanning different industries and geographies, helps investors manage risk by ensuring that a large concentration of their wealth isn’t affected by adverse events that impact a single investment or market.

Here’s what I’m doing

I’m not saying these tactics will make me a millionaire. But I believe they’ll significantly increase my chances of building a big ISA nest egg by retirement.

I currently own about 25 stocks in my ISA operating across a wide variety of sectors. These include drinks maker Diageo, miner Rio Tinto, and rental equipment supplier Ashtead.

This gives me a healthy level of diversification. And one of my plans for the new tax year is to increase my stake in financial services giant Legal & General (LSE:LGEN).

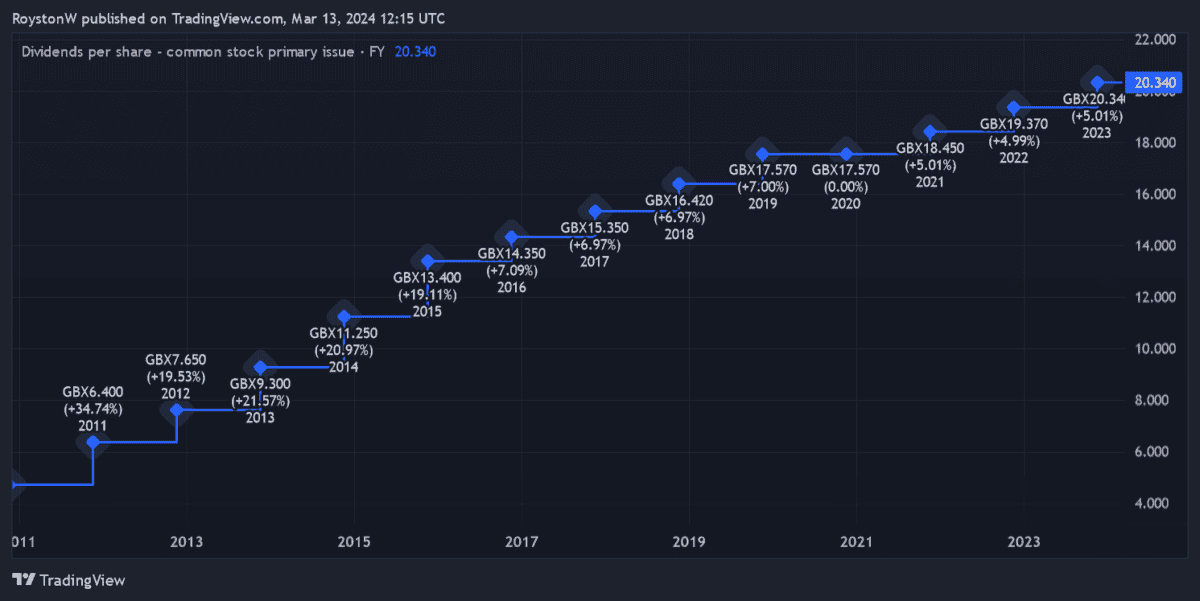

Why this particular share? As the chart below shows, the FTSE 100 firm has an excellent record of raising the annual dividend which, in turn, gives me an increasing passive income.

This is important as I reinvest these dividends to boost my long-term wealth. This phenomenon — known as compounding — means I make money on my initial investment as well as on those dividend payments.

And thanks to the huge dividends Legal & General regularly pays, it could turbocharge my wealth. This year, the company’s dividend yield sits at an enormous 7.2%.

Its share price performance could disappoint over the short term if economic conditions remain tough. But over the long term, I’m confident Legal & General will — like the other UK and US shares I own — deliver outstanding returns.