Global markets were driven higher by tech stocks today (22 February) following a rosy revenue forecast from artificial intelligence (AI) chipmaker Nvidia (NASDAQ: NVDA). Japan’s Nikkei 225 index and the pan-European STOXX 600 both hit record highs. The tech-starved FTSE 100 rose, but only just.

To be fair, Nvidia’s earnings were incredible, with growth rates that were almost cartoonish. Fourth-quarter revenue soared 265% year on year to $22.1bn, while net income rocketed 769% to $12.3bn. For the full year, revenue more than doubled to $60.9bn.

Looking ahead, management is anticipating first-quarter revenue of around $24bn. For context, Nvidia generated $7.19bn in revenue in the first quarter of last year. So that would be growth of 233%.

Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.

Jensen Huang, founder and CEO of Nvidia

No wonder the shares are up 14%, as I write. This adds another $230bn or so to Nvidia’s already mammoth $1.67trn market cap!

FOMO risk

Fortunately, many Foolish growth investors already own Nvidia shares. But what if I didn’t? Is it worth investing in the stock today after its meteoric 1,160% rise in just five years?

Well, possibly, but there are risks. The US has increasingly imposed restrictions that prevent the company from selling its advanced AI chips in China. Nvidia has been implementing workarounds, but it seems increasingly likely it will permanently lose billions of dollars annually from this market.

Also, once the firm’s revenue growth inevitably slows, investor euphoria may fade dramatically. So it could be dangerous chasing the stock, especially if this is motivated by FOMO (fear of missing out).

On Nvidia’s results, Peter Garnry, head of equity strategy at Saxo Bank, said: “This is just an insane result…I have never seen anything like this in my career…However, it will be increasingly difficult for Nvidia to exceed expectations, and this could be the last insane quarter.”

Therefore, I’d stop staring longingly at the Nvidia share price and invest in Scottish Mortgage Investment Trust (LSE: SMT) instead.

An attractive alternative

The aim of Scottish Mortgage is to invest in the world’s greatest growth companies. I think it’s fair to say Nvidia qualifies as that. So does the trust hold the stock?

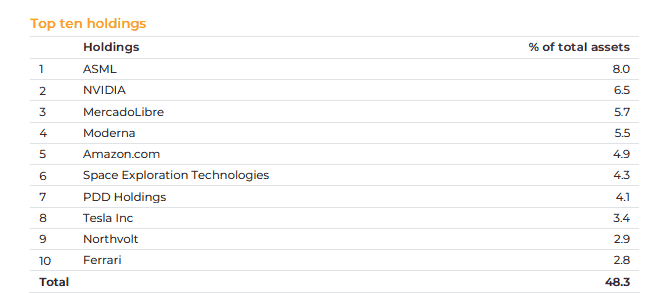

Yes, it does, as we can see from its top 10 holdings, as of 31 January.

Therefore, I could invest in these FTSE 100 shares and get exposure to Nvidia as well as a portfolio of other exciting growth companies.

Scottish Mortgage first invested in Nvidia shares back in 2016. So the trust has a knack for identifying the next big winners.

Still, there is risk here. Around 28% of the portfolio is invested in unlisted companies such as Elon Musk’s SpaceX and internet payments processor Stripe.

While I’m excited about the future growth potential of such firms, they add an element of risk because they’re perceived to be harder to value. This can cause volatility.

However, the shares are currently trading at a 14% discount to the trust’s underlying net asset value.

As such, I reckon discounted Scottish Mortgage shares are a smarter alternative to investing directly in Nvidia. If I wasn’t already a shareholder, I’d become one today.