Ferrexpo (LSE:FXPO) is a FTSE 250 mining company, and it currently offers one of the most appealing dividend yields on the index, at least at first glance. So is this dividend sustainable and is the company worth me investing in?

The business

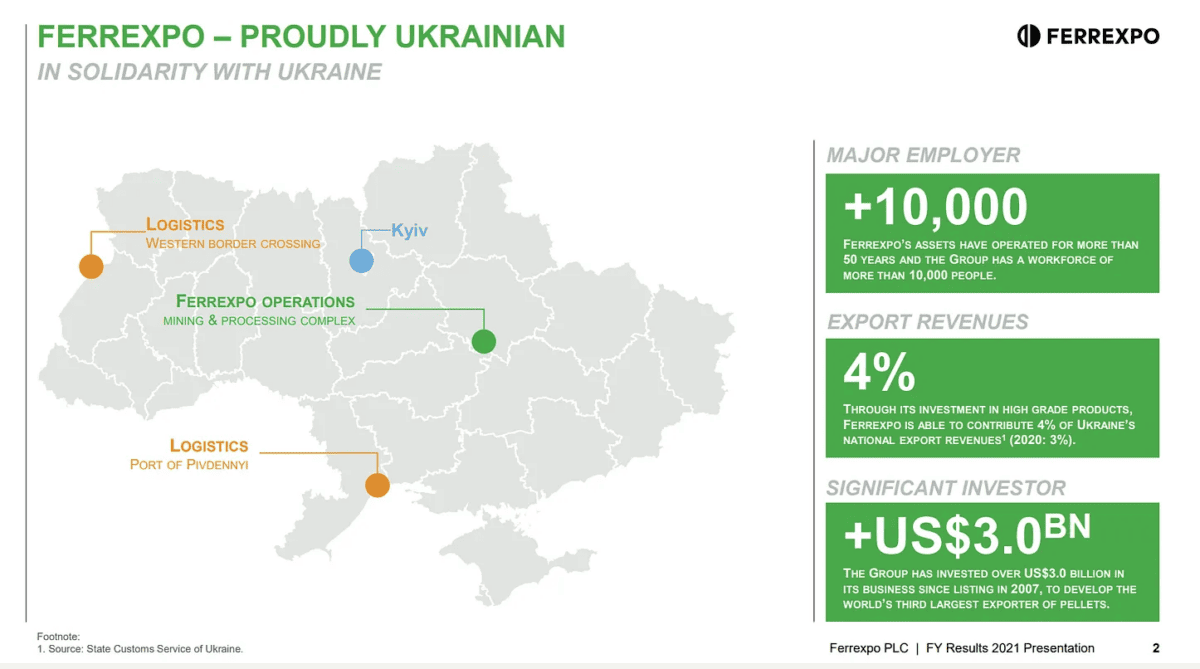

The problem is, Ferrexpo is a Ukraine-based iron-ore mining company, and the war has greatly impacted the firm’s earnings, and its viability as an investment proposition.

So while it might have some really interesting metrics right now — a 12.3% dividend yield and trading at 2.3 times earnings — red lights are flashing.

Some 70% of Ferrexpo’s mines are in war-torn Ukraine, and it’s by no means operating anywhere near full capacity.

Thankfully, Ferrexpo’s operations aren’t near the front line, but supply chain logistics and getting product to market — notably through the Port of Pivdennyi — has been challenging.

A trustworthy dividend?

According to Hargreaves Lansdown, Ferrexpo has a dividend yield of 12.3%. That’s based on the fact that for the year 2022, the company paid $13.2 per share.

However, this looks likely to be misleading. Investors will likely only receive $3.3 per share for the financial year 2023. In turn, that equates to a dividend yield of just 3.5%.

And this shows us why we often need to be looking at forward metrics — forward dividend yield, forward price-to-earnings — in order to inform our investment decisions.

Betting on a recovery

My colleague Mark Tovey has high hopes for this stock, and appears to be betting on a recovery. But as he says, it’s a risky bet.

In the year ending December 31, 2021 — before the Russian invasion — Ferrexpo recorded basic earnings per share of $148.2. That’s almost double the current value of each share.

But these are exceptional circumstances and the company isn’t likely to be that profitable for some time, even if the war does conclude soon.

In fact, making an investment decision informed by earnings forecasts and other metrics is near-impossible given the uncertainty of the situation. And this is reflected in the fact that the consensus estimates for this stock really don’t make any sense at all.

The bottom line

Ferrexpo’s assets haven’t been damaged since the war. It’s got a strong cash position, insignificant debt, and it’s clearly more resilient than other Ukrainian firms. It’s also got world-class resources, and over 50 years of iron-ore reserves at current mining rates.

However, a two-year-long campaign against the country’s infrastructure has meant getting its iron pellets to market is far more challenging. The closure of the Black Sea ports is a major part of this. Previously it accounted for 50% of its export sales. If the war finished tomorrow, it wouldn’t be at full capacity for some time.

It’s also something of a gamble. We don’t know when this war is going to end, much as we fervently hope it will. For now, Ferrexpo’s not for me.