On paper, Vodafone (LSE:VOD) shares are among the most interesting investment opportunities on the FTSE 100.

However, we shouldn’t be fooled by the price-to-earnings (P/E) ratio of two, and the 11.2% dividend yield. This is a company with some issues to work through.

Let’s take a closer look.

One year on

If I’d put £1,000 in Vodafone shares a year ago, I’d be a little disappointed today. That’s because the stock is down 17.1%, at the time of writing. So my £1,000 investment would be worth worth just £829 today.

That’s an underperformance relative to the FTSE 100, which is up around 1% over the past 12 months.

However, there is one positive. And that’s the Vodafone dividend yield. If I’d invested a year ago, I would have earned around £85 in dividends over the course of the year.

That goes someway to improving the overall returns. But I’d still be down around £85.

Debt and interest rates

Vodafone’s net debt stands at €36.2bn. That’s down from €45.6bn a year previously. A major reason for this falling debt is the sale of business units, positively impacting cash holdings and allowing for debt repayments. Nonetheless, net debt is around twice the market-cap.

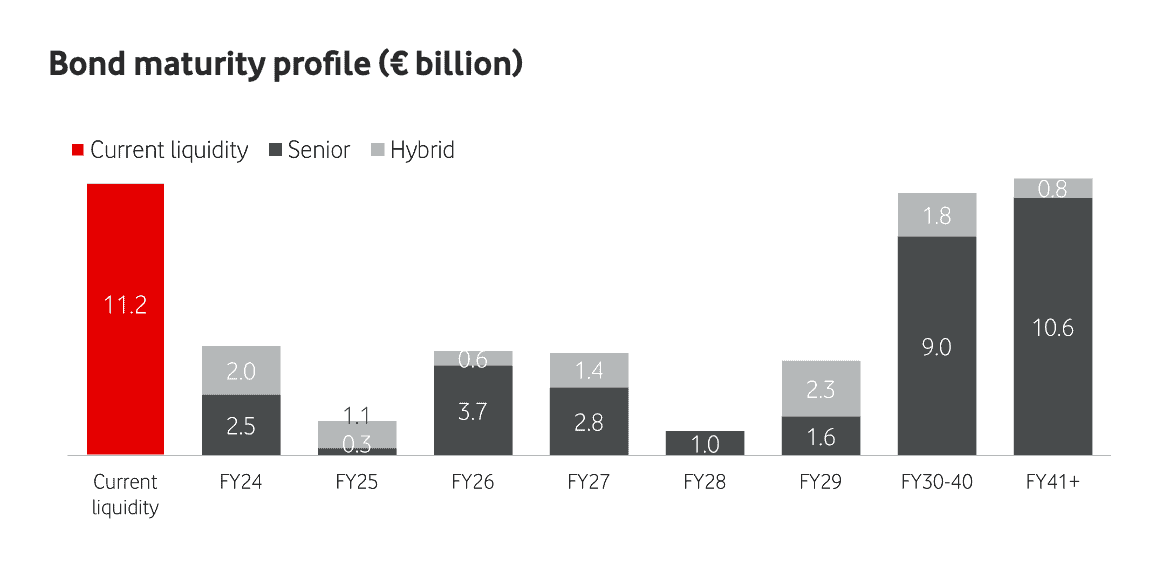

However, it’s worth noting that much of this debt doesn’t mature until 2030 onwards. And that’s something of a positive.

While I don’t have the exact figures, it’s likely a sizeable proportion of this debt is on variable rates. For example, peer BT Group looks to ensure at least 70% of debt is on fixed rates.

As such, it’s fair to suggest that Vodafone will benefit from interest rates falling over the coming 24 months. This could mean lower debt repayments and the ability to issue debt with lower coupon rates.

A risk worth taking?

Investing in firms with significant leverage always scares me. Especially when the company in question isn’t expected to deliver exciting rates of growth in the coming years.

The company’s earnings forecasts has recently been revised, with 2024 looking increasingly unimpressive. Below is the company’s earnings forecast for the medium term along with P/E ratio based on the current share price.

| 2024 | 2025 | 2026 | |

| Basic EPS (p) | 3.5 | 6 | 6.9 |

| P/E | 20 | 11.6 | 10.1 |

While it’s reassuring to see earnings increase year over year, these figures have constantly been revised downwards over the past 12 months.

Moreover, it’s worth noting that while the current P/E may appear to be just two times, that’s because earnings were heavily influenced by business sales in the last financial year.

Moreover, I’m a little concerned about the dividends. Vodafone looks set to maintain a 9¢ (7.9p) dividend for 2024, but that’s more than the basic earnings listed above.

In the year ahead, this may be funded by the sale of its Spanish operations for €4.1bn, but further into the future, I’m not sure that’s possible.

For me, the future is uncertain at Vodafone, and that’s why I’m not investing.