Warren Buffett first bought Apple (NASDAQ:AAPL) shares in 2016 and the results have been spectacular. But is the stock still a good investment?

It’s much harder to see Apple shares as a bargain at today’s prices. But I think there are reasons to be positive on it for investors willing to look beneath the surface.

Investment returns

Accounting for exchange rates and stock splits, five years ago, £10,000 would have bought me 310 shares in Apple. The market value of that investment today would be £45,255.

That’s an average annual return of 35% per year. But with a market cap of around $2.8trn and trading at a price-to-earnings (P/E) ratio of just under 30, it’s difficult to think this can continue.

One big reason for this is that the company’s revenue growth has been slowing – and even stalling. Over the last decade, sales have grown at an average of around 7%, which is steady but not spectacular.

A 13% decline in revenues from China – which accounts for around 20% of total sales – is part of the problem. But I think investors should look beyond top-line growth when considering Apple shares.

Margins

Not all growth is revenue growth – one way for a company to make more money is by expanding its margins. And I think this is the key for Apple going forward.

The company divides its revenue into two sources. There’s what it generates from selling products like iPhones, and services revenue that comes from places like the App Store.

The margins in these different operations are very different. Gross margins in the products division are around 39%, compared to 73% in the services part of the business.

This means Apple doesn’t have to grow its overall sales to increase its profits. Higher revenues in its services business will boost earnings even if the top line as a whole doesn’t increase much.

Growth

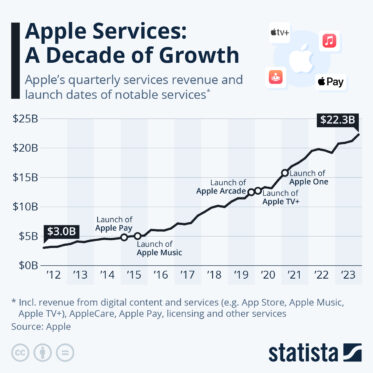

I think this is the key to future growth for Apple. Slow growth in overall revenues masks the fact that sales in the firm’s services division have increased by an average of 22% over the last decade.

This is where I think the company’s future growth is going to come from. This part of the business is generating record sales and isn’t really showing much sign of slowing down.

According to Apple’s latest report, revenues from its services business increased by 11% during the last three months of 2023 and this provides a big boost to earnings.

Given this, I think investors who think the stock is overpriced because overall revenue growth has been slow lately are making a mistake. There’s much more to take into consideration here.

Patience

In many ways, Apple is a great demonstration of what Warren Buffett looks for in a stock to buy. It’s a business that has demonstrated the ability to keep growing its earnings steadily over a long time.

I don’t think this is likely to change any time soon. That’s why I hold the stock and I’m looking for an opportunity to buy more of it.