We here at The Motley Fool are huge believers in the the ability of UK shares to create long-term wealth. Putting your money to work in a tax-efficient Stocks and Shares ISA give one’s returns a nice added boost, too.

Don’t just take our word for it, though. A Freedom of Information (FOI) request from The Openwork Partnership reveals how ISAs have helped supercharge the number of British millionaires.

ISA millions

Latest HM Revenues and Customs (HMRC) data showa that were 4,070 investors sitting on seven-figure ISAs as of April 2021. That’s a near-tenfold increase from the 450 that were reported five years earlier.

The 50 top ISA millionaires were sitting on average pots of £8,509,000, the data revealed. The average across all those 4,000-plus millionaires stood at a tasty £1,397,000.

All of these wealthy investors are likely to have used their ISAs to buy stocks and shares, the data suggested.

Best in the world

The ISA has proved a gamechanger for tens of thousands of everyday investors. According to then-head of partnership services at The Openwork Partnership, Setul Metha:

The ISA has not only created thousands of millionaires, but it has also empowered millions of ordinary investors to build a nest-egg alongside their pension.

Metha — who is now head of UK Intermediary Distribution at AIG – went on to describe the ISA as “perhaps the best tax-free investment wrapper in the western world”.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

My wealth building strategy

Owning shares can be a bumpy ride at times. It’s never nice to see the value of your investments slump when economic conditions worsen and stock markets fall.

However, UK shares have proven to be an excellent way to create wealth over the long term. And this makes the possibility of some short-term discomfort easier to swallow.

The FTSE 100, for instance, has provided an average annual return of around 7.5% since 1984. The FTSE 250, meanwhile, has yielded an even-better return of 11% since 1992.

This is far better than the return provided by a cash savings account over the period. It’s why I invest some of my spare cash each month in a Cash ISA, but use the majority to buy shares in my Stocks and Shares ISA.

Past performance is not a reliable indicator of the future. But the potential to make big riches makes this strategy worthwhile to me, as I demonstrate below.

A £520 monthly investment

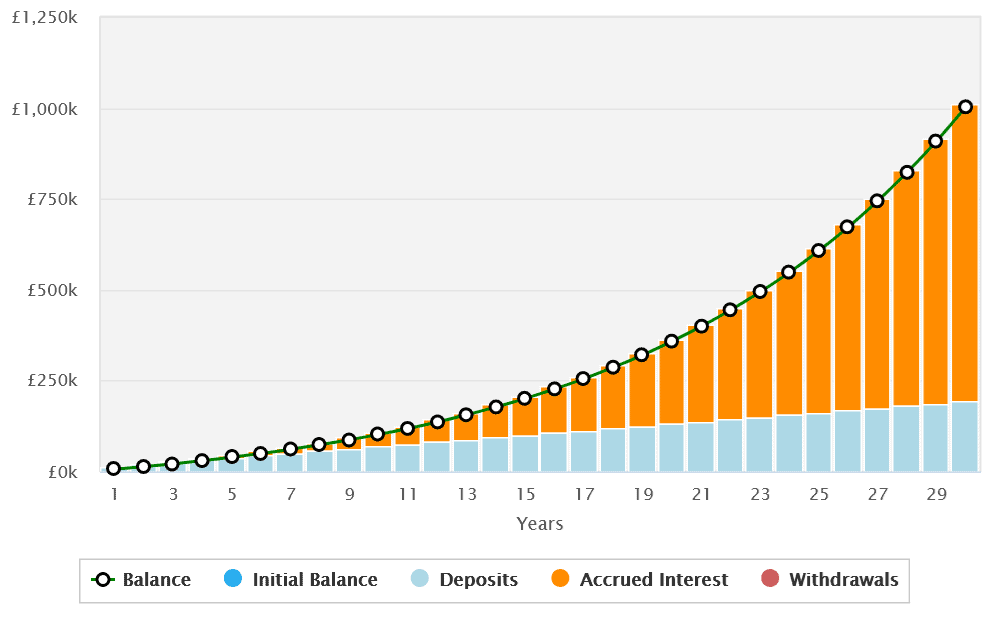

Let’s say I have £520 ready to invest in a Stocks and Shares ISA each month, and decide to invest this equally in FTSE 100 and FTSE 250 shares.

Based on an average 9.25% yearly return, this monthly investment could help push me into millionaire status after 30 years. As the chart above shows, I would have made a nest egg of £1,003,045.94 if those proven rates of return continue.

And that’s excluding any extra cash I would earn by also investing in a Cash ISA.

Buying UK shares isn’t a risk-free activity. But, as I have shown above, it can release substantial wealth and help everyday people secure financial independence.