Looking for cheap shares that could rise significantly in a short time frame is not an easy challenge.

Also, there are no guarantees in the stock market. What looks like it might rise based on sound evidence today could change based on wider economic factors tomorrow.

Nonetheless, I have a positive view of Cairn Homes (LSE:CRN), and I think it has the potential to rise 25% in the next year. Here’s why, as well as the risks to my outlook.

An overview of the company

The organisation is an Irish homebuilder, particularly prominent in the residential construction market in Dublin.

It was founded in 2014, and is known for a range of different developments, from starter homes to luxury apartments across Ireland.

Amazingly, in 2019, it sold 1,080 residential units and became the largest residential construction company in Ireland for that year.

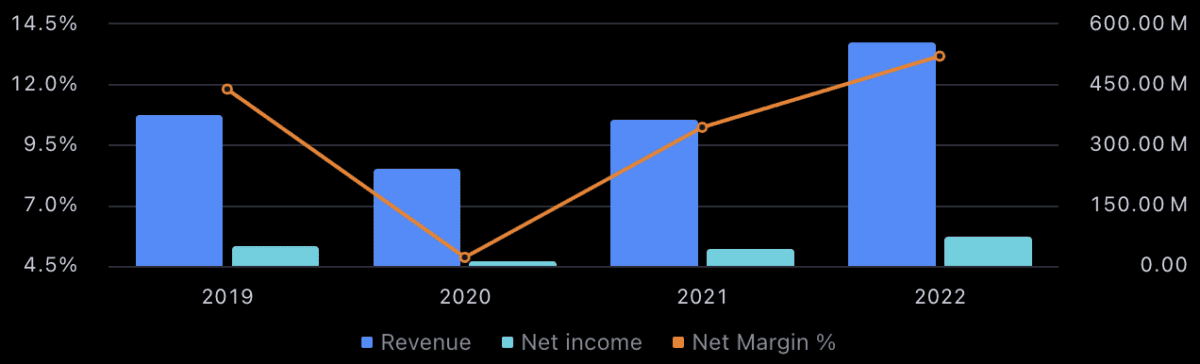

What’s more, its revenue and gross profit have had a nice upward trend from 2016 to 2023.

However, there was a significant dip in 2020, primarily due to the pandemic.

In £ – Source: TradingView

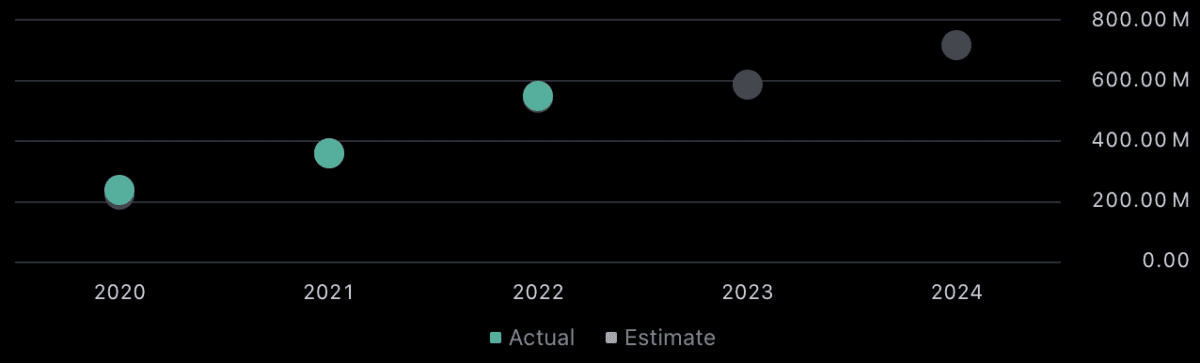

Promisingly, the future growth of this company looks set to continue, with revenue and earnings estimates by analysts looking healthy for at least the next two years.

In £ – Revenue estimates – Source: TradingView

In £ – Earnings estimates – Source: TradingView

Could it rise 25% in a year?

A 25% gain in one year is highly unlikely. However, certain companies are positioned for this kind of growth to occur.

I think Cairn Homes is particularly geared for higher investment returns than normal. The reason why is its shares look deeply undervalued to me.

To arrive at this conclusion, I looked at how the price-to-earnings (P/E) ratio of the firm has decreased recently:

P/S = Price-to-sales ratio – Source: TradingView

What this means is that the shares are selling at much lower prices than historically.

A couple of years ago, at such a high P/E ratio, I would have stayed away from the investment.

However, at this point, it looks cheap. The shares are trading at a current P/E ratio of around 13.5.

As a value investor, I work on the premise that the price of a company’s shares should eventually rise to the fair value evidenced by the growth of the earnings.

Taking into account the fluctuations in the P/E ratio and the firm’s recent and predicted earnings growth, I estimate a reasonable price for each share to be about £1.70 right now.

It’s currently selling at £1.25, roughly a 25% discount based on my prediction.

No guarantees

Now, although my estimate looks promising, I can’t guarantee I’ll get that return in a year.

There’s a risk the shares stay flat if investors don’t change their sentiment on the investment, especially in such a short time period.

Also, the consensus analyst estimates and my forecast could be off, and something could happen to the business severely depleting the earnings. So, there’s even a risk I lose money on what I initially invest.

That’s why in value investing we don’t call the 25% discount a given profit. Instead, the famous term coined by Warren Buffett‘s teacher is a margin of safety.

Even if things go wrong, my loss shouldn’t be so bad because I bought the investment at a low, undervalued price.