Last year, Nvidia (NASDAQ: NVDA) stock rose almost as quickly as ChatGPT rattles off a sonnet. It ended the year at $495, up from $146 at the start. That was a staggering 239% gain!

The conventional wisdom is that this epic rally has left Nvidia shares grossly overpriced. But has it?

Explosive growth

There’s a war going on out there in AI, and Nvidia is the only arms dealer.

Srini Pajjuri, analyst

Graphics processing units (GPUs) carry out multiple computations simultaneously, making them ideal for training artificial intelligence (AI) and deep learning models.

With approximately 80% share of the AI chip and associated software market, Nvidia is guiding for full-year revenue of $59bn. That would be an incredible 118% increase over last year. Meanwhile, annual profits are set to quadruple.

Based on forecast earnings for FY 2025 (starting February), the stock is trading on a forward price-to-earnings (P/E) ratio of 24. That’s cheaper than peers Intel (24.9) and Advanced Micro Devices (36). This is due to its far higher rate of growth.

A forward-looking P/E multiple of 24 for a company powering the AI revolution doesn’t look excessive to me. For perspective, it’s the same as McDonald’s.

Moreover, the price-to-earnings growth (PEG) ratio, which factors in the firm’s anticipated five-year rate of growth, is 0.5. For context, the S&P 500 index currently has a PEG ratio of around 1.5. This suggests the stock might even be undervalued.

Of course, these metrics rest upon forecasts. Something could always throw a spanner in the earnings. Sanctions, for example.

Geopolitical risk

The ongoing battle for technological supremacy between the US and China is well-documented. And Nvidia is already banned from exporting its higher-end chips to Chinese customers.

China accounted for 21% of Nvidia’s revenue last year (FY 2023). The worst-case scenario is a complete ban on supplying products to this market.

While that’s a concern, I don’t think it would be disastrous considering how big the global AI industry could eventually become. But it’s still worth pointing out.

A massive market opportunity

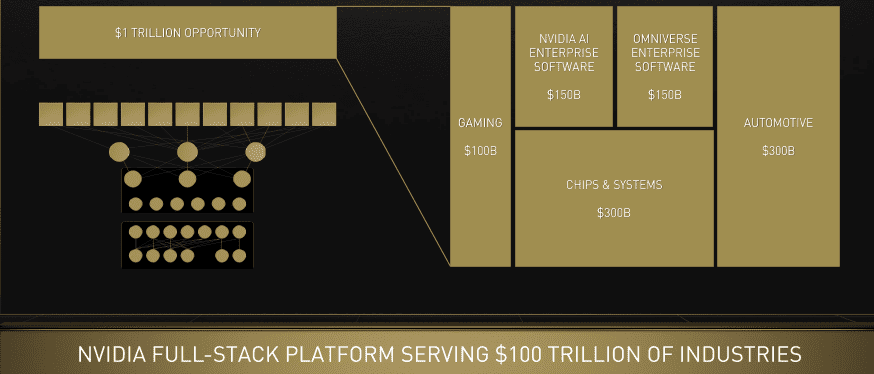

Nvidia puts its total addressable market (TAM) at $1trn. Here’s how it breaks that down.

It’s generally wise for investors to take TAM projections with a large pinch of salt. Generally, that is, but not always.

Nvidia was founded on the belief that a future of accelerated computing would rest upon GPUs. This is happening and nearly every blue chip around is partnering with it. So it’s plausible the firm might also be right about the size of these various markets.

More importantly, the company has a tremendous record of execution to seize such opportunities. It’s one thing to identify huge growth markets, another to actually grasp them with both hands.

Therefore, it wouldn’t surprise me if Nvidia’s products power multiple future industries like cloud gaming and autonomous vehicles. And I expect more businesses to rent use of the firm’s ‘AI supercomputer in the cloud’.

I’ll invest then do nothing

CEO Jensen Huang estimates that $1trn of installed global data centre infrastructure will transition from general-purpose to accelerated computing as companies apply generative AI into every product and service.

Given this tantalising prospect, I’m looking to add to my holding in 2024, ideally on share price weakness. Then I’ll keep my shares for the long term.