Finding an impressive penny stock significantly less well-known than major blue-chip investments particularly appeals to me.

While finding a diamond in the rough can be more challenging, I think the best deals are often found this way.

And I’m convinced that dotDigital Group (LSE:DOTD) shares are worth owning. Here’s why.

A look at its operations

The firm focuses on artificial intelligence (AI) for advertising purposes and tools to use on multiple platforms.

It aims to improve what digital marketing professionals can achieve across the world.

Recently, the management released a Customer Experience Data Platform and acquired Fresh Relevance, providing personalisation technology for its clients.

Now it started up shop in 1999, so it has had quite a long history. It called itself Ellipsis Media back then and focused on web design and development.

Today, it’s keeping up with market trends and is taking the AI bull by the horns as a marketing technology player.

What I like about it

The fact that the company is operating in a highly relevant field in today’s tech economy is a bonus in and of itself, in my opinion.

However, I appreciate that a lot of technology and AI stocks can be all hype and have not a lot of substance at the moment.

Thankfully, dotDigital doesn’t seem to be one of these at all to me.

For one, the company’s balance sheet is in an immensely strong position.

I’m considering the firm’s 80% of assets being balanced by equity at the moment, and I’m very pleased by it.

That means the company only finances 20% of what it owns through debts right now.

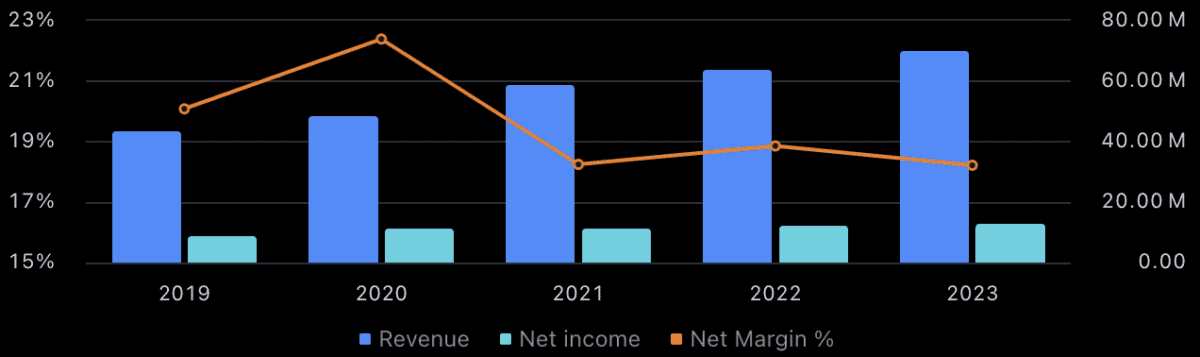

In addition, it has a net margin of over 18%, and its revenues have grown at a 13% rate on average over the last three years.

Source: TradingView

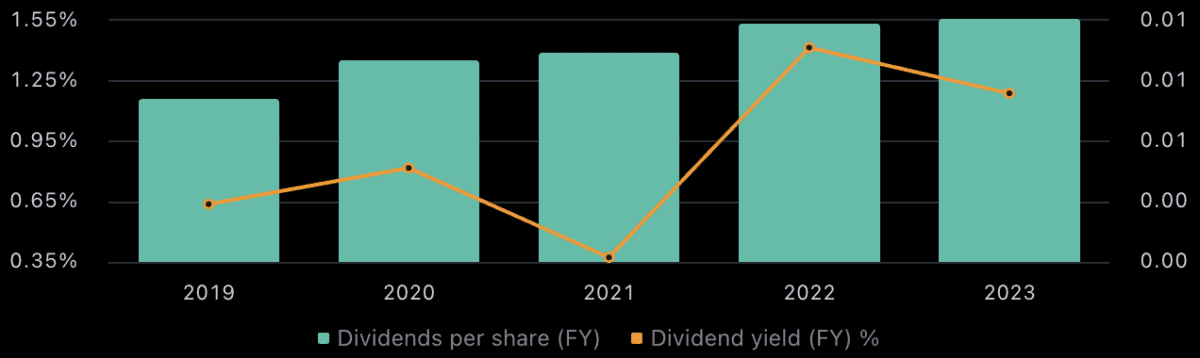

Now, one of the big financial weaknesses to consider is its lack of a dividend.

So, if I was looking for income from these shares, I might consider looking elsewhere. The present dividend yield is only 1%.

Source: TradingView

Some further weaknesses

Investing in technology can make for a highly turbulent ride. That’s why I think if I added this to my portfolio, it would be after I’ve diversified away from technology a bit.

Additionally, I’ve not forgotten that the shares are down over 65% from their high.

There’s no guarantee it will get back up to the level it was at before.

However, this makes for a classic value play — as long as I have the patience to sit this one out, I think I could see some nice returns.

I’ve got to make sure I have discipline, though.

If I see this investment isn’t rising like some of my growth shares, there’s a risk I could sell at a loss before any real profits are made.

An obvious choice for me

This company deserves to be in my portfolio. Along with a couple of other less well-known shares at the moment I’m considering, I’m certain I’ll be adding it in the next few months. Because I consider it so deeply undervalued with the price down so significantly, I’m not in any massive rush.

Value investments like these often take years to play out. I’ve got a couple of months to get my chips on the table yet.