The Rolls-Royce (LSE:RR.) share price seems to be the gift that keeps giving. What is it about the popular jet engine manufacturer that has everybody and their uncle jumping into the stock?

While many major FTSE 100 shares suffered losses throughout January, Rolls-Royce kept flying at an even keel. I’ll admit that the spectacular upward trajectory of 2023 has somewhat levelled off, but Rolls-Royce doesn’t look ready to land just yet.

Up 4% this month and trading at a decent £3.11 per share, I’m looking for signs of when the price might drop. However, most analysts seem hell-bent on predicting further increases for the stock.

Why are they so confident when Rolls-Royce’s balance sheet doesn’t look that attractive?

Taking a peak under the hood

Rolls-Royce’s earnings have been growing at an average annual rate of 20% — in an industry with an average of only 12%. Yet despite this, the company isn’t exactly flush on paper.

One of the key issues affecting Rolls-Royce’s balance sheet is negative shareholder equity. With liabilities totalling £34.7bn and assets of only £29.7bn, that’s a £5bn shortfall — leaving it with a debt-to-equity ratio of -83.2%.

But that certainly hasn’t shaken confidence within the company walls. Roll-Royce insiders have bought almost £164,000 worth of shares in the past three months, mostly by newly-appointed CEO Tufan Erginbilgiç.

I guess a £25.4bn company is too big to fail, right?

What analysts are saying about the Rolls-Royce share price

When I consider the impressive balance sheet of BAE Systems, I do wonder why Rolls-Royce has outshone this competitor by such a margin.

At £5.12bn, BAE has more debt than Rolls-Royce but it’s very well covered by short-term assets and operating cash flow.

BAE shareholders shouldn’t have anything to worry about.

Yet the Rolls-Royce share price has increased four times more than BAE in the past year. Furthermore, BAE shares are considered to be trading at fair value, while Rolls-Royce is estimated to be undervalued by a massive 59.5%.

Analysts scoff at the meagre £3.11 share price, feeling that £7.50 would be more accurate.

Across the board, Rolls-Royce shares remain a strong buy by the majority of analysts, attracting forecasts of anything from 14% to 25% increases over the coming 12 months.

What do I think?

Like BAE, Rolls-Royce has likely profited from an increase in government defence spending as tensions escalate in Ukraine and the Middle East. Couple this with a recent change in strategy and increased demand for air travel, and it appears Rolls-Royce has developed a winning formula for success.

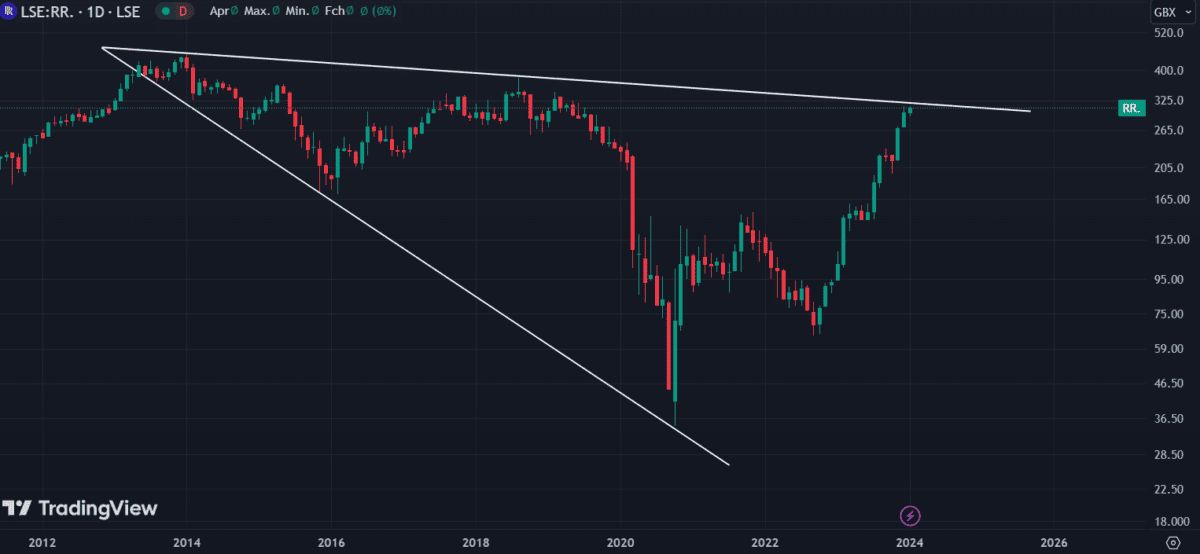

However, I don’t see much potential for further growth here. The share price appears to be trading right on the brink of a trendline that goes back 10 years. If there is a ceiling, I think Rolls-Royce might have reached it.

I wouldn’t quite jump to a sell position yet (as German broker Berenberg recently did) but I’ll be holding for now and eyeing the potential in smaller defence stocks like QinetiQ.