Investors don’t need to break the bank to build a portfolio of top dividend stocks. The London stock market is packed with cheap, income-paying shares that could deliver a brilliant passive income now and for the rest of the 2020s.

Take the two dividend shares discussed here, Greencoat UK Wind (LSE:UKW) and TBC Bank Group (LSE:TBCG). As the table below shows, each trades on an ultra-low price-to-earnings (P/E) ratio. They also both carry dividend yields that sail above the 3.4% average for FTSE 250 shares.

| Company | Forward P/E ratio | Forward dividend yield |

|---|---|---|

| Greencoat UK Wind | 8.5 times | 6.5% |

| TBC Bank Group | 4.1 times | 7.3% |

Passive income of £1,380

Dividends are never guaranteed. But if broker forecasts prove correct, a lump sum invested evenly across these UK shares could provide me with a healthy income.

With an average dividend yield of 6.9%, £20,000 invested in them could help me achieve a passive income of £1,380 in 2024. I expect them to provide a solid second income this year and to supply me with bigger dividends as time goes on. Here’s why.

Green giant

Greencoat UK Wind is one of the UK’s most popular renewable energy stocks. Today, it’s invested in 49 British wind farms which have combined net generating capacity north of 2GW.

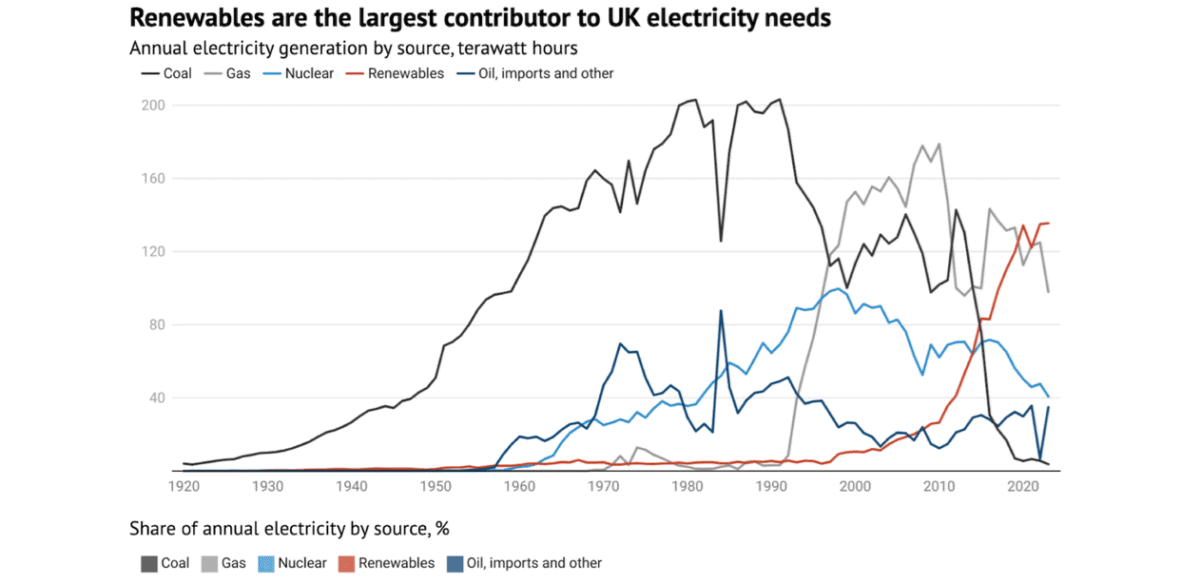

Demand for green energy is rocketing across the globe which, in turn, gives companies like this incredible growth potential. Renewables are now the largest energy category in the UK, as the chart from Carbon Brief below shows. And the percentage is on course to grow as the drive to net zero rolls on.

Electricity generation from wind farms can be lumpy at times. And this can affect energy from companies like Greencoat. But on the plus side, the enduring nature of energy demand still provides them with stability most UK shares can only dream of.

Star bank

TBC Bank is one such stock whose earnings can be more unpredictable from year to year. During economic downturns, demand for their financial products can fall and loan impairments spike.

But over the long term, profits here have grown strongly and are tipped to continue doing so. Demand for banking products in its Georgian marketplace is booming (the bank’s operating profit leapt 18% between January and September).

Low product penetration and a strong outlook for the emerging market’s economy mean revenues should continue their steady march higher.

Encouragingly for dividends, TBC Bank has a strong balance sheet to help it reward investors even if earnings come under pressure. Its CET1 capital ratio stood at an impressive 17.5% as of September. To put this in context, this is several percentage points higher than those of UK high street banks Lloyds, NatWest and Barclays.

Both Greencoat UK Wind and TBC Bank have strong records of delivering large and growing dividends. I expect this to continue long into the future.