Tesla (NASDAQ:TSLA) stock extended losses as the car company pointed to slower growth in its Q4 results, which also fell short of expectations. So, let’s take a close look at the results, and explore whether this recent dip could be a golden opportunity for investors.

Missed expectations

The much-awaited Q4 results fell short of analyst expectations.

In the quarter, the Austin-based company said that earnings per share (EPS) came in at $0.71, falling short of the consensus estimate of $0.74.

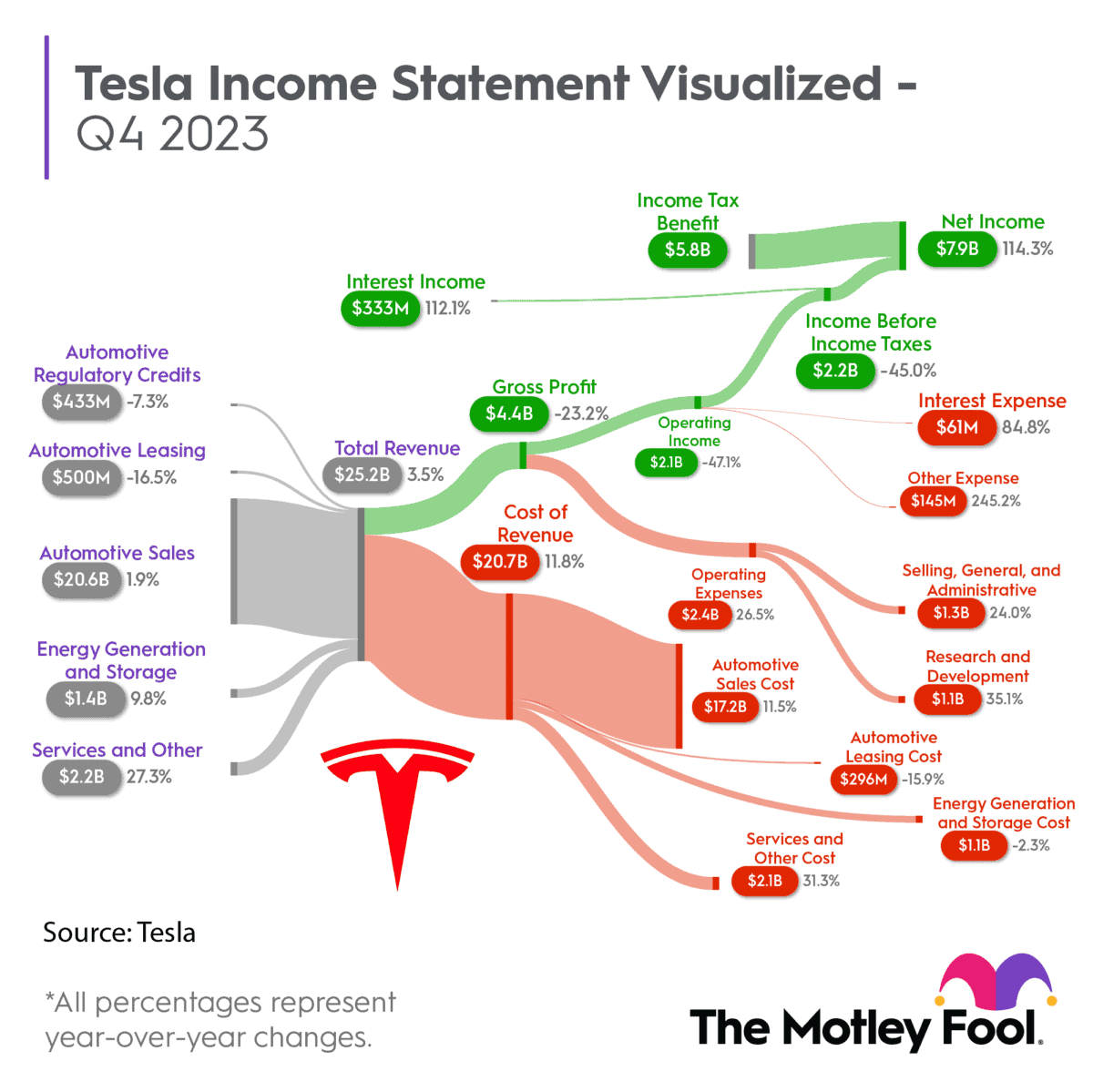

Meanwhile, despite a 3.5% year-on-year (YoY) increase, the $25.2bn revenue was $590m below the analysts’ expectations.

The Elon Musk-company built 494,989 vehicles — a 13% YoY increase — and delivered 484,507 vehicles, a 20% YoY increase, in Q4.

While this may sound impressive, production numbers were actually down quarter on quarter. This sequential decline was attributed to planned factory downtimes for upgrades.

For the full year, vehicle deliveries grew by 38% YoY to 1.81m. Production jumped by 35% to 1.85m vehicles.

Investors were also keen to see what had happened to Tesla’s margins. The firm has been slashing prices in an effort to shift vehicles and maintain market share. But it’s comes at a cost.

The operating margin declined to 7.6%, down from the previous quarter’s 9.6% and the 17.2% reported a year ago.

Unsurprisingly, this was attributed to reduced average selling prices and elevated operating expenses linked to AI and other R&D projects.

Tesla ended the quarter with $29.1bn in cash, up $3bn sequentially.

Sales seen lower

Management also gave some guidance for the year ahead, but pointed to slower growth amid a slowing global economy and a deceleration in the adoption of EVs.

This slowdown is expected despite the ramp up of cybertruck production and the start of production at its Gigafactory in Texas.

Tesla added that its expects profitability from its hardware to improve in time, accompanied by “AI, software and fleet-based profits.”

A golden opportunity, or not?

Even at $207 a share, Tesla still looks expensive. The company is trading at 65.9 times forward earnings, making it hugely expensive for the automotive sector. This is also a 322% premium to the consumer discretionary sector.

Of course, Tesla is a growth stock. But even on metrics adjusted for growth, it looks pricey. The current price-to-earnings-to-growth (PEG) ratio is 5.04. For reference, a PEG ratio of one is normally considered fair value, and anything below one is overvalued.

So, with the stock trading at high multiples, and growth expectations falling, it’s hard to make the case that Tesla is good value.

I say this despite being a huge fan of Elon Musk’s projects, and recognising how much he and Tesla have done to advance the adoption of electric vehicles.

Moreover, I don’t doubt that — subject to regulatory approval — Tesla’s plans for a fleet of self-driving taxis will be hugely profitable. And I’m sure the company is miles ahead of the competition here.

The issue, as an investor, is that this self-driving fleet, among other projects, are not expected to positively contribute to earnings for some time.

Personally, I’m looking at alternatives to Tesla in order to gain exposure to the EVs market. My personal favourite is Li Auto, which trades at just 20.4 times forward earnings, and has a PEG ratio significantly under one.