The Marks and Spencer (LSE:MKS) share price is up around 50% over the last year, primarily due to strong financial results as a consequence of its ongoing turnaround efforts.

I’ve decided to take a closer look at the operational changes under way and the financials of the company to see if it’s worth me investing.

Restructuring

Marks and Spencer is closing stores that have low productivity. Its plan includes 110 total stores targeted for closure. By doing so, the firm expects to save around £300m.

This is part of a wider 10-year strategy, which aims to shift the focus somewhat from its less strong homeware and clothing segment to its more profitable food business. As part of the change, management is planning to open 104 new food stores.

Additionally, the company is expanding internationally. It opened its third store recently in Jaipur, India, and it now operates over 107 stores across 33 cities in that country. Marks and Spencer has been present in India since 2001, and it formed a partnership with Reliance Retail in 2008.

The good financials

The organisation’s share price rising so significantly over the last 12 montths can largely be attributed to the 75% jump in profit for the first half of its financial year. It expects its annual profit to rise over 30% too.

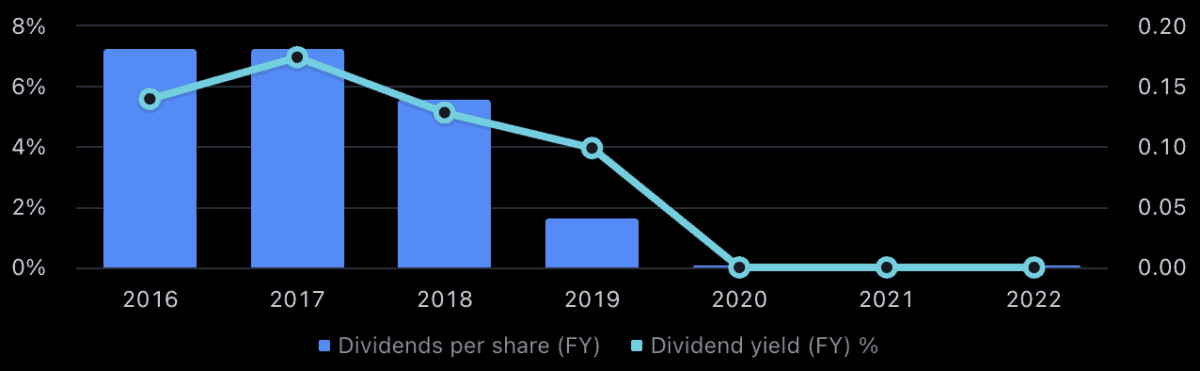

Additionally, after four years, the company has finally reinstated its dividend, albeit only at 1p per share. Nonetheless, it seems to be a good time to be a shareholder, in my opinion. The dividend coming back signals potential stability for the firm’s future.

A look at the negatives

Now, although Marks and Spencer seems to be going through a decent transition at the moment that looks quite promising, there are still risks I must consider.

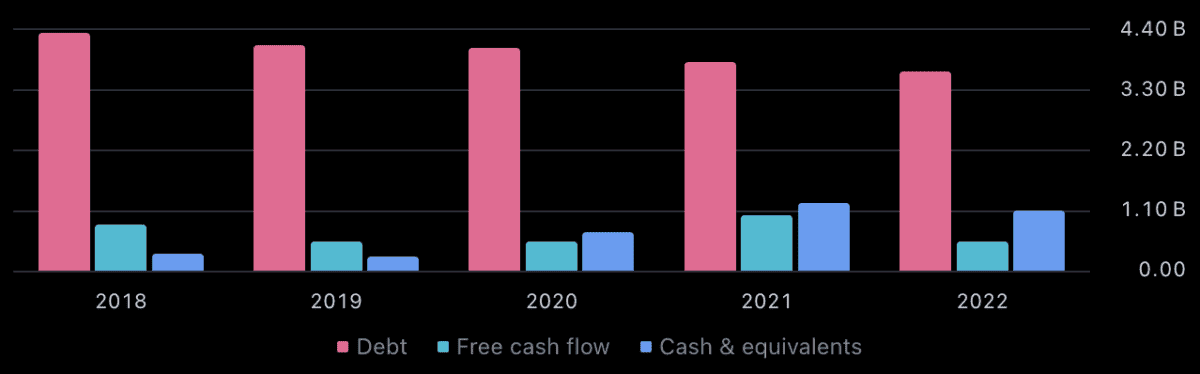

For example, the firm’s balance sheet is quite weak at the moment and has been for the last 10 years. It has reported an average for that time of 33% of assets balanced by equity. That means it has a hefty 67% of its assets usually balanced by debts.

Additionally, for the past three years, Marks and Spencer has had revenue growth of only 3.2% on average. I know this might improve with the restructuring over the long term. Yet, I still have to be honest with myself; this might not be a high-growth investment for a full decade or more.

Valuation uncertainty

The shares look cheap on the surface at the moment, with a price-to-earnings ratio of just 10.

Also, using a method called discounted cash flow analysis, the shares look around 12% undervalued to me. That’s if I project 5% earnings growth per year for the firm over the next 10 years.

However, the real concern is whether the company can really keep up with my estimated positive growth rate over the next decade. In the last decade, it certainly didn’t, averaging a decrease of 12.8% in earnings per year (although that was a decade in which its turnaround hadn’t yet kicked in).

Not quite right for me

I think this transition period for it is unpredictable right now. Also, I’m not convinced the results will be long-lasting.

While it has some good things going for it, I’m not going to invest.