Warren Buffett stands out as one of history’s most accomplished investors, having built a net worth in excess of $120bn.

Since 1970, he has led Berkshire Hathaway, an American multinational conglomerate holding company, that now boasts a valuation of $777bn.

And thankfully, Buffett has share many nuggets of wisdom with investors over the years. So what are his golden rules and how can they help me turn an empty portfolio into a thriving one?

Start saving

If I’m going to start investing, I’m going to need to begin putting some money aside. It doesn’t matter that I may not have any savings, but I can put some of my salary aside to fuel my financial goals. Some investing platforms could allow me to do this with just £50 a month, or less.

Don’t lose money

Buffett’s “don’t lose money” mantra highlights the disproportionate impact of losses on investment goals.

If I invest poorly and lose 50%, I need a 100% gain to recover. That’s a very important lesson to remember and it should shape my investment decision process.

This emphasis on capital preservation stems from the asymmetric nature of gains and losses.

Buffett’s strategy prioritises safeguarding capital to minimise the challenging task of recovering from substantial declines.

The margin of safety

Buffett’s investment strategy involves a margin-of-safety approach. This means finding a significant gap between the market’s valuation of a company and my own valuation, providing a cushion against market fluctuations.

In order to find my own margin of safety, I should undertake research into a company’s intrinsic value, evaluating its fundamentals and potential risks.

Finding value

There are plenty of ways to value a company. There are simple methods that include the use metrics such as the price-to-earnings (P/E) ratio or my personal favourite, the price/earnings-to-growth.

By comparing the P/E ratio with peers, I can develop an idea as to whether a stock is cheap for its sector.

However, most metrics, on their own at least, don’t give us a complete picture. By using a combination I can gain a more complete understanding of a company’s current worth relative to its peers.

Another method is using a discounted cash flow model. This requires me to forecast how much cash flow a company will have over a set period and then offset that against the value of time. Thankfully, there are online resources to help me with this.

Let it compound

Compounding, a cornerstone of Buffett’s strategy, is the process of reinvesting earnings to generate additional returns over time. The so-called ‘Oracle of Omaha’ recognises its transformative power, often calling it the eighth wonder of the world.

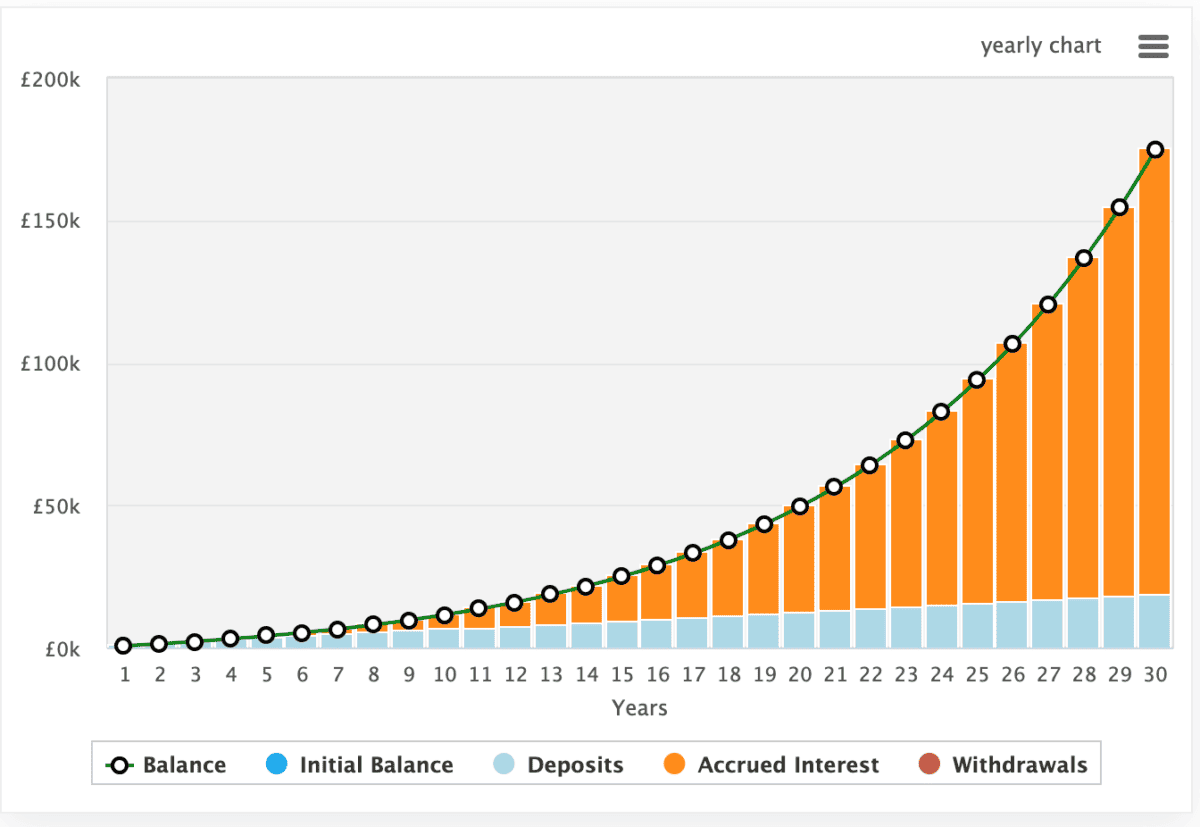

The exponential growth potential of compounding underscores the importance of starting early and maintaining a disciplined, buy-and-hold investment approach for enduring financial success.

So what could this mean for £50 a month? Well, over the course of his career, Buffett has generated annual returns averaging roughly 22%, an incredible record that approximately doubles the S&P 500.

But let’s take a still-ambitious, but more achievable, 12% annualised return. Here’s how my wealth could grow.