I think Amazon (NASDAQ:AMZN) has been one of the best investments of modern times. As I write, it has risen 166,489% since it went public. However, in 2022, the stock price dropped almost 50%.

In fact, 2023 was one of the greatest periods to be an Amazon shareholder… had the shares been bought in late 2022 when the price was down.

If I’d bought exactly at the bottom in December 2022, the price would have risen 75% by now. I didn’t time it that perfectly, but my profits have been good nonetheless.

How the shares bounced back

The firm’s net income was the primary cause of the big 2022 drop. It went down massively during that year and only started to rise again after the company reported a loss of $2.7bn in 2022!

Management had made a $700m investment in Rivian in 2019, which has dropped 80% since it went public in 2021, the leading contributor to Amazon’s 2022 loss. In 2023, the Rivian share price stopped falling, and Amazon’s earnings began to stabilise as a result.

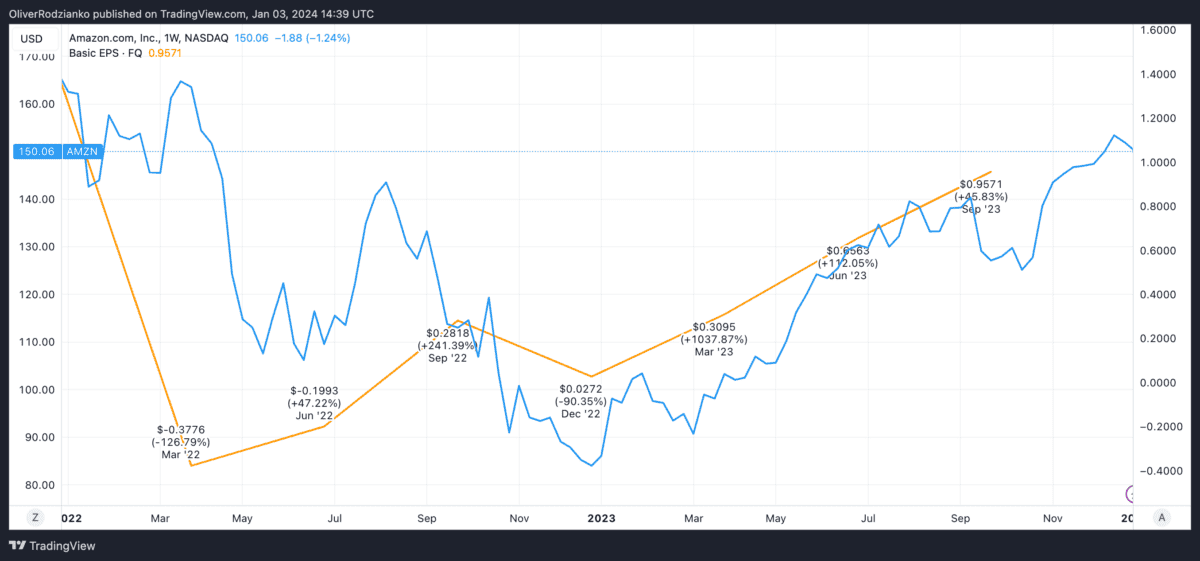

The graph below shows the company’s stock price (in blue) and its earnings per share (in orange) from January 2022 until today.

Amazon has significantly beaten expectations in the last three quarters of earnings results. It beat them by $0.10 in Q1, $0.31 in Q2, and $0.35 in Q3.

Contributing to the recent growth, high-margin segments of the business have continued to expand, like Amazon Web Services. Also, with a focus on automation related to AI, including drone deliveries, warehouse management tools, and vehicle inspection, margins have started to increase across the firm’s divisions.

However, one of the key risks to consider is that efficiency tools take money to invest in. Therefore, margin growth attributed to this may be slower due to financing the new technology to begin with.

Cost-cutting and efficiency measures

The firm announced 27,000 job cuts last year, which was a common trend at the time for technology companies.

The macroeconomic slowdown certainly put pressure on businesses to maintain their bottom lines and revenue growth. Yet the only significant way to maintain earnings during the period of reduced consumer spending seemed to be through internal cuts.

In 2023, management also deployed over 750,000 robots. For example, Digit helped the firm stack boxes and move items, replacing manual labour by humans in warehouses. And Sequoia is a robotic system the company is using to identify and store inventory faster, increasing delivery speeds.

A look at risks to come

To me, the greatest risks related to Amazon shares right now are the firm’s revenue growth and valuation.

For example, it has a price-to-earnings ratio of over 77, which is extremely high. When using future earnings estimates, that does come down to just under 40, but it’s still hefty and priced for perfection.

Also, because the company is so large and has expanded to such a significant extent, there may be limits on how much revenue can grow. Instead, the company will be looking at increasing earnings through improved margins. I think it’s geared up well for this.

2023 was a good year to buy Amazon shares, in my opinion.

I definitely don’t regret buying my stake last year, and I plan on holding it for a long time.