The easyJet (LSE:EZJ) share price is currently trading over 75% below its all-time high. Whether this is an opportunity for me depends on many factors, including how I compare this investment to other shares.

I think the company deserves to be given credit as a very innovative and useful business. I have flown on the airline many times myself, and I like that it provides cheap flights, unlike most other airlines.

However, the company’s financials are not the best, in my opinion. There is significant reason to believe that the low share price could, in fact, be a ‘value trap’.

A value trap

A value trap is when shares may appear undervalued at a low, attractive price, but in fact, the price deserves to be this way for valid reasons.

For example, in the case of easyJet shares, while the price-to-earnings ratio is around a healthy 9.5, there are deeper financial concerns. These include negative long-term revenue growth rates and a high level of debt right now.

One of the core reasons that might make easyJet seem like a value trap is the pandemic’s effect on the business. If it weren’t for such a destructive turn of events, it’s reasonable for me to think that the share price would have remained much higher than it is now.

What the pandemic caused

The easyJet shares were trading at 1,260p pre-pandemic. Now, they’re at almost 500p.

Obviously, Covid-19 caused a standstill for most air travel for different periods, depending on location and jurisdiction. easyJet’s revenue tanked, down from £6.4bn in September 2019 to as low as £1.5bn in 2021, a 77% decrease.

The company’s total liabilities on the balance sheet also increased from 63% of assets in 2019 to 72% today.

Yet, amazingly, the company has managed to maintain an equal amount of cash compared to debt as of today. This is significant to consider when I evaluate easyJet’s long-term prospects regarding its ability to deal with its debt burden.

easyJet’s plan from here

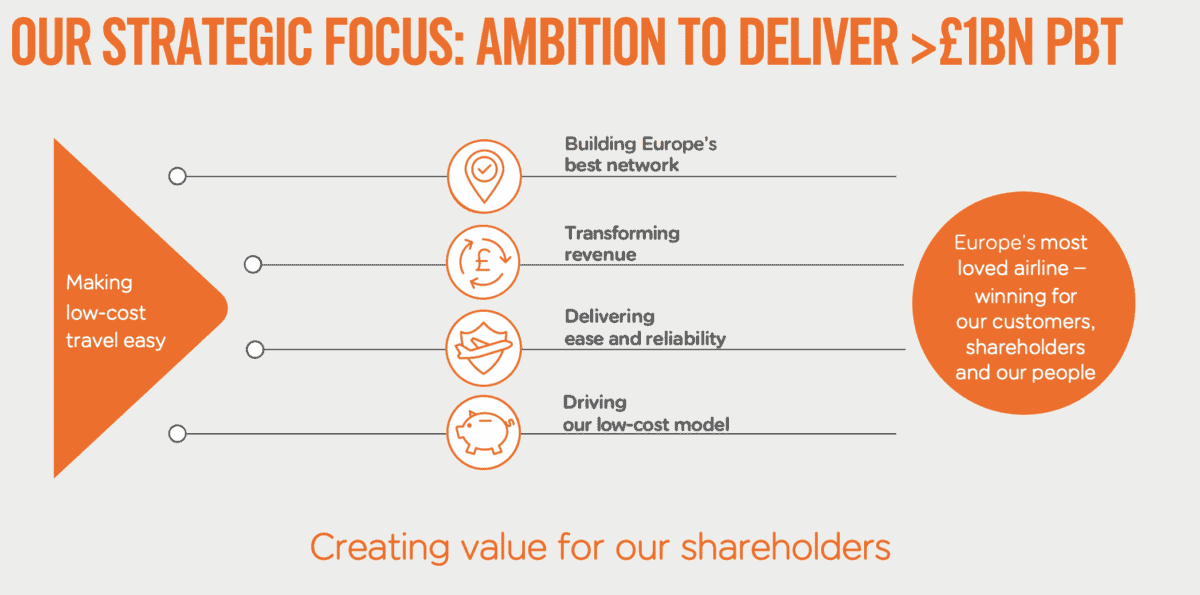

From reading the annual reports and investor presentations, the organisation clearly plans to adhere to its low-cost business model.

Here’s the current strategy as outlined by the CEO Johan Lundgren:

The company also plans to follow a ‘roadmap to net zero’. This is vital for an investor like me who cares deeply about environmental, social, and governance concerns.

Yet, there is very little mention in the recent reports and presentations on the company’s recovery post-pandemic.

The good news is that easyJet’s revenue per share has increased steadily from £2.70 in September 2021 (the lowest point of the pandemic woes) to £10.90 today. That’s over a 300% increase.

Watching carefully

While the company appears to be undervalued to me, the low price could be a trap if the organisation doesn’t increase its revenue growth rates to make up for the significant pandemic drop.

I think there could be an opportunity here, but I also think it’s too soon to tell.

I don’t want to risk getting trapped at a low price, so I’m just adding this one to my watchlist for further research instead of buying the shares.