The FTSE 100 enjoyed a strong end of 2023 and has remained rock-solid in the New Year. It’s perhaps no wonder: the UK’s leading share index is packed with brilliant value stocks for savvy investors to buy.

Purchasing quality stocks at beaten-down prices can be a great way to build long-term wealth. Just ask Warren Buffett, who has made billions by building a winning portfolio of value stocks with his Berkshire Hathaway firm.

Here are two FTSE bargains that have grabbed my attention. I’ll be looking to buy them for my Stocks & Shares ISA when I next have cash to invest.

Glencore

The outlook for miners’ earnings is highly uncertain in 2024. If China’s economy keeps underwhelming, demand for industrial commodities like iron ore and copper could follow suit.

On the plus side, expected interest rate cuts could give metals consumption a shot in the arm. But this isn’t why I’m considering adding Glencore (LSE:GLEN) shares to my portfolio. I think it could be a great stock for me to profit from the upcoming commodities supercycle.

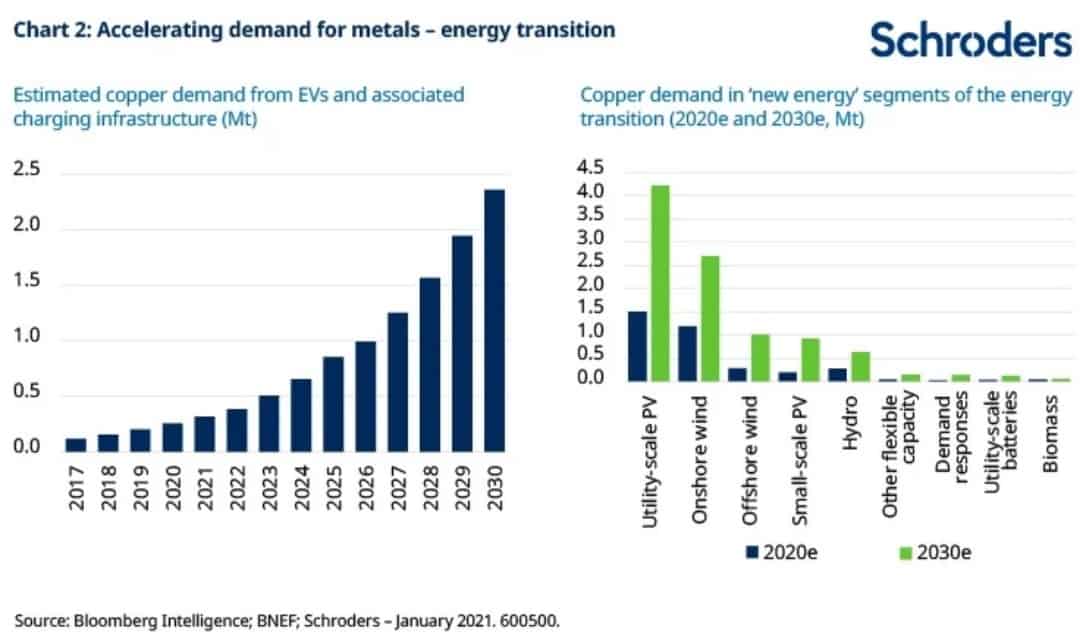

Demand for base metals is tipped to rocket as decarbonisation initiatives take hold, as the graphs above show. And thanks to its extensive trading operations, Glencore gives me a chance to capitalise on this with lower risk than by investing in pure-play commodities producers.

After all, the business of metals mining is highly unpredictable and problems are commonplace. Trouble at the exploration, mine development, and production phases can push costs through the roof and rip up revenues forecasts.

Glencore’s trading unit is responsible for around 20% of group earnings, which gives me a decent hedge against these threats.

At 450p per share, the company trades on a forward price-to-earnings (P/E) ratio of 11.1 times. It also carries a healthy 4% dividend yield. I think this is solid all-round value given its bright long-term outlook.

DS Smith

Packaging manufacturer DS Smith (LSE:SMDS) is another FTSE 100 stock I’m very familiar with. In fact I’ve held its shares in my own ISA for several years now.

The cyclical nature of its operations means its share price performance has underwhelmed of late. This could continue during 2024 too if consumer spending remains under pressure.

Yet at current levels of 297p per share I’m considering increasing my holdings. It trades on a tasty P/E ratio of nine times for this year, while it also boasts an index-beating 6% dividend yield.

Once again, I’m considering DS Smith’s investment potential over a long time horizon. And I expect its sales to grow steadily as e-commerce volumes increase. The business makes the cardboard boxes so beloved by the likes of Amazon.

DS Smith is about much more than internet shopping, however. Steady growth in global food retail should also drive sales streadily northwards (the firm makes the trays, boxes, and shelf-ready packaging that you see in your local supermarket).

One final, but important, point: I feel its decision to ditch plastics in favour of paper-based products could pay off handsomely as demand for sustainable goods accelerates. This is a FTSE 100 share I plan to hold for years to come.