Investing in FTSE 250 shares can be an excellent way to build long-term wealth. It’s why I’m planning to increase my exposure to such stocks in 2024. If past performance is anything to go by, this strategy could help me create a life-changing passive income stream.

The FTSE 100 is a popular place for new and experienced investors alike to park their cash. I own a wide range of blue-chip shares including Aviva, Diageo, Rio Tinto and Unilever in my portfolio.

But I also own a cluster of FTSE 250 companies like Games Workshop and Spire Healthcare. And there are literally dozens of other top shares from London’s second-tier index I’m considering buying.

History suggests that £300 invested each month in FTSE 250 stocks could help me generate a second income of £33,654 for the rest of my life. Here’s how.

A FTSE 250 strategy

The excellent long-term returns that UK share investing provides is well documented. The FTSE 100, for instance, delivered an average annual return of around 7.5% between its inception in 1984 and 2022.

However, returns from the FTSE 250 have been even greater. Since it began life in 1992, the index has provided an average annual return of 11%.

Past performance is no guarantee of the future. But let’s assume these rates of return continue for the next 30 years. What would a £300 monthly investment turn into?

| Timescale | FTSE 100 | FTSE 250 |

|---|---|---|

| 5 years | £21,758.13 | £23,855.42 |

| 10 years | £53,379.10 | £65,099.44 |

| 20 years | £166,119.22 | £259,691.41 |

| 30 years | £404,233.63 | £841,355.92 |

Big difference

As we can see, over a 30-year period I would earn more than twice as much by selecting FTSE 250 shares instead of FTSE 100 ones.

A small difference in the short term gradually spirals over those three decades, thanks to the miracle of compounding. This involves the steady reinvestment of dividends, which would give me even more shares and (by extension) dividends, giving me an increasingly large pot to earn money on.

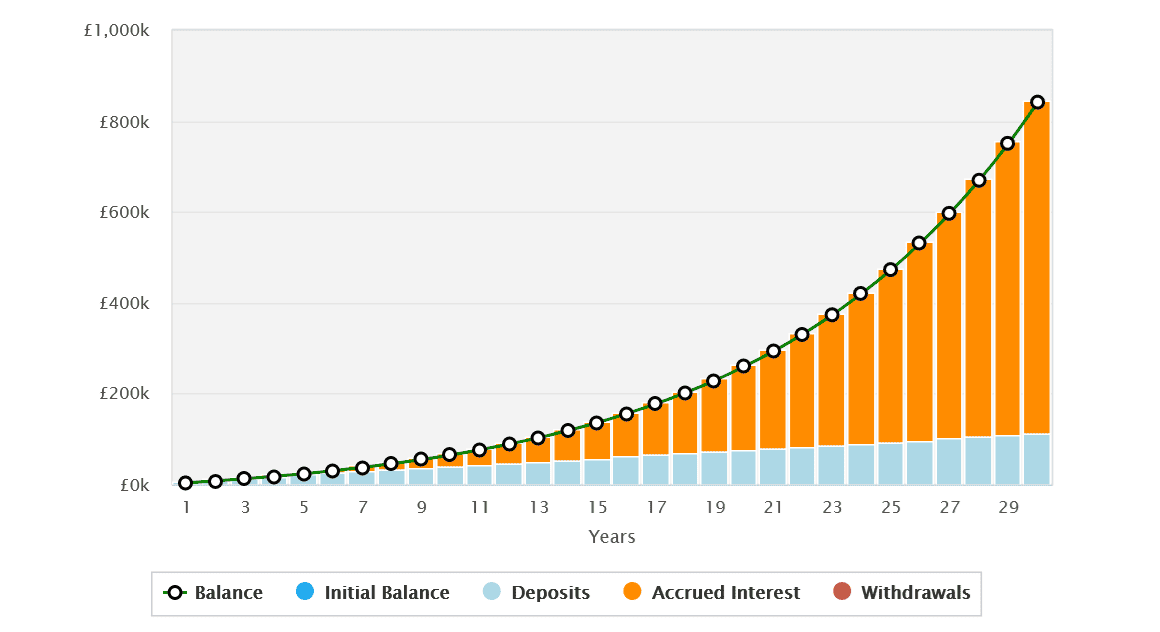

The chart below shows just how mighty a weapon compounding can be in creating long-term wealth.

So we’ve managed to make a whopping retirement pot of £841,355.92 after 30 years of regular investment. Now let’s transfer that into a second income by using the 4% drawdown rule.

This strategy would let me draw a retirement income for 30 years before I run out of money. In this example it would give me a generous annual income of £33,654.24.

A £33,654 passive income

Earning a £30k+ income for doing nothing is a pretty thrilling prospect, I’m sure readers will agree. But as with any investment, purchasing UK shares isn’t without risk.

In the case of the FTSE 250, annual returns could trail those historical levels should the British economy endure sluggish growth. This because the index is highly geared towards companies that earn most or all their profits from these shores.

But as I’ve shown, building a portfolio of FTSE 250 stocks could also generate life-changing riches and speed up the journey to financial freedom. This is why I plan to continue adding to my shares portfolio long into the future.