There’s a dividend stock that has an exceptional yield right now, and I also think it has good financial reports.

Additionally, I think the shares could be considered cheap at the moment. Here are the main pros and cons I saw while deciding whether to invest in it.

What’s the company?

But first, which stock am I talking about? Polar Capital Holdings (LSE:POLR). It’s an investment management firm offering professionals and institutions a range of funds.

As of 29 December 2023, the company had £19.6bn of assets under management.

Rather than analysing price charts, the organisation is focused on investing based on financial reports. It has 13 teams operating different portfolios, and it generates a lot of its revenue through management fees.

A 10% yield

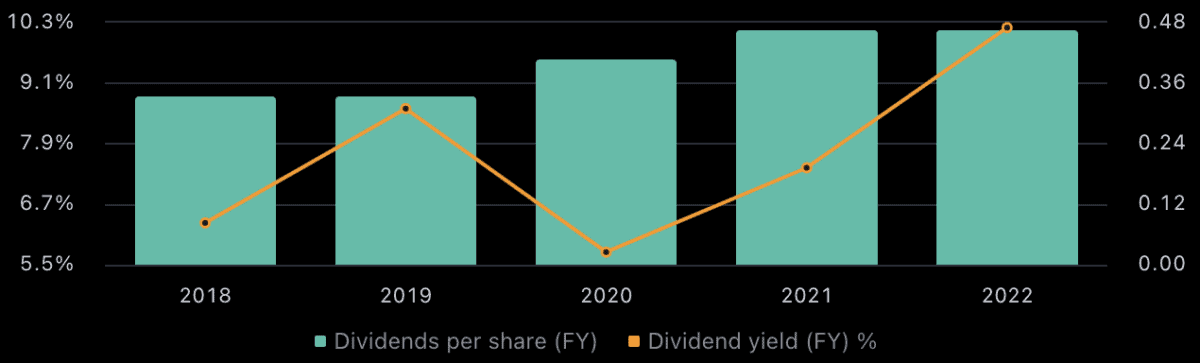

Polar Capital’s dividend yield fell significantly in 2020, around the time of the pandemic. But today, the yield is 10.2%, a large increase from the 5.8% low reported around four years ago.

That’s primarily due to the firm’s share price being down almost 50% since August 2021.

This is because the yield is calculated by dividing the stock price by the dividend paid out per share.

And the firm has increased its dividend payment even as the share price has fallen. In fact, Polar Capital’s policy is to distribute at least 80% of its earnings as passive income to shareholders.

Also, share price volatility is often temporary. Therefore, the lower price right now could be a buying opportunity for me if I want dividends.

Other financials I’m considering

At the moment, the company has a price-to-earnings ratio of around 13. That’s not bad, considering an industry median of 13.5.

However, it’s not exactly cheap. Also, its net margin is 21% right now.

While that may sound high on the surface, the median for the company is 25%. So it’s earning less than usual at the moment.

The good news is the balance sheet looks quite strong to me. It has 63% of its assets balanced by equity, creating stability if the company encounters any economic hardships in the future.

A closer look at the risks

While the business has some good things going for it, I think there are some significant concerns that I need to keep in mind if I invest.

The revenue growth rate of 6% on average over the last three years isn’t ideal. Also, its free cash flow has only grown at 1.6% over the same period.

And I’m concerned about the high volatility that isn’t exactly uncommon in the share price. Personally, I prefer to choose stocks that don’t rise and crash in value too often.

Is this one for me?

Don’t get me wrong, I think Polar Capital has a lot going for it.

However, mainly due to that instability in the price of the shares, I don’t feel that comfortable owning it as a long-term investment.

I think of it as more similar to a short-term trade based on price, with the dividend an added bonus.

Short-term trades just aren’t The Motley Fool way. Therefore, I’m not considering Polar Capital for my portfolio at this time.