Tesla (NASDAQ: TSLA) stock is having a poor run at the moment. So much so that CNBC host Jim Cramer has said that the high-flying ‘Magnificent Seven’ tech stocks have now become the ‘Super Six’, with Tesla out of the group.

So, what’s going on with the car manufacturer right now? Well, here are three things to know.

Breaking down the Mag Seven

Firstly, it was always going to be tough for the Magnificent Seven (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) to keep rising in unison.

That’s because they are very different companies.

Microsoft, for example, predominantly sells software. And businesses can’t do without its products.

Tesla, meanwhile, sells electric vehicles (EVs). And the market for EVs has cooled a little recently as interest rates have risen and disposable income levels have dropped.

Poor Q4 earnings

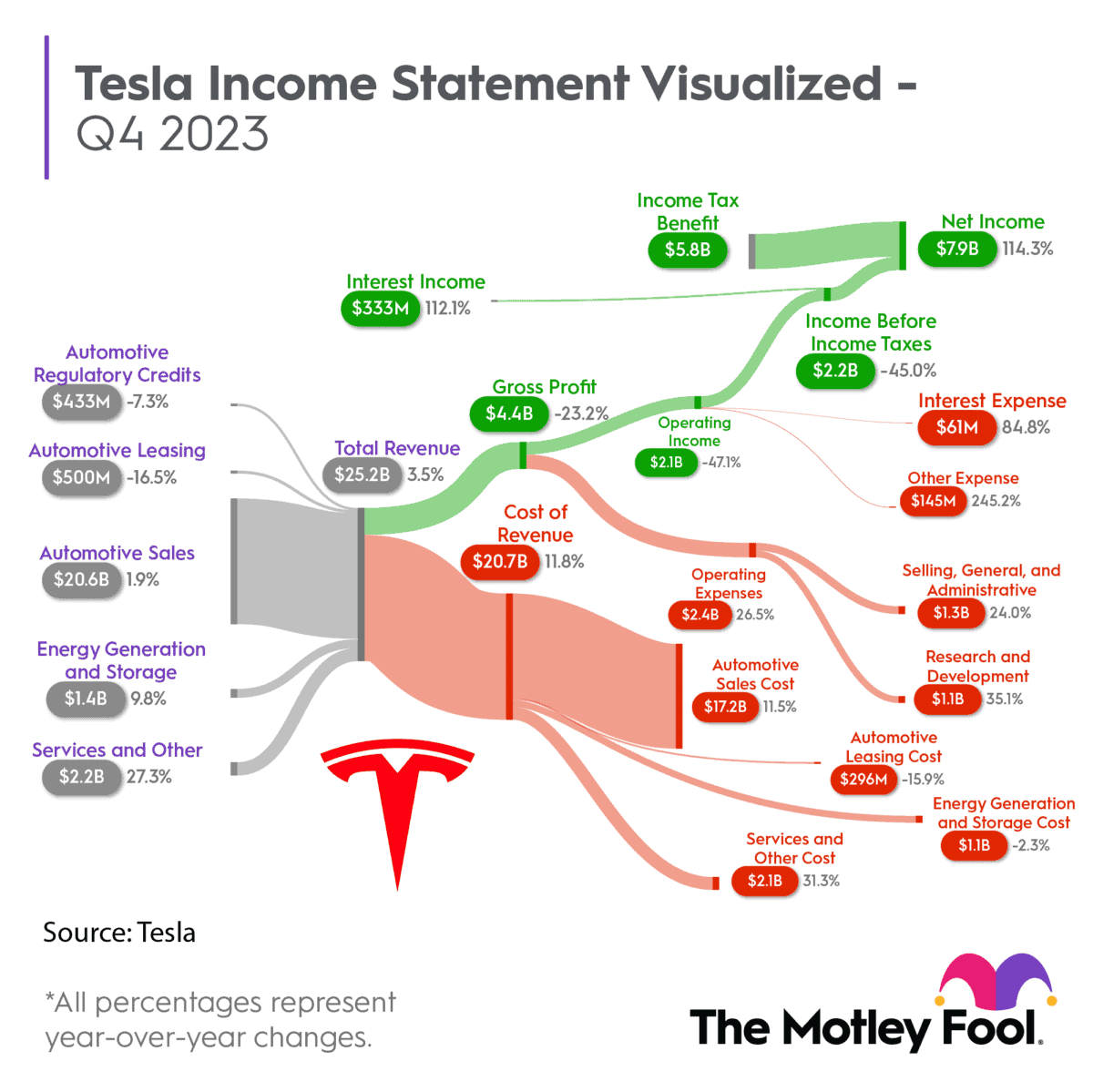

This brings me to Tesla’s results for Q4 2023. Put simply, they were quite poor.

For the period, revenue was up just 3% year on year to $25.2bn. This marks the slowest pace of growth in more than three years.

Meanwhile, gross margin came in at just 17.6%, compared with 23.8% a year earlier and analysts’ average estimate of 18.3%. Many of the other Magnificent Seven stocks have gross margins in excess of 50%.

As for earnings per share, they came in at 71 cents, down 40% year on year and below the consensus forecast of 74 cents.

And looking ahead, the company warned of “notably lower” sales growth.

The problem here is that Tesla stock was trading at a very high valuation going into the earnings (the P/E ratio was near 60). So, there was little room for error.

Intense competition

It’s worth noting that a slowdown in consumer demand is not the only challenge the EV maker is facing right now.

Another major issue is competition from rivals such as China’s BYD (which overtook Tesla to become the world’s top selling EV company last year).

On the Q4 earnings call, Tesla CEO Elon Musk said that Chinese automakers will “demolish” global rivals if trade barriers are not put in place, underscoring the heat that the company is facing from Chinese rivals right now.

I’ll point out that analysts at Bernstein reckon that BYD stock is a better bet than Tesla. In a research note posted late last year, they highlighted the big valuation gap between the two EV makers.

Long-term potential

Now, from a long-term investment perspective, Tesla still has a lot going for it.

One the earnings call, Musk said that he sees a “path to creating an artificial intelligence (AI) and robotics juggernaut of truly immense capability and power”.

This is something to be excited about.

In the near term, however, I expect the stock to be volatile, given the challenges the company is facing and its high valuation.

My personal short-term share price target for Tesla (and a level I might be interested in buying at) is $150. Let’s see if it gets there.