Investing in the stock market has proven to be one of the most reliable ways to build wealth, provided it is done correctly. And a self-invested personal pension (SIPP) is an excellent vehicle to do this in the UK.

A SIPP is a pension ‘wrapper’ that allows me to save, invest and build up a pot of money for my retirement. My contributions qualify for tax relief, meaning I automatically get a government top-up on anything I pay in (currently up to £60,000 per year).

So if I contribute £800, I’d get an extra £200, bringing the total to £1,000.

If I pay tax at a higher rate, I can claim more through my tax return. But for the purposes of this article, I’m going to keep the figures simple.

Needless to say, these extra top-ups can make an enormous difference in the long run. Indeed, as we’ll see, it means I could eventually retire with a very substantial sum.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investing in growth and income shares

Historically, the stock market has returned an annualised 8-10%. That includes stocks from both the UK and US markets, which generally have different characteristics.

The FTSE 100, for example, is dominated by old economy companies like banks, miners and housebuilders. Meanwhile, the S&P 500 is top-heavy with innovative tech giants like Microsoft.

But both kind of stocks can have a role to play in a thriving SIPP portfolio. The old economy firms often have stable market positions and pay attractive dividends.

Conversely, some tech stocks offer much higher growth potential but not much in the way of dividends.

Choosing one style completely over the other risks an imbalanced portfolio. My own SIPP is probably 60/40 in favour of growth stocks right now, but that’s my own personal preference.

My risk tolerance and approach will probably change as I get closer to retirement.

The maths

As mentioned, stock returns have averaged 8-10% per year over the very long term. There is no guarantee that will continue in future, but I don’t think a 10% return is a totally unrealistic goal to aim for.

After all, Warren Buffett has averaged 19.8% per year. If I can do basically half as well as him, I’d still be able to build up a nice nest egg.

In this scenario, then, my £100 a week would become £125 (or £6,500 per year) with the government top-ups. Achieving an average 10% return over 30 years, I’d end up with a final pot of £1,069,211 (excluding any platform fees).

To be honest, I find it incredible that investing a mere £100 a week in a SIPP could end up as £1.07m.

It could be even higher

Now, so far we have assumed that I start from scratch. But what if I put in a lump sum before I started investing regularly? What difference would that make? Quite a lot, actually.

The average person in the UK has £17,365 in their savings, according to the Building Society Association.

So if I invested this money in my SIPP at the start, then my final sum would be £1.37m, assuming the same average returns and government tax relief. That’s a huge £300,000 or so difference.

What if I kept this going for 35 years instead of 30?

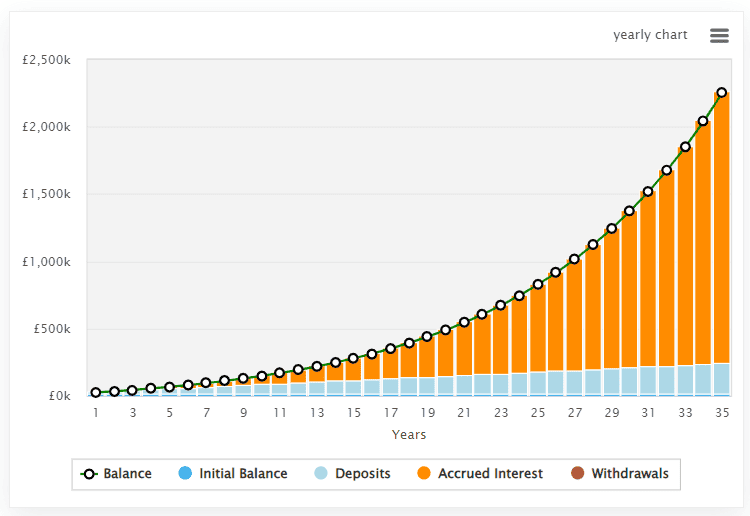

As the chart above shows, I’d end up with a whopping £2.25m instead of £1.37m. And if I could invest £200 a week rather than £100, then I’d be looking at a very comfortable retirement indeed.

The lessons, then, are clear. Fuelled by compounding, my returns can just explode higher the longer I keep investing.