The spectacular rise of artificial intelligence (AI) stocks was one of the biggest investment stories of 2023. Chipmaker Nvidia (NASDAQ:NVDA) attracted most of the headlines last year, its share price rising a stunning 233% in value.

Today, the Nasdaq company is trading at around $481.70 a share. If it replicates last year’s performance it will end 2024 at $1,600.

Can Nvidia shares hit these heights? And should I buy the AI giant for my shares portfolio today?

Growth market

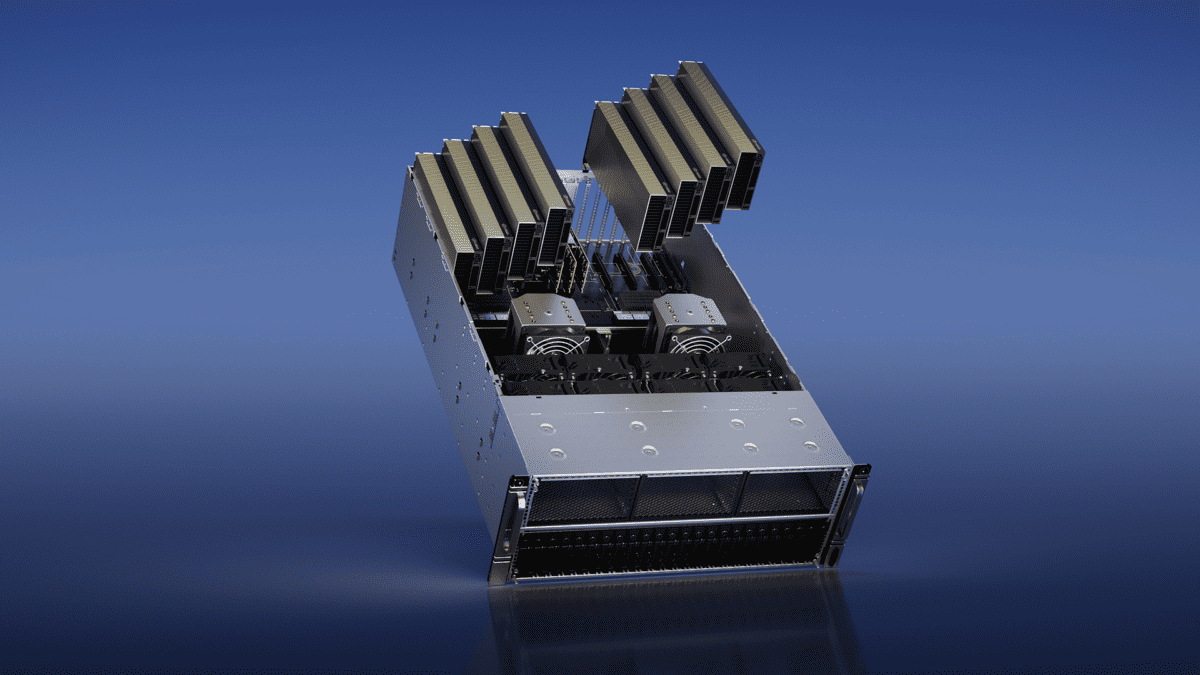

To quickly recap, Nvidia is a major manufacturer of graphics processing units (GPUs). These are critical in a wide range of computer-based applications. And they’re becoming especially popular in the realm of AI.

In a nutshell, these chips allow highly complex computational processes to be carried out. Deep learning frameworks (such as Google’s TensorFlow open-source machine learning library) rely on GPUs to accelerate the development of neural networks.

The AI market provides Nvidia with significant growth opportunities for the next decade and beyond. According to PwC, AI could contribute an astonishing $15.7trn to the global economy by 2030. That’s more than the current Chinese and Indian economies combined.

Strong trading

Nvidia’s is acting quickly to capture this opportunity too. It’s a market leader in its field of AI-related tech and is investing boatloads in new tech to keep its crown. Analysts at Bloomberg have described its H100 chip as “the go-to workhorse for training the large language models undergirding apps like OpenAI’s ChatGPT“.

Investors are confident the company can continue growing sales and profits above expectations too. In its forecast-beating third-quarter update, Nvidia announced revenues of $18.1bn, up 206% year on year and driven by soaring demand for its AI products.

Premium rating

Like the company itself, Nvidia’s share price has exceptional momentum right now. But while it could rise further in 2024, I’m not planning to buy the shares for my portfolio.

Heavy investor interest means the tech giant now trades on a high forward price-to-earnings (P/E) ratio of 39.2 times. The market is pricing in the possibility of further estimate-smashing trading releases.

The danger is that any signs of weakness could result in sharp selling that sends the firm’s share price plummeting.

Danger signs

One potential threat is that production at Nvidia fails to keep up with the rate of demand. The firm is also facing intensifying competition as other tech giants try to muscle their way into the AI arena.

Intel, Microsoft, and Alphabet-owned Google are just a few companies designing their own chips (Google has even claimed its TPU chips are faster and more energy efficient than Nvidia’s tech).

Nvidia is also vulnerable to worsening relations between the US and major consumer China. This raises the spectre on further restrictions from Washington on the export of microchips.

And finally, a great deal of uncertainty hangs over how strict AI regulation will be. The US, China and the UK are all tipped to introduce their own ruling frameworks in the not-too-distant future. These could all cast doubts on current growth estimates for the AI industry.

While I like Nvidia shares, I’m not happy to buy them at current prices. I’d rather invest in other UK and US shares right now.