The JD Sports Fashion (LSE:JD.) share price has endured a rotten start to 2024. At 108p per share, the sports retailer has plummeted 35% since 1 January. This makes it the worst performer on the FTSE 100.

JD is being battered by tough trading conditions in its North American marketplace. It released a shock profit warning last month. And demand for its premium fashions may remain sluggish if broader pressure on consumer spending persists.

Having said that, I’m wondering if now could be a great time to load up on the company’s shares. I’m focused on long-term returns and willing to withstand short-term volatility for potentially significant gains in the future.

And what’s more, JD shares look dirt cheap at current prices. In fact, I believe they could be undervalued by almost 90% at current prices.

A brilliant bargain?

I’ve arrived at this conclusion by considering the current valuations of some of the FTSE company’s industry peers. The price-to-earnings (P/E) ratios of these companies can be seen in the table below.

| Company | Forward P/E ratio |

|---|---|

| Foot Locker | 16.8 times |

| Frasers Group | 9.5 times |

| Dick’s Sporting Goods | 13.9 times |

| Next | 13.6 times |

| Nike | 29.3 times |

| Marks & Spencer | 10.2 times |

The table includes multinational sportswear chains Foot Locker, Dick’s Sporting Goods, and Frasers Group (which owns the Sports Direct banner). I have also included Nike: the major manufacturer also operates a large store network and e-commerce operation.

Finally, I have included Next and Marks & Spencer. These companies, like JD (and also Frasers Group), consider the UK to be their single largest market.

The average P/E ratio for these six sportswear giants stands at 15.6 times for their current financial years. By comparison, the corresponding multiple for JD Sports shares sits way, way back at eight times.

To bring the FTSE 100 company up to that industry average, it would need to be changing hands at 204p per share. That’s an 89% premium to its recent share price.

Why I’d buy JD Sports shares

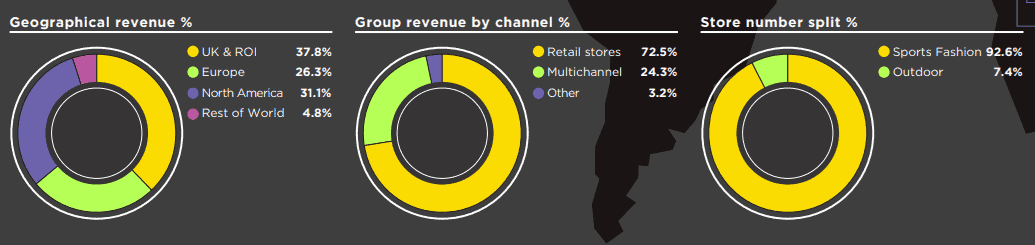

A breakdown of JD Sports’ operations by geography, channel, and product segment

“Form is temporary, class is permanent“, is a popular phrase in the world of sports. I couldn’t think of a better way to describe JD Sports and its investment case.

The global athleisure market has ballooned in size over the past decade. This is explained by evolving fashion trends and lifestyle shifts, where people are seeking out comfortable, utilitarian clothing that can be worn at the gym, at home, and increasingly in the post Covid-19 landscape, at work.

Demand for high-priced sportswear has grown especially strongly, and is tipped to continue stomping higher by industry analysts.

It’s a trend JD is well placed to continue capturing through its focus on the world’s most desired (and especially expensive) brands, and the tight exclusivity arrangements it has on many product lines. This model means that it continues to win market share today.

The firm has also exploited this growing market through rapid expansion across Europe, North America, and Asia in this time. It has also invested heavily in its online channel to great success to capitalise on the e-commerce boom.

I’ll be looking to buy JD Sports shares when I next have cash to invest.